White spinning top

White Spinning Top, forex market mein ek candlestick pattern hai jo market sentiment ko represent karta hai. Ye pattern trading charts par dekha gaya hai aur traders ko market dynamics aur potential trend reversals ke bare mein malumat deti hai. White Spinning Top ek neutral ya indecisive market condition ko darust karta hai, jahan buyers aur sellers ke darmiyan equilibrium bana hota hai.

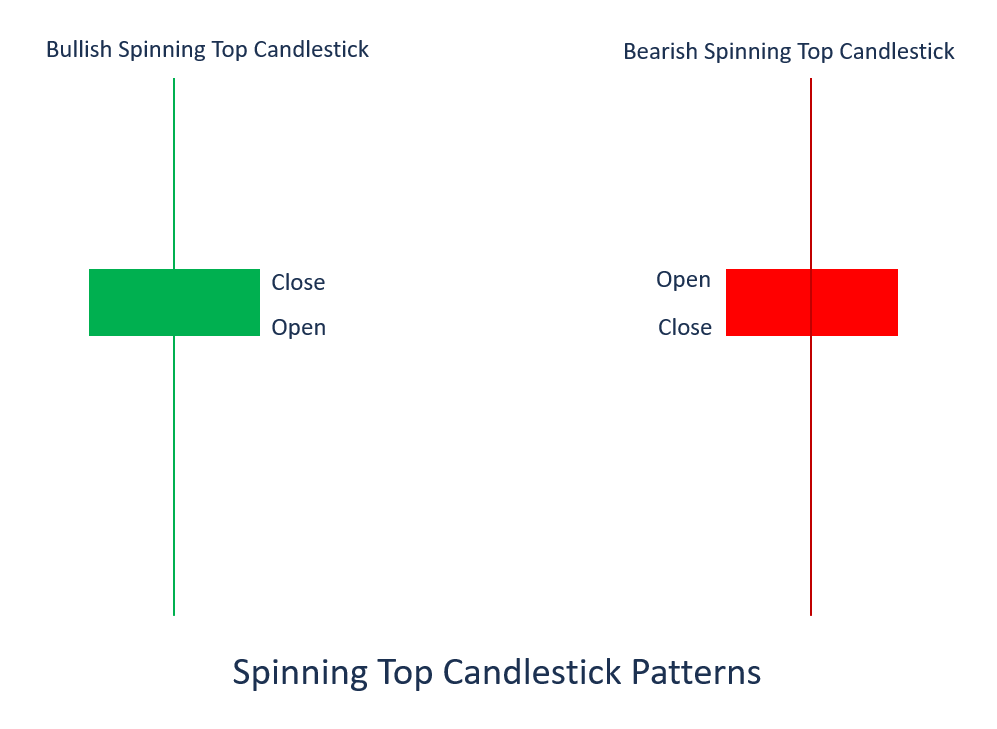

White Spinning Top ka formation ek single candle se hota hai. Is candle ka shape chakkar ya spinning top ki tarah hota hai. Candle ka body chhota hota hai, jismein opening price aur closing price aapas mein kafi qareeb hoti hain. Iske alawa, candle ke upper aur lower shadows bhi hote hain, jo ke indicate karte hain ke price mein during the session fluctuation hui hai.

Jab White Spinning Top market charts par aata hai, to iska matlab hai ke market mein uncertainty hai aur traders ke darmiyan ek tug-of-war chal raha hai. Buyers aur sellers dono control mein hain, lekin koi clear trend nahi dikha raha.

Is pattern ko samajhne ke liye, traders ko doosre technical indicators aur market conditions ka bhi tafsili tor par mutala karna chahiye. White Spinning Top ka asal maqsad ye hai ke show kare ke market mein stability aur indecision hai. Iski shape, jismein chhota body aur long shadows shamil hain, indicate karte hain ke price mein fluctuation to hui hai, lekin overall, market kisi specific direction mein nahi gaya.

Traders ko White Spinning Top ko dusre signals ke saath combine karke dekha jata hai. Agar ye pattern trend reversal ya trend continuation ke sath aata hai, to iska impact zyada hota hai. For example, agar ye pattern uptrend ke baad aata hai, to ye indicate kar sakta hai ke uptrend ki strength kam ho sakti hai aur potential reversal ka khatra hai.

Lekin yaad rahe ke White Spinning Top ek individual candlestick pattern hai aur iski tafsili analysis ke liye doosre technical tools aur market indicators ka istemal zaroori hai. Market ke overall context ko samajhne ke liye, traders ko White Spinning Top ko doosre price action patterns ke saath dekhna chahiye.

Aakhir mein, White Spinning Top traders ko market ke indecisive moments ko identify karne mein madad karta hai. Lekin, is pattern ko sahi taur par interpret karne ke liye, comprehensive technical analysis aur risk management ka istemal zaroori hai.

White Spinning Top, forex market mein ek candlestick pattern hai jo market sentiment ko represent karta hai. Ye pattern trading charts par dekha gaya hai aur traders ko market dynamics aur potential trend reversals ke bare mein malumat deti hai. White Spinning Top ek neutral ya indecisive market condition ko darust karta hai, jahan buyers aur sellers ke darmiyan equilibrium bana hota hai.

White Spinning Top ka formation ek single candle se hota hai. Is candle ka shape chakkar ya spinning top ki tarah hota hai. Candle ka body chhota hota hai, jismein opening price aur closing price aapas mein kafi qareeb hoti hain. Iske alawa, candle ke upper aur lower shadows bhi hote hain, jo ke indicate karte hain ke price mein during the session fluctuation hui hai.

Jab White Spinning Top market charts par aata hai, to iska matlab hai ke market mein uncertainty hai aur traders ke darmiyan ek tug-of-war chal raha hai. Buyers aur sellers dono control mein hain, lekin koi clear trend nahi dikha raha.

Is pattern ko samajhne ke liye, traders ko doosre technical indicators aur market conditions ka bhi tafsili tor par mutala karna chahiye. White Spinning Top ka asal maqsad ye hai ke show kare ke market mein stability aur indecision hai. Iski shape, jismein chhota body aur long shadows shamil hain, indicate karte hain ke price mein fluctuation to hui hai, lekin overall, market kisi specific direction mein nahi gaya.

Traders ko White Spinning Top ko dusre signals ke saath combine karke dekha jata hai. Agar ye pattern trend reversal ya trend continuation ke sath aata hai, to iska impact zyada hota hai. For example, agar ye pattern uptrend ke baad aata hai, to ye indicate kar sakta hai ke uptrend ki strength kam ho sakti hai aur potential reversal ka khatra hai.

Lekin yaad rahe ke White Spinning Top ek individual candlestick pattern hai aur iski tafsili analysis ke liye doosre technical tools aur market indicators ka istemal zaroori hai. Market ke overall context ko samajhne ke liye, traders ko White Spinning Top ko doosre price action patterns ke saath dekhna chahiye.

Aakhir mein, White Spinning Top traders ko market ke indecisive moments ko identify karne mein madad karta hai. Lekin, is pattern ko sahi taur par interpret karne ke liye, comprehensive technical analysis aur risk management ka istemal zaroori hai.

تبصرہ

Расширенный режим Обычный режим