WHAT IS MEETING LINE PATTERN:

Meeting Line ak candlestick pattern ha or is pattern ko market ma bahot hi widely use kiya jata ha or market ma is pattern ko technical analysis kar ka predict kiya jata ha jo future market ki price ha is ko. Ya meeting line pattern two candles sa mil kar banta ha or ya pattern huma indicates karta ha potential reversal hona ka bara ma price ma jo current trend chal raha hota ha is ka bara ma. Ya pattern tab banta ha jab long jo bullish ki candlestick hoti ha jo ka green ya white colour ki hoti ha ya follow karti ha long bearish ki candle ko jo ka black ya red colour ke hoti ha or jo is pattern ke second candle hoti ha ya close hoti ha jo previous first candle hoti ha is ka mid ka near ma a kar hoti ha bullish ke candle ka.

TYPES OF MEETING LINE PATTERN:

1. Bullish Meeting Line pattern:

Jo ya bullish meeting line pattern ha is ki jo first candle hoti ha ya long bullish ki candle hoti ha jo ka huma batati ha market ka strong uptrend ka bara ma or jo is pattern ki second candle hoti ha ya open hoti ha below ma first candle ka or ya phir ya higher ma close hoti ha ya near ma hoti ha first candle ka mid point ka. Ya bullish meeting line pattern huma batat ha ka jo market ma bears ha ya try kar raha ha price ko push karna ka lower ke traf magar ya no kar pa raha or dosri side par jo bull ha is ka market ma control ha.or ya huma bata raha ha potential trend ka reversal hona ka bara ma bearish sa bullish ke traf.

2. Bearish Meeting Line pattern:

Ya jo bearish meeting line pattern ha ya bhi two candles sa bana hota ha is ki jo first candle hoti ha ya long bearish ki candle hoti ha jo ka huma batati ha strong downtrend ka bara ma. Or jo second candle hoti ha ya opens hoti ha above sa previous bearish candle sa or ya ya move hoti hoi lower ma jati ha ja kar close near ma hoti ha first bearish candle ka mid point ka. Ya bearish meeting line pattern huma indicates karta ha ka bulls ha ya try kar raha ha or push kar raha ha price ko higher ke traf magar ya failed ho raha ha or jo bears ha is ka control ha market ma .or ya bearish meeting line pattern huma suggests kar raha jota ha trend ka reversal hona ka bara ma bullish sa bearish ki traf.

CHARACTERISTICS OF MEETING LineLINE PATTERN:

1. Two candlestick:

Meeting Line pattern bana hota ha two candlestick ka sath or is pattern ma jo first one candle hoti ha ya hua represents kar rahi hoti h market ma jo current trend chal raha hota ha os ka bara ma,or jo is pattern ke second candle ho ge ya signal da ge potential reversal ka bara ma.

2. Long candlestick:

Is meeting line pattern ki jo dono candles ho ge ya bahot hi long bodies candlestick ho ge or ya huma indicating karay ge significant price movement ka bara ma market ka period ma.

3. Close near mid point:

Jo is pattern ki second candle ho ge ya close ho ge mid point ka near ma ja kar jo is pattern ki first candle ho ge is ka or ya huma showing kar rahi ho ge ka jo market ha is ma buyers or sellers balance ho kar move kar raha ha.

TRADING WITH THE MEETING lineLINE PATTERN:

Meeting Line pattern ha ya ak bahot hi reliable reversal pattern ha is patten ko traders use karta ha trading ka decisions lana ka liya.ya kuch points ha jin ko use kar ka trading kar sakta ha meeting line pattern ma.

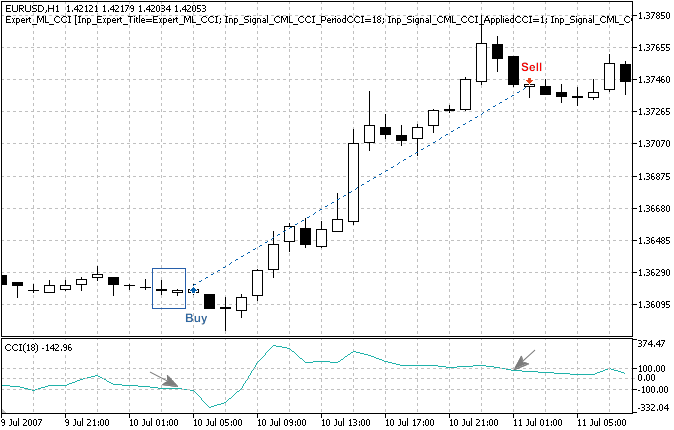

1. Confirmation:

Is meeting line pattern ma traders trade wait karay ga trade enter karna sa phalay confirmation ka signal ki,jab REVERSAL ho ga price action ka or break up ga trend line ka to is ma confirmation ka signal mila ga or traders confirmation ka liya use karay ga or technical indicators ko is pattern ma trade ko enter karna sa phalay.

2. Stop loss:

Is meeting line pattern ma traders place karay ga stop loss ko below ma or low ma jo is pattern ki second candle ho ge is ka jab ya bullish meeting line pattern ho ga. Or stop loss ko set karay ga above or high ma second candlestick ka jab bearish meeting line pattern ho ga or ya jo stop loss ho ga help karay ga potentially losses sa or pattern ka fail hona sa.

3. Target price:

Traders set karay ga jo price target ho ga os ko support or resistance level ko dakhta hua or traders target ko set karna ka liya use karay ga or technical analysis tools ko or is ki madad sa determine karay ga potentially price targets ko.

4. Volume analysis:

Analysis karay ga trading volume ko jo ka huma provide karay ga or additional confirmation ka bara ma or pattern ki validity ka bara ma.jab increase ho ga volume to jo pattern ki formation ho ge is ma strength or reliability ho ge.

Meeting Line ak candlestick pattern ha or is pattern ko market ma bahot hi widely use kiya jata ha or market ma is pattern ko technical analysis kar ka predict kiya jata ha jo future market ki price ha is ko. Ya meeting line pattern two candles sa mil kar banta ha or ya pattern huma indicates karta ha potential reversal hona ka bara ma price ma jo current trend chal raha hota ha is ka bara ma. Ya pattern tab banta ha jab long jo bullish ki candlestick hoti ha jo ka green ya white colour ki hoti ha ya follow karti ha long bearish ki candle ko jo ka black ya red colour ke hoti ha or jo is pattern ke second candle hoti ha ya close hoti ha jo previous first candle hoti ha is ka mid ka near ma a kar hoti ha bullish ke candle ka.

TYPES OF MEETING LINE PATTERN:

1. Bullish Meeting Line pattern:

Jo ya bullish meeting line pattern ha is ki jo first candle hoti ha ya long bullish ki candle hoti ha jo ka huma batati ha market ka strong uptrend ka bara ma or jo is pattern ki second candle hoti ha ya open hoti ha below ma first candle ka or ya phir ya higher ma close hoti ha ya near ma hoti ha first candle ka mid point ka. Ya bullish meeting line pattern huma batat ha ka jo market ma bears ha ya try kar raha ha price ko push karna ka lower ke traf magar ya no kar pa raha or dosri side par jo bull ha is ka market ma control ha.or ya huma bata raha ha potential trend ka reversal hona ka bara ma bearish sa bullish ke traf.

2. Bearish Meeting Line pattern:

Ya jo bearish meeting line pattern ha ya bhi two candles sa bana hota ha is ki jo first candle hoti ha ya long bearish ki candle hoti ha jo ka huma batati ha strong downtrend ka bara ma. Or jo second candle hoti ha ya opens hoti ha above sa previous bearish candle sa or ya ya move hoti hoi lower ma jati ha ja kar close near ma hoti ha first bearish candle ka mid point ka. Ya bearish meeting line pattern huma indicates karta ha ka bulls ha ya try kar raha ha or push kar raha ha price ko higher ke traf magar ya failed ho raha ha or jo bears ha is ka control ha market ma .or ya bearish meeting line pattern huma suggests kar raha jota ha trend ka reversal hona ka bara ma bullish sa bearish ki traf.

CHARACTERISTICS OF MEETING LineLINE PATTERN:

1. Two candlestick:

Meeting Line pattern bana hota ha two candlestick ka sath or is pattern ma jo first one candle hoti ha ya hua represents kar rahi hoti h market ma jo current trend chal raha hota ha os ka bara ma,or jo is pattern ke second candle ho ge ya signal da ge potential reversal ka bara ma.

2. Long candlestick:

Is meeting line pattern ki jo dono candles ho ge ya bahot hi long bodies candlestick ho ge or ya huma indicating karay ge significant price movement ka bara ma market ka period ma.

3. Close near mid point:

Jo is pattern ki second candle ho ge ya close ho ge mid point ka near ma ja kar jo is pattern ki first candle ho ge is ka or ya huma showing kar rahi ho ge ka jo market ha is ma buyers or sellers balance ho kar move kar raha ha.

TRADING WITH THE MEETING lineLINE PATTERN:

Meeting Line pattern ha ya ak bahot hi reliable reversal pattern ha is patten ko traders use karta ha trading ka decisions lana ka liya.ya kuch points ha jin ko use kar ka trading kar sakta ha meeting line pattern ma.

1. Confirmation:

Is meeting line pattern ma traders trade wait karay ga trade enter karna sa phalay confirmation ka signal ki,jab REVERSAL ho ga price action ka or break up ga trend line ka to is ma confirmation ka signal mila ga or traders confirmation ka liya use karay ga or technical indicators ko is pattern ma trade ko enter karna sa phalay.

2. Stop loss:

Is meeting line pattern ma traders place karay ga stop loss ko below ma or low ma jo is pattern ki second candle ho ge is ka jab ya bullish meeting line pattern ho ga. Or stop loss ko set karay ga above or high ma second candlestick ka jab bearish meeting line pattern ho ga or ya jo stop loss ho ga help karay ga potentially losses sa or pattern ka fail hona sa.

3. Target price:

Traders set karay ga jo price target ho ga os ko support or resistance level ko dakhta hua or traders target ko set karna ka liya use karay ga or technical analysis tools ko or is ki madad sa determine karay ga potentially price targets ko.

4. Volume analysis:

Analysis karay ga trading volume ko jo ka huma provide karay ga or additional confirmation ka bara ma or pattern ki validity ka bara ma.jab increase ho ga volume to jo pattern ki formation ho ge is ma strength or reliability ho ge.

تبصرہ

Расширенный режим Обычный режим