Forex Trading Mein Support aur Resistance Levels Ke Saath

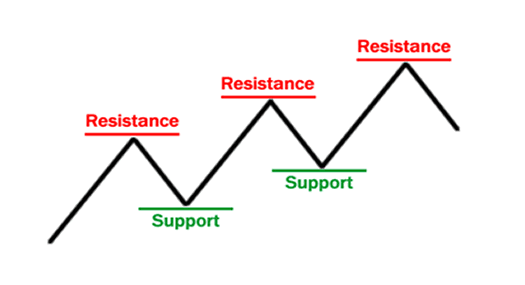

Forex trading mein support aur resistance levels, market analysis mein ahem hotay hain kyun ke yeh traders ko potential entry aur exit points ka pata lagane mein madad karte hain. In levels ka istemal kar ke traders market trends ko samajh sakte hain aur trading strategies banane mein asani hoti hai

Support Levels

Support levels wo price points hote hain jahan traders expect karte hain ke currency pair ka price giray ga, lekin is se neeche nahi jayega. Jab price support level tak pohanchta hai, wahan se buying interest barh jati hai aur market mein reversal hone ke chances hote hain

Resistance Levels

Resistance levels, on the other hand, wo price points hote hain jahan traders expect karte hain ke currency pair ka price barhay ga, lekin is se upar nahi jayega. Jab price resistance level tak pohanchta hai, wahan se selling pressure barhti hai aur market mein reversal hone ke chances hote hain

Support aur resistance levels ko identify karne ke liye traders price charts, technical indicators aur historical data ka istemal karte hain. Yeh levels aksar round numbers, previous highs ya lows, moving averages aur Fibonacci retracement levels par mabni hote hain

Trading Strategies with Support and Resistance

Breakout Strategy

Agar price ek specific resistance level ko break karta hai, toh yeh ek bullish signal ho sakta hai, aur traders is breakout ke baad long positions le sakte hain. Similarly, agar price ek specific support level ko break karta hai, toh yeh ek bearish signal ho sakta hai, aur traders is breakout ke baad short positions le sakte hain

Range-bound Trading

Agar price ek range ke andar move kar raha hai, jaise ke support aur resistance levels ke darmiyan, toh traders range-bound trading strategies istemal kar sakte hain. Yahan, traders long positions support level par aur short positions resistance level par le sakte hain

Trend Reversal

Jab price ek strong support ya resistance level ko touch karta hai aur phir usi direction mein reverse hota hai, toh yeh ek trend reversal signal ho sakta hai. Traders is signal par amal kar ke naye trend ka pata lagakar trading kar sakte hain

Conclusion

Support aur resistance levels, jab sahi tarah se istemal kiye jate hain, traders ko market movements samajhne aur sahi waqt par positions lena mein madad karte hain. Yeh levels trading strategies ko mazbooti dete hain aur market ke dynamics ko samajhne mein asani farahem karte hain. Isliye, har trader ko in levels ka sahi tarah se istemal karne ki practice karni chahiye

Forex trading mein support aur resistance levels, market analysis mein ahem hotay hain kyun ke yeh traders ko potential entry aur exit points ka pata lagane mein madad karte hain. In levels ka istemal kar ke traders market trends ko samajh sakte hain aur trading strategies banane mein asani hoti hai

Support Levels

Support levels wo price points hote hain jahan traders expect karte hain ke currency pair ka price giray ga, lekin is se neeche nahi jayega. Jab price support level tak pohanchta hai, wahan se buying interest barh jati hai aur market mein reversal hone ke chances hote hain

Resistance Levels

Resistance levels, on the other hand, wo price points hote hain jahan traders expect karte hain ke currency pair ka price barhay ga, lekin is se upar nahi jayega. Jab price resistance level tak pohanchta hai, wahan se selling pressure barhti hai aur market mein reversal hone ke chances hote hain

Support aur resistance levels ko identify karne ke liye traders price charts, technical indicators aur historical data ka istemal karte hain. Yeh levels aksar round numbers, previous highs ya lows, moving averages aur Fibonacci retracement levels par mabni hote hain

Trading Strategies with Support and Resistance

Breakout Strategy

Agar price ek specific resistance level ko break karta hai, toh yeh ek bullish signal ho sakta hai, aur traders is breakout ke baad long positions le sakte hain. Similarly, agar price ek specific support level ko break karta hai, toh yeh ek bearish signal ho sakta hai, aur traders is breakout ke baad short positions le sakte hain

Range-bound Trading

Agar price ek range ke andar move kar raha hai, jaise ke support aur resistance levels ke darmiyan, toh traders range-bound trading strategies istemal kar sakte hain. Yahan, traders long positions support level par aur short positions resistance level par le sakte hain

Trend Reversal

Jab price ek strong support ya resistance level ko touch karta hai aur phir usi direction mein reverse hota hai, toh yeh ek trend reversal signal ho sakta hai. Traders is signal par amal kar ke naye trend ka pata lagakar trading kar sakte hain

Conclusion

Support aur resistance levels, jab sahi tarah se istemal kiye jate hain, traders ko market movements samajhne aur sahi waqt par positions lena mein madad karte hain. Yeh levels trading strategies ko mazbooti dete hain aur market ke dynamics ko samajhne mein asani farahem karte hain. Isliye, har trader ko in levels ka sahi tarah se istemal karne ki practice karni chahiye

تبصرہ

Расширенный режим Обычный режим