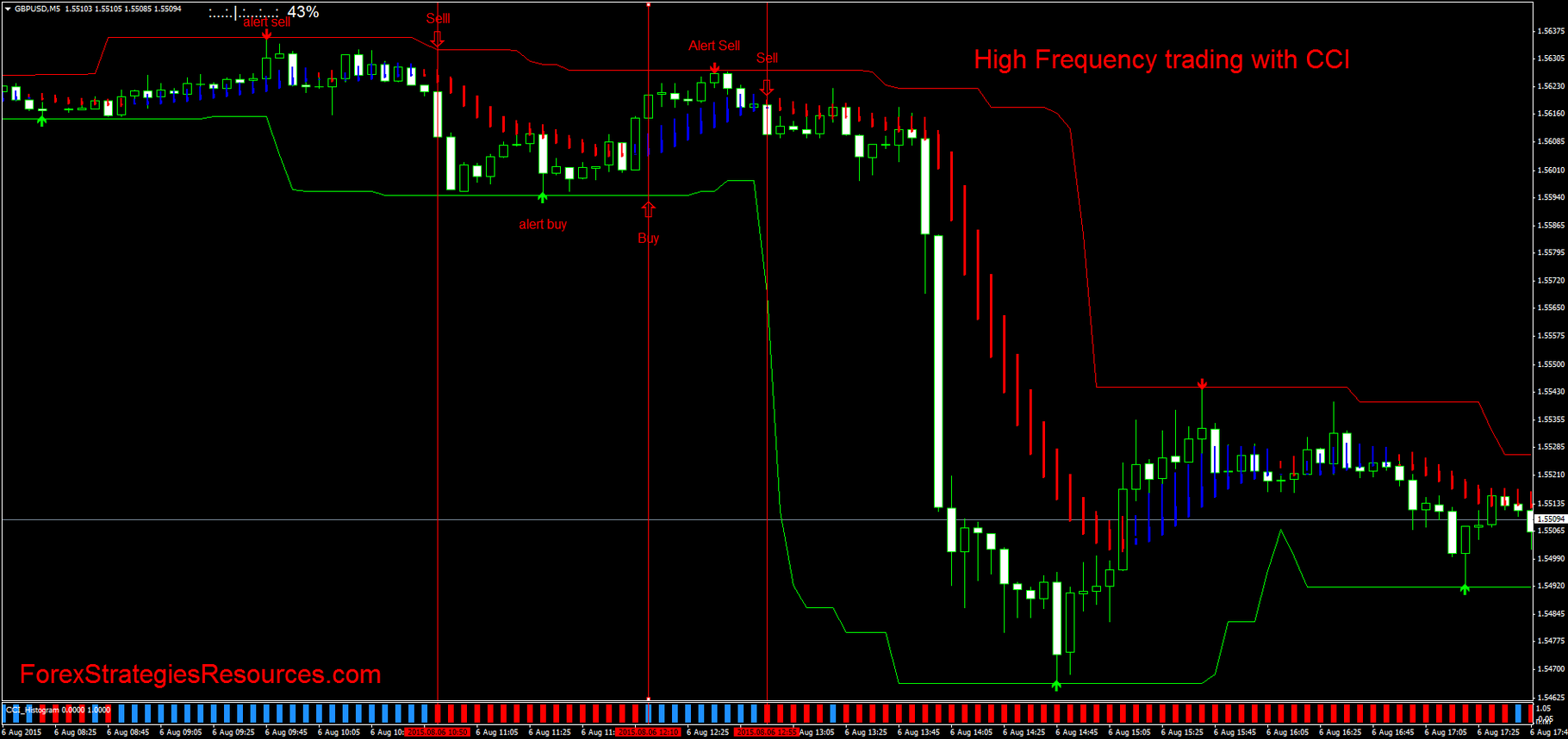

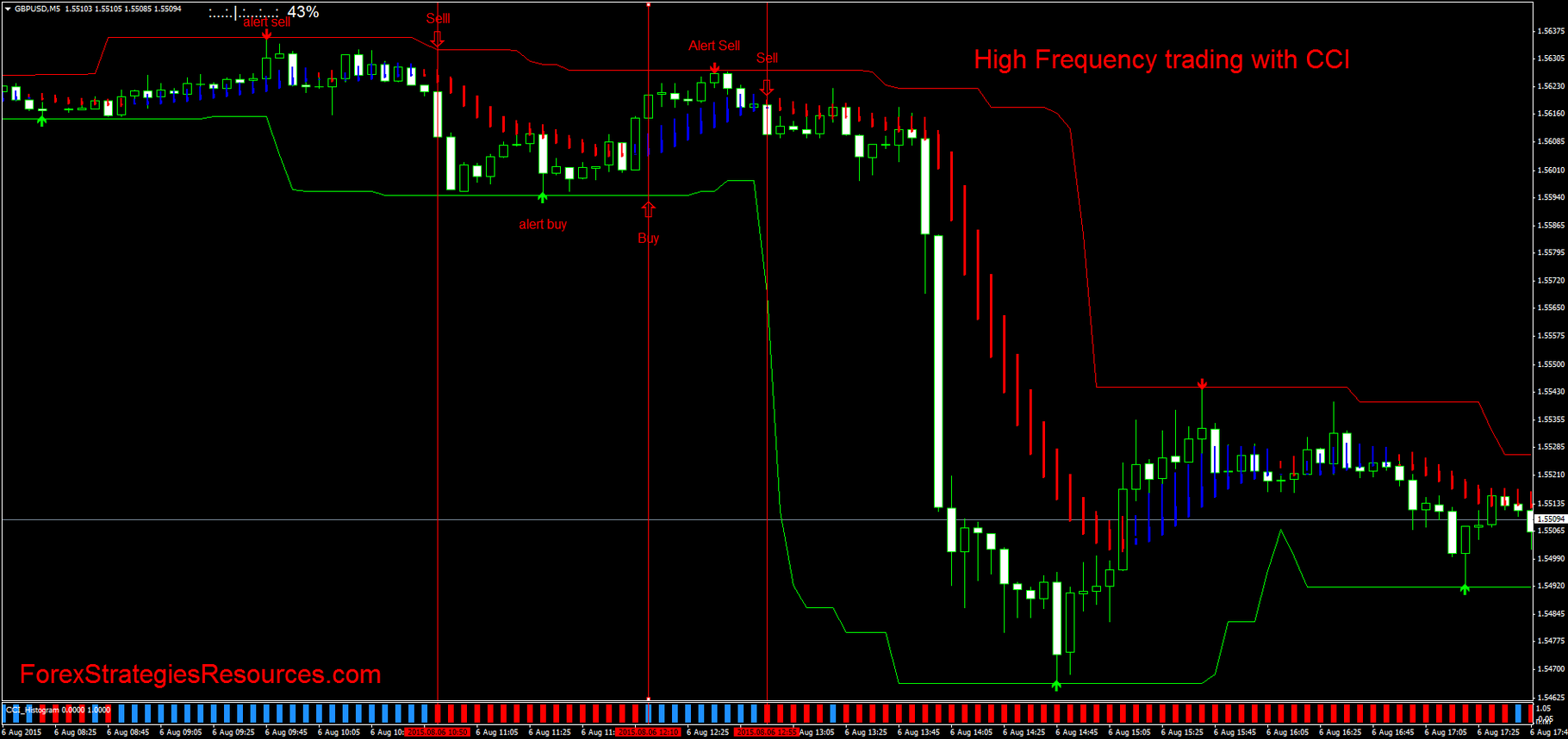

trading mein, High-Frequency Trading (HFT) ne apna aham kirdar ada kiya hai, jise ke financial markets ki operability mein tabdil kar raha hai. Jaise ke aap ek hissa waqtan-fa-waqtan individual forex trader hain, HFT ke gehrayon mein samajh hasil karna market ke dynamics mein ahem malumat farahem kar sakta hai.

High-Frequency Trading Ki Tashreeh: High-Frequency Trading, jise aksar HFT ke naam se jana jata hai, aik trading strategy ko daryaft karta hai jo market mein bohot se orders ko itni tezi se execute karna shamil hai. HFT ka bunyadi maqsad market mein chhotay price farqat se faida uthana hai, jise ke milliseconds ke andar trades ko execute kiya jata hai. Is tajaweez mein advanced algorithms aur cutting-edge technology ka istemal karna hota hai taake market data ko tafseel se analyze kiya ja sake aur trades ko jald bazi se execute kiya ja sake.

HFT Ke Khaas Kirdar:

HFT Strategies:

HFT Ke Fawaid:

Mushkilat aur Fikrayat:

High-Frequency Trading Ki Tashreeh: High-Frequency Trading, jise aksar HFT ke naam se jana jata hai, aik trading strategy ko daryaft karta hai jo market mein bohot se orders ko itni tezi se execute karna shamil hai. HFT ka bunyadi maqsad market mein chhotay price farqat se faida uthana hai, jise ke milliseconds ke andar trades ko execute kiya jata hai. Is tajaweez mein advanced algorithms aur cutting-edge technology ka istemal karna hota hai taake market data ko tafseel se analyze kiya ja sake aur trades ko jald bazi se execute kiya ja sake.

HFT Ke Khaas Kirdar:

- Tez Raftar Sab Se Ahem Hai: HFT insan traders ki kapasity se zyada waqt scale par kaam karta hai. Taqatwar computers aur high-speed data connections ka istemal HFT algorithms ko split-second faislay lene aur trades ko tez tareen raftar mein execute karne ki anumati deta hai.

- Algorithmic Trading: HFT ke liye markazi hai mushkil algorithms ka istemal jo ke bohot se market data ko analyze karte hain, patterns aur trends ko pehchantay hain. Ye algorithms trading faislay ko khud-ba-khud lene ke liye design kiye jate hain, jise ke manual intervention ki zarurat nahi hoti.

- Liquidity Provision: HFT firms aksar market mein liquidity farahem karne ka ahem kirdar ada karte hain. Frequently positions ko enter aur exit karke, ye traders ek zyada liquid market environment mein contribute karte hain.

HFT Strategies:

- Market Making: HFT firms aksar market making strategies mein shamil hote hain, bid-ask spread se faida uthane ke liye buy aur sell prices quote karte hain. Ye strategy kam price farqat ke sath zyada volume of trades par mabni hai.

- Statistical Arbitrage: Statistical arbitrage mein short-term price discrepancies ko exploit karna shamil hai jo ke related financial instruments ke darmiyan hoti hain. HFT algorithms ye anomalies ko pehchantay hain aur quick profits hasil karne ke liye trades ko execute karte hain.

- Order Flow Analysis: Kuch HFT strategies market mein order flow ko analyze karne par mabni hote hain. Other market participants ke buying aur selling activities ko track karke, HFT algorithms short-term price movements ko predict karne ki koshish karte hain.

HFT Ke Fawaid:

- Efficiency aur Liquidity: HFT market efficiency mein shamil hota hai by bid-ask spreads ko narrow karke aur liquidity ko barhakar. Isse sabhi market participants ko, including individual traders, trades ko mazeed smooth aur tez tareen taur par execute karne mein madad milti hai.

- Price Discovery: HFT ki tez raftar mein naye malumat ko prices mein timely shamil karna hota hai. Ye more accurate price discovery mein madad karta hai, yaani ke market prices ko sab se taaza malumat ke mutabiq banana.

Mushkilat aur Fikrayat:

- Market Volatility: Tanqeedkar ye kehte hain ke HFT market volatility mein hissa dal sakta hai, khaas kar economic uncertainty ke doran. Large volumes of trades ko tezi se execute karna price swings ko amplify kar sakta hai.

- Technical Glitches Ka Khatra: Technology par itemaad ke bajaye HFT firms ko technical glitches aur system failures ka khatra hota hai. Ye significant financial losses aur, extreme cases mein, market disruptions ka samna kar sakte hain.

تبصرہ

Расширенный режим Обычный режим