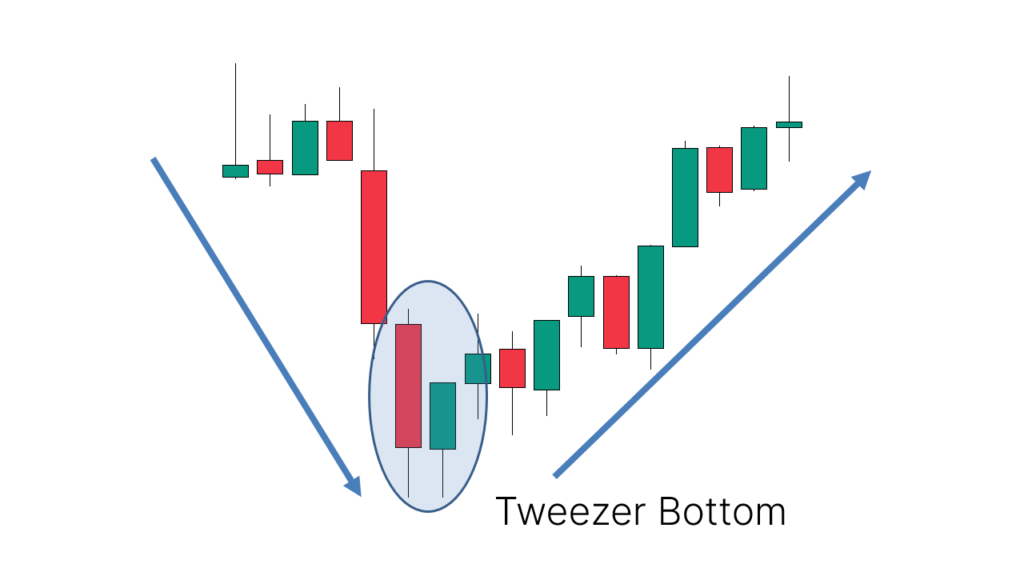

What is Tweezer Top pattern:

Tweezer Top pattern aik bearish reversal pattern hai jo aam tor par oopri rujhan ke oopar waqay hota hai. Yeh aik jaisi ya qareeb aik jaisi oonchaiyon ya ounchay saaye wali do candle par mushtamil hai. Pehli candle caught taizi ki hai, jo bazaar ke andar kharidari ke dabao ki nishandahi karti hai, aur doosri candle stick mandi ki hai, jo is baat ki nishandahi karti hai ke farokht ka dabao bazaar mein daakhil ho gaya hai.

Formation Of Tweezer top pattern:

1. Qeematein behtar oonchai aur onche neechi bananay ke sath, marketplace aik oopri rujhaan mein hai.

2. Pehli candle ki body lamba blush hai aur is ki zaroorat se ziyada ke qareeb band ho jata hai. Yeh tanao aur izafay ke tasalsul ke liye mazboot kharidari ki numaindagi karta hai.

3. Doosri candle stick mein aik chhota ya koi blush frame aur aik lamba ouncha saya hai. Is candle stuck ki zayad-ti pichlle candle caught ki onche ki terhan aik jaisi stage ke qareeb honi chahiye.

4. Doosri candle caught ka bearish body aur lamba taap shadow is baat ka ishara hai ke saylng stress marketplace region mein daakhil ho gayi hai aur akhrajaat ko kam karne par zor day rahi hai.

Characteristics Of Tweezer Top:

1. Trend reversal:

Tweezer pinnacle pattern is baat ki nishandahi karta hai ke kharidari ka tanao kam ho raha hai, aur baichnay walay intizam karna shuru kar rahay hain, ghaliban fashion ke badlay mein taizi se mandi ki taraf.

2. High reliability:

Namoonay ko ziyada qabil bharosa mandi ke reversal stayl mein se aik samjha jata hai, khaas tor par is waqt jab yeh aik taweel up trained ke baad zahir hota hai .

3. Confirmation:

Tajir baqaidagi se patteren ki tasdeeq ke liye aglay candle caught ki taraf dekh kar doosri candle caught ke kam se neechay band honay ke liye talaash karte hain.

4. Volume:

Doosri shama par barhti hui ya ziyada miqdaar mein nazar aana behtareen hai, jo jazbaat mein ziyada mazboot tabdeeli ka mahswara deta hai .

Trading With Tweezer Top pattern:

1. Confirmation:

Pattern ki candle ko badhaane ke liye, agli candle stick ka intzaar karen jo doosri candle stick ke nichale hissay se neechay band ho jaye. Yeh saylng tanao ki mojoodgi ki tasdeeq karta hai aur fori mutabadil mein daakhil honay ka ishara paish karta hai .

2. Place Stop Loss:

Patteren ke andar mumkina ulat phair ki hifazat ke liye doosri candlestick ki zayad-ti ke oopar prevent-loss order set karen .

3. Set Target:

Bunyadi tor par madad ki hudood, pichlle kam, ya fibonacci retracement darjaat ki bunyaad par hadaf ki costs ka taayun karen. Is se aap ko tijarat se salahiyat ke faiday ka andaza laganay mein madad miley gi .

4. Manage Risk:

Khatray par qaboo panay ki munasib tareka ke istemaal par ghhor karen, jaisay kirdaar ke length ko alter karna, trailing stop ka istemaal, ya juzwi munafe lena kyunkay tabdeeli agay barh rahi hai .

Tweezer Top pattern aik bearish reversal pattern hai jo aam tor par oopri rujhan ke oopar waqay hota hai. Yeh aik jaisi ya qareeb aik jaisi oonchaiyon ya ounchay saaye wali do candle par mushtamil hai. Pehli candle caught taizi ki hai, jo bazaar ke andar kharidari ke dabao ki nishandahi karti hai, aur doosri candle stick mandi ki hai, jo is baat ki nishandahi karti hai ke farokht ka dabao bazaar mein daakhil ho gaya hai.

Formation Of Tweezer top pattern:

1. Qeematein behtar oonchai aur onche neechi bananay ke sath, marketplace aik oopri rujhaan mein hai.

2. Pehli candle ki body lamba blush hai aur is ki zaroorat se ziyada ke qareeb band ho jata hai. Yeh tanao aur izafay ke tasalsul ke liye mazboot kharidari ki numaindagi karta hai.

3. Doosri candle stick mein aik chhota ya koi blush frame aur aik lamba ouncha saya hai. Is candle stuck ki zayad-ti pichlle candle caught ki onche ki terhan aik jaisi stage ke qareeb honi chahiye.

4. Doosri candle caught ka bearish body aur lamba taap shadow is baat ka ishara hai ke saylng stress marketplace region mein daakhil ho gayi hai aur akhrajaat ko kam karne par zor day rahi hai.

Characteristics Of Tweezer Top:

1. Trend reversal:

Tweezer pinnacle pattern is baat ki nishandahi karta hai ke kharidari ka tanao kam ho raha hai, aur baichnay walay intizam karna shuru kar rahay hain, ghaliban fashion ke badlay mein taizi se mandi ki taraf.

2. High reliability:

Namoonay ko ziyada qabil bharosa mandi ke reversal stayl mein se aik samjha jata hai, khaas tor par is waqt jab yeh aik taweel up trained ke baad zahir hota hai .

3. Confirmation:

Tajir baqaidagi se patteren ki tasdeeq ke liye aglay candle caught ki taraf dekh kar doosri candle caught ke kam se neechay band honay ke liye talaash karte hain.

4. Volume:

Doosri shama par barhti hui ya ziyada miqdaar mein nazar aana behtareen hai, jo jazbaat mein ziyada mazboot tabdeeli ka mahswara deta hai .

Trading With Tweezer Top pattern:

1. Confirmation:

Pattern ki candle ko badhaane ke liye, agli candle stick ka intzaar karen jo doosri candle stick ke nichale hissay se neechay band ho jaye. Yeh saylng tanao ki mojoodgi ki tasdeeq karta hai aur fori mutabadil mein daakhil honay ka ishara paish karta hai .

2. Place Stop Loss:

Patteren ke andar mumkina ulat phair ki hifazat ke liye doosri candlestick ki zayad-ti ke oopar prevent-loss order set karen .

3. Set Target:

Bunyadi tor par madad ki hudood, pichlle kam, ya fibonacci retracement darjaat ki bunyaad par hadaf ki costs ka taayun karen. Is se aap ko tijarat se salahiyat ke faiday ka andaza laganay mein madad miley gi .

4. Manage Risk:

Khatray par qaboo panay ki munasib tareka ke istemaal par ghhor karen, jaisay kirdaar ke length ko alter karna, trailing stop ka istemaal, ya juzwi munafe lena kyunkay tabdeeli agay barh rahi hai .

تبصرہ

Расширенный режим Обычный режим