Assalam o alikum.!

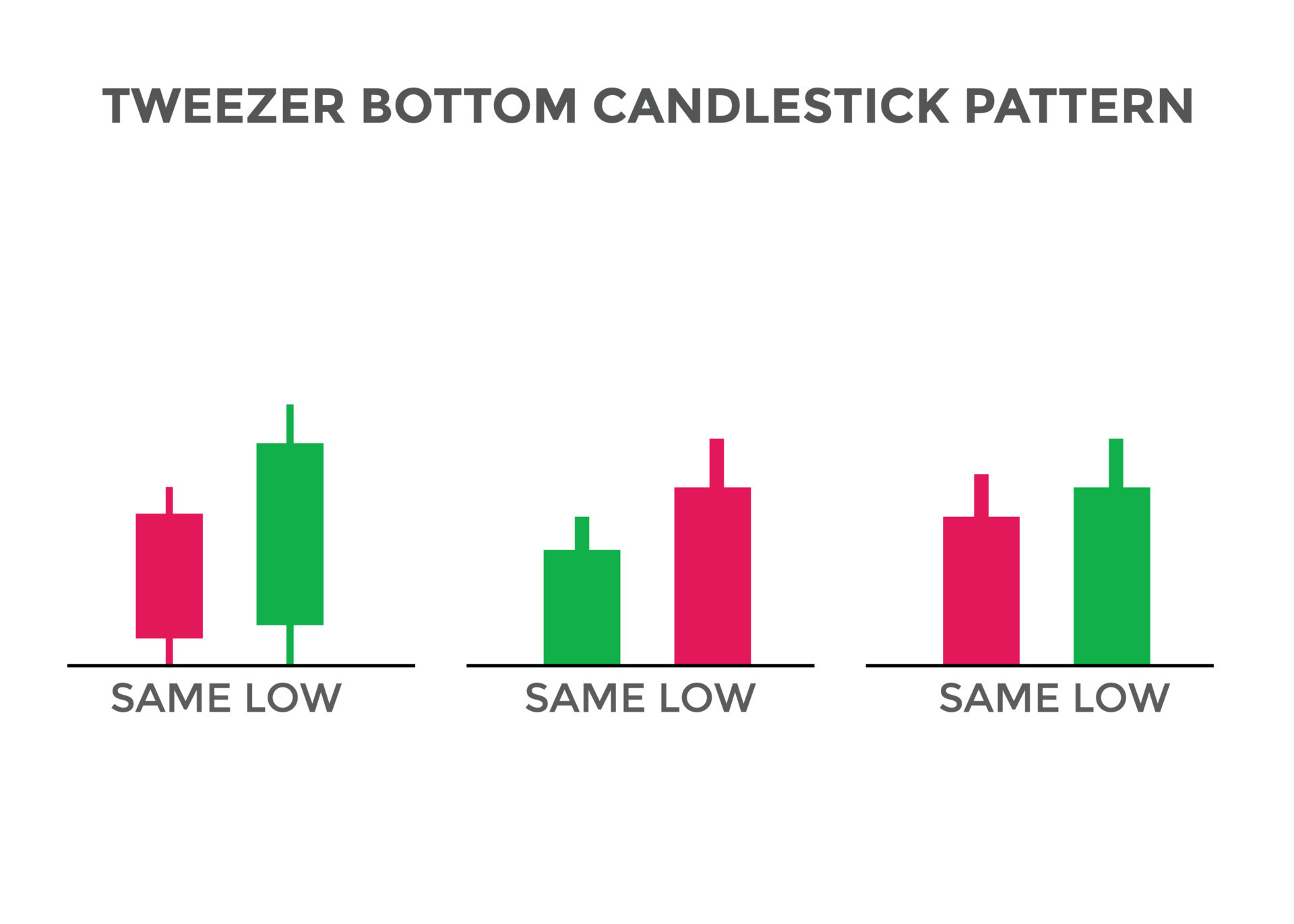

Umeed krta hun ap sub loog khariyat sy hungy or enjoy kr rahy hungy apni trading life ko dosto Tweezer Bottom ek technical analysis pattern hai jo market charts par dikhta hai. Ye pattern do candlesticks se bana hota hai jisme pehla candlestick downtrend ke baad aata hai aur doosra candlestick usi price level par ya uske nearby close hota hai. Ye pattern bullish reversal signal provide karta hai, indicating ke downtrend ke baad upmove shuru ho sakta hai.

Tweezer Bottom Pattern py trade kasy kryan

Tweezer Bottom pattern par trade karna, chart pe pattern ko pehchan kar aur ek trading strategy implement karne ko involve karta hai. Yahan ek basic approach hai:

1. Tweezer Bottom Pehchanen:

Downtrend mein do candlesticks ko dhunden.

Pehla candlestick bearish hota hai, aur doosra bullish hota hai, jo ek hi price level ke paas bottom banata hai.

2. Confirmation:

Additional confirmation signals ka intezaar karen, jaise ki volume mein izafah ya doosre technical indicators jo potential reversal ke saath hain.

3. Entry Point:

Long (buy) position enter karen yaad rahe slightly above the high of the second bullish candlestick.

4. Stop-Loss:

Stop-loss order set karen, jo tweezer bottom pattern ke low ke neeche hota hai. Ye risk ko manage karne mein madad karta hai agar reversal nahi hota.

5. Take Profit:

Profits len ke liye ek target set karen. Ye risk-reward ratio ya key resistance levels par based ho sakta hai.

6. Risk Management:

Apne risk ko manage karne ke liye ek single trade par trading capital ka pehle se decide kiya gaya percentage se zyada risk na karen.

Yaad rahe: koi bhi trading strategy foolproof nahi hoti, aur zaroori hai ke Tweezer Bottom pattern ko doosre forms of analysis aur risk management ke saath combine karen. Iske alawa, live trading mein kisi nayi strategy ko implement karne se pehle demo account par practice karen.

Umeed krta hun ap sub loog khariyat sy hungy or enjoy kr rahy hungy apni trading life ko dosto Tweezer Bottom ek technical analysis pattern hai jo market charts par dikhta hai. Ye pattern do candlesticks se bana hota hai jisme pehla candlestick downtrend ke baad aata hai aur doosra candlestick usi price level par ya uske nearby close hota hai. Ye pattern bullish reversal signal provide karta hai, indicating ke downtrend ke baad upmove shuru ho sakta hai.

Tweezer Bottom Pattern py trade kasy kryan

Tweezer Bottom pattern par trade karna, chart pe pattern ko pehchan kar aur ek trading strategy implement karne ko involve karta hai. Yahan ek basic approach hai:

1. Tweezer Bottom Pehchanen:

Downtrend mein do candlesticks ko dhunden.

Pehla candlestick bearish hota hai, aur doosra bullish hota hai, jo ek hi price level ke paas bottom banata hai.

2. Confirmation:

Additional confirmation signals ka intezaar karen, jaise ki volume mein izafah ya doosre technical indicators jo potential reversal ke saath hain.

3. Entry Point:

Long (buy) position enter karen yaad rahe slightly above the high of the second bullish candlestick.

4. Stop-Loss:

Stop-loss order set karen, jo tweezer bottom pattern ke low ke neeche hota hai. Ye risk ko manage karne mein madad karta hai agar reversal nahi hota.

5. Take Profit:

Profits len ke liye ek target set karen. Ye risk-reward ratio ya key resistance levels par based ho sakta hai.

6. Risk Management:

Apne risk ko manage karne ke liye ek single trade par trading capital ka pehle se decide kiya gaya percentage se zyada risk na karen.

Yaad rahe: koi bhi trading strategy foolproof nahi hoti, aur zaroori hai ke Tweezer Bottom pattern ko doosre forms of analysis aur risk management ke saath combine karen. Iske alawa, live trading mein kisi nayi strategy ko implement karne se pehle demo account par practice karen.

تبصرہ

Расширенный режим Обычный режим