Elliott wave theory

Elliott Wave Theory ek technical analysis concept hai jo market trends ko samajhne aur anticipate karne ke liye istemal hota hai. Ye theory Ralph Nelson Elliott ke naam par hai, jinhonay 1930s mein isko develop kiya. Elliott Wave Theory ka maqsad market ke cyclical nature ko samajhna hai, jisse traders future price movements ko predict kar sakein.

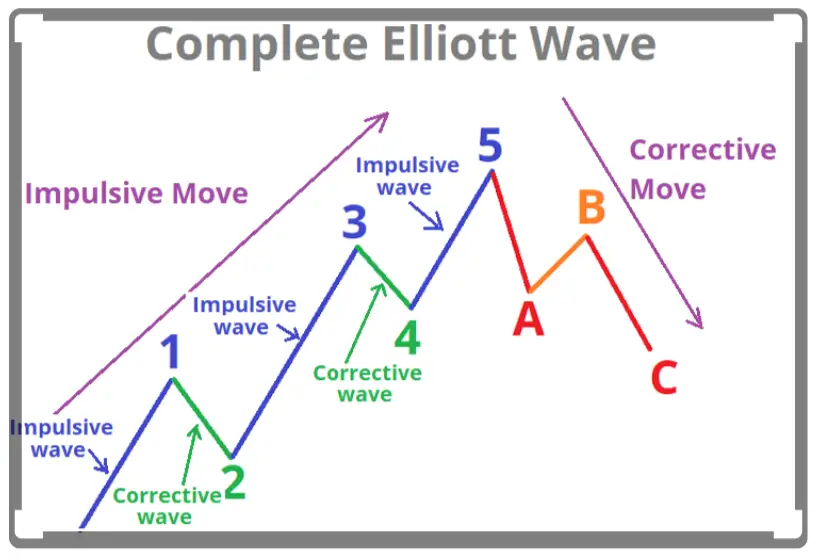

Is theory ke mutabiq, market trends mein a certain repetitive pattern hota hai, jo ko "waves" kehte hain. Har trend mein 5 impulsive waves (1, 2, 3, 4, 5) aur 3 corrective waves (a, b, c) hoti hain. Impulsive waves trend ki direction ko follow karte hain, jabke corrective waves us trend mein minor reversals ko represent karte hain.

Impulsive waves mein, wave 1 trend ki initial move ko darust karta hai, wave 2 ise counter karta hai, wave 3 phir se major move hoti hai, wave 4 minor reversal hoti hai, aur wave 5 trend ke end ko darust karta hai. Yeh 5 waves ek uptrend ya downtrend ko complete karte hain.

Corrective waves mein, wave a ek initial decline ko darust karta hai, wave b ise counter karta hai, aur wave c phir se downtrend mein move ko complete karta hai. Yeh 3 waves ek overall trend mein minor corrections ko represent karte hain.

Elliott Wave Theory ka istemal market trends ko predict karne mein hota hai. Agar kisi market mein Elliott Waves ka pattern milta hai, to traders usko istemal karke future price movements ko forecast karte hain. Lekin, yeh theory ka istemal challenging ho sakta hai kyun ke waves ko sahi taur par identify karna aur interpret karna mushkil hota hai.

Is theory mein kuch rules aur guidelines hote hain jinhe traders ko follow karna chahiye. For example, wave 3 kabhi bhi wave 1 ke shorter nahi hoti, aur wave 4 kabhi bhi wave 1 ke overlapping nahi hoti.

Elliott Wave Theory ke followers isko ek powerful tool mante hain, lekin yeh bhi accepted hai ke iska istemal market ki uncertainties ke beech mein challenging ho sakta hai. Is theory ko samajhne ke liye comprehensive technical analysis aur experience ki zarurat hoti hai.

Elliott Wave Theory ek technical analysis concept hai jo market trends ko samajhne aur anticipate karne ke liye istemal hota hai. Ye theory Ralph Nelson Elliott ke naam par hai, jinhonay 1930s mein isko develop kiya. Elliott Wave Theory ka maqsad market ke cyclical nature ko samajhna hai, jisse traders future price movements ko predict kar sakein.

Is theory ke mutabiq, market trends mein a certain repetitive pattern hota hai, jo ko "waves" kehte hain. Har trend mein 5 impulsive waves (1, 2, 3, 4, 5) aur 3 corrective waves (a, b, c) hoti hain. Impulsive waves trend ki direction ko follow karte hain, jabke corrective waves us trend mein minor reversals ko represent karte hain.

Impulsive waves mein, wave 1 trend ki initial move ko darust karta hai, wave 2 ise counter karta hai, wave 3 phir se major move hoti hai, wave 4 minor reversal hoti hai, aur wave 5 trend ke end ko darust karta hai. Yeh 5 waves ek uptrend ya downtrend ko complete karte hain.

Corrective waves mein, wave a ek initial decline ko darust karta hai, wave b ise counter karta hai, aur wave c phir se downtrend mein move ko complete karta hai. Yeh 3 waves ek overall trend mein minor corrections ko represent karte hain.

Elliott Wave Theory ka istemal market trends ko predict karne mein hota hai. Agar kisi market mein Elliott Waves ka pattern milta hai, to traders usko istemal karke future price movements ko forecast karte hain. Lekin, yeh theory ka istemal challenging ho sakta hai kyun ke waves ko sahi taur par identify karna aur interpret karna mushkil hota hai.

Is theory mein kuch rules aur guidelines hote hain jinhe traders ko follow karna chahiye. For example, wave 3 kabhi bhi wave 1 ke shorter nahi hoti, aur wave 4 kabhi bhi wave 1 ke overlapping nahi hoti.

Elliott Wave Theory ke followers isko ek powerful tool mante hain, lekin yeh bhi accepted hai ke iska istemal market ki uncertainties ke beech mein challenging ho sakta hai. Is theory ko samajhne ke liye comprehensive technical analysis aur experience ki zarurat hoti hai.

تبصرہ

Расширенный режим Обычный режим