Assalam o alikum.!

Umeed krta hun ap sub loog khariyat sy hungy or enjoy kr rahy hungy apni trading life ko dosto Neck Bullish Candlestick Pattern ka aam tor par technical analysis mein koi maqbool term nahi hai. Agar aap mujhe mazeed tafseelat farahem kar sakte hain ya kisi aur candlestick pattern ke bare mein malumat chahte hain, to mein madad karne ke liye tayyar hoon.

How to Trade

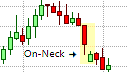

Agar aap "On Neck Bullish Candlestick Pattern" ki baat kar rahe hain, toh yeh ek khaas tarah ka candlestick pattern hai jo bullish market trend ko darust karti hai.

Yahan kuch Important Straps hain:

1. Pattern Pehchanein:

Price chart par yeh pattern dhoondhein.

2. Tasdeeq Karein:

Yeh dekhein ke pattern woh criteria ko pura karta hai jo aapne pehchana hai.

3. Dakhli Point Tay Karein:

Jab pattern tasdeeq ho jaye, ek munasib dakhli point tay karein. Yeh breakout level ya key support level par ho sakta hai.

4. Stop-Loss Set Karein:

Risk ko manage karne ke liye stop-loss level tay karein. Aam taur par yeh pattern ke neckline ya key support level ke neeche rakha jata hai.

5. Target Set Karein:

Pattern ki mutabaqat ke mutabiq ya key resistance levels ke hisab se ek munasib maqami nishan tay karein.

6. Risk-Reward Ratio:

Yah dekhein ke aapka potential munafa aapke potential nuksan se zyada ho. Aam taur par 1:2 risk-reward ratio tay karna faida pohancha sakta hai.

7. Trade Par Nazar Rakhein:

Apne trade par nazar rakhein, aur agar keemat aapke umeed ke mutabiq chal rahi hai, to stop-loss ko adjust ya phir hissa munafa lena ka tasawwur karein.

Yad rahe:

koi bhi trading strategy safalta ka koi guarantee nahi deti, aur zaroori hai ke aap risk management ka amal karein. Agar aapke paas koi khaas chart ya pattern hai toh mazeed madad ke liye detail se bayan karein.

Umeed krta hun ap sub loog khariyat sy hungy or enjoy kr rahy hungy apni trading life ko dosto Neck Bullish Candlestick Pattern ka aam tor par technical analysis mein koi maqbool term nahi hai. Agar aap mujhe mazeed tafseelat farahem kar sakte hain ya kisi aur candlestick pattern ke bare mein malumat chahte hain, to mein madad karne ke liye tayyar hoon.

How to Trade

Agar aap "On Neck Bullish Candlestick Pattern" ki baat kar rahe hain, toh yeh ek khaas tarah ka candlestick pattern hai jo bullish market trend ko darust karti hai.

Yahan kuch Important Straps hain:

1. Pattern Pehchanein:

Price chart par yeh pattern dhoondhein.

2. Tasdeeq Karein:

Yeh dekhein ke pattern woh criteria ko pura karta hai jo aapne pehchana hai.

3. Dakhli Point Tay Karein:

Jab pattern tasdeeq ho jaye, ek munasib dakhli point tay karein. Yeh breakout level ya key support level par ho sakta hai.

4. Stop-Loss Set Karein:

Risk ko manage karne ke liye stop-loss level tay karein. Aam taur par yeh pattern ke neckline ya key support level ke neeche rakha jata hai.

5. Target Set Karein:

Pattern ki mutabaqat ke mutabiq ya key resistance levels ke hisab se ek munasib maqami nishan tay karein.

6. Risk-Reward Ratio:

Yah dekhein ke aapka potential munafa aapke potential nuksan se zyada ho. Aam taur par 1:2 risk-reward ratio tay karna faida pohancha sakta hai.

7. Trade Par Nazar Rakhein:

Apne trade par nazar rakhein, aur agar keemat aapke umeed ke mutabiq chal rahi hai, to stop-loss ko adjust ya phir hissa munafa lena ka tasawwur karein.

Yad rahe:

koi bhi trading strategy safalta ka koi guarantee nahi deti, aur zaroori hai ke aap risk management ka amal karein. Agar aapke paas koi khaas chart ya pattern hai toh mazeed madad ke liye detail se bayan karein.

تبصرہ

Расширенный режим Обычный режим