Ladder Top Candlestick Patterns,

Ladder Top Candlestick Patterns ka matlab hota hai chand aham aur commonly istemal hone wale candlestick patterns jo traders aur investors ko market mein price action ko samajhne mein madad karte hain. Ye patterns chart analysis ka ek hissa hain jo traders ko market trends aur potential reversals ke bare mein maloomat faraham karte hain.

Top Candlestick Patterns,

Yahan kuch aham aur popular candlestick patterns diye gaye hain jo ladder top candlestick patterns mein shamil hote hain:

Doji,

Doji ek aham candlestick pattern hai jo indicate karta hai ke market mein indecision hai. Ye pattern ek chhota sa body aur lambi shadows ke saath hota hai, jisse samjhaya jata hai ke buyers aur sellers ke darmiyan balance hai.

Engulfing Pattern,

Engulfing pattern ek strong reversal signal hai jo indicate karta hai ke market ka trend badalne wala hai. Bullish engulfing pattern jab ek chhota bearish candle ko engulf karta hai aur bearish trend ko indicate karta hai, jabke bearish engulfing pattern jab ek chhota bullish candle ko engulf karta hai aur bullish trend ko indicate karta hai.

Hammer,

Hammer ek bullish reversal pattern hai jo downtrend ke end ko indicate karta hai. Ye pattern ek chhota body aur lambi lower shadow ke saath hota hai, jo ki buyers ke dominance ko darust karta hai.

Shooting Star,

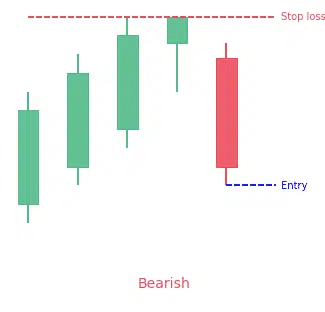

Shooting star ek bearish reversal pattern hai jo uptrend ke end ko indicate karta hai. Ye pattern ek chhota body aur lambi upper shadow ke saath hota hai, jo ki sellers ke dominance ko darust karta hai.

Harami,

Harami pattern ek reversal pattern hai jo ek bara candle ko ek chhote candle ke andar engulf karta hai. Bullish harami jab ek bara bearish candle ko ek chhota bullish candle engulf karta hai, jabke bearish harami jab ek bara bullish candle ko ek chhota bearish candle engulf karta hai.Ladder top candlestick patterns market analysis mein aham role ada karte hain aur traders ko market trends aur reversals ke bare mein maloomat faraham karte hain. In patterns ko samajhna aur recognize karna traders ke liye zaroori hai takay wo sahi trading decisions le sakein aur market movements ka behtar andaza laga sakein.

Ladder Top Candlestick Patterns ka matlab hota hai chand aham aur commonly istemal hone wale candlestick patterns jo traders aur investors ko market mein price action ko samajhne mein madad karte hain. Ye patterns chart analysis ka ek hissa hain jo traders ko market trends aur potential reversals ke bare mein maloomat faraham karte hain.

Top Candlestick Patterns,

Yahan kuch aham aur popular candlestick patterns diye gaye hain jo ladder top candlestick patterns mein shamil hote hain:

Doji,

Doji ek aham candlestick pattern hai jo indicate karta hai ke market mein indecision hai. Ye pattern ek chhota sa body aur lambi shadows ke saath hota hai, jisse samjhaya jata hai ke buyers aur sellers ke darmiyan balance hai.

Engulfing Pattern,

Engulfing pattern ek strong reversal signal hai jo indicate karta hai ke market ka trend badalne wala hai. Bullish engulfing pattern jab ek chhota bearish candle ko engulf karta hai aur bearish trend ko indicate karta hai, jabke bearish engulfing pattern jab ek chhota bullish candle ko engulf karta hai aur bullish trend ko indicate karta hai.

Hammer,

Hammer ek bullish reversal pattern hai jo downtrend ke end ko indicate karta hai. Ye pattern ek chhota body aur lambi lower shadow ke saath hota hai, jo ki buyers ke dominance ko darust karta hai.

Shooting Star,

Shooting star ek bearish reversal pattern hai jo uptrend ke end ko indicate karta hai. Ye pattern ek chhota body aur lambi upper shadow ke saath hota hai, jo ki sellers ke dominance ko darust karta hai.

Harami,

Harami pattern ek reversal pattern hai jo ek bara candle ko ek chhote candle ke andar engulf karta hai. Bullish harami jab ek bara bearish candle ko ek chhota bullish candle engulf karta hai, jabke bearish harami jab ek bara bullish candle ko ek chhota bearish candle engulf karta hai.Ladder top candlestick patterns market analysis mein aham role ada karte hain aur traders ko market trends aur reversals ke bare mein maloomat faraham karte hain. In patterns ko samajhna aur recognize karna traders ke liye zaroori hai takay wo sahi trading decisions le sakein aur market movements ka behtar andaza laga sakein.

تبصرہ

Расширенный режим Обычный режим