Piercing candlestick pattern

Piercing Candlestick Pattern, jo kay technical analysis mein istemal hota hai, ek bullish reversal pattern hai jo market ke trend ka mawad badalne ki sambhavna ko darust karta hai. Ye pattern do candlesticks se banta hai aur aam taur par downtrend ke badalne ki nishani hoti hai.

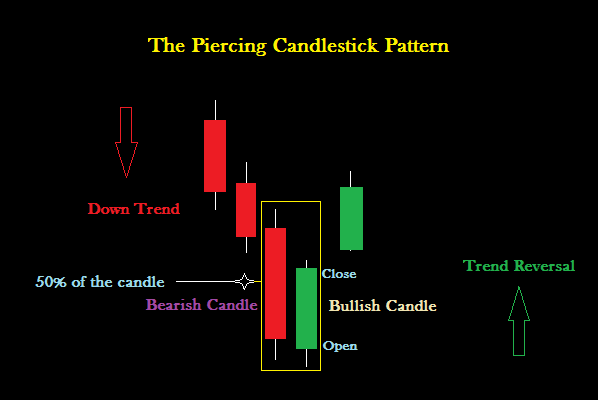

Pehla Candlestick (Bearish): Pattern ka pehla candlestick ek bearish candle hota hai, jise sellers ne control kiya hota hai. Is candle ki opening price pehle din ke closing price se neeche hoti hai, jo downtrend ko confirm karta hai. Candlestick ki body ka size aur woh space jo opening aur closing price ke darmiyan hota hai, ye show karta hai ke sellers ne control mein hai.

Dusra Candlestick (Bullish): Dusra candlestick pehle candle ki body ke neeche open hoti hai, indicating continued bearish sentiment initially. Lekin, iska closing price pehle candle ki body ke beech mein hota hai ya uske upper half mein. Is upward movement ka matlab hai ke buyers ne control mein entry mara hai aur market sentiment mein shift hone ki sambhavna hai.

Interpretation: Piercing candlestick pattern ka mukhya uddeshya hai bearish trend ko reverse karna. Dusra candle, pehle candle ke neeche open hone ke baad bhi, ek strong buying interest ka sign deta hai. Agar ye pattern confirm hota hai, toh traders expect karte hain ki ab market bullish trend mein ja sakta hai.

Trading Strategy: Traders is pattern ko dekhte hue market mein long position lete hain, yaani ki wo stocks ya securities khareedte hain, in the anticipation of a bullish reversal. Lekin, hamesha yaad rahe ke ek hi candlestick pattern par pura bharosa na karein, aur additional technical indicators aur analysis ka istemal karein confirmation ke liye.

Risk Management: Har trading decision ke saath risk management ka bhi dhyan rakhna zaroori hai. Stop-loss orders ka istemal karein taki nuksan se bacha ja sake, agar market expectations ke khilaf chala gaya.

Is tarah se, piercing candlestick pattern traders ko market ke potential trend reversal ka pata lagane mein madad karta hai, lekin hamesha saavdhaan rahein aur doosre technical factors ko bhi madde nazar rakhein trading decisions mein.

Piercing Candlestick Pattern, jo kay technical analysis mein istemal hota hai, ek bullish reversal pattern hai jo market ke trend ka mawad badalne ki sambhavna ko darust karta hai. Ye pattern do candlesticks se banta hai aur aam taur par downtrend ke badalne ki nishani hoti hai.

Pehla Candlestick (Bearish): Pattern ka pehla candlestick ek bearish candle hota hai, jise sellers ne control kiya hota hai. Is candle ki opening price pehle din ke closing price se neeche hoti hai, jo downtrend ko confirm karta hai. Candlestick ki body ka size aur woh space jo opening aur closing price ke darmiyan hota hai, ye show karta hai ke sellers ne control mein hai.

Dusra Candlestick (Bullish): Dusra candlestick pehle candle ki body ke neeche open hoti hai, indicating continued bearish sentiment initially. Lekin, iska closing price pehle candle ki body ke beech mein hota hai ya uske upper half mein. Is upward movement ka matlab hai ke buyers ne control mein entry mara hai aur market sentiment mein shift hone ki sambhavna hai.

Interpretation: Piercing candlestick pattern ka mukhya uddeshya hai bearish trend ko reverse karna. Dusra candle, pehle candle ke neeche open hone ke baad bhi, ek strong buying interest ka sign deta hai. Agar ye pattern confirm hota hai, toh traders expect karte hain ki ab market bullish trend mein ja sakta hai.

Trading Strategy: Traders is pattern ko dekhte hue market mein long position lete hain, yaani ki wo stocks ya securities khareedte hain, in the anticipation of a bullish reversal. Lekin, hamesha yaad rahe ke ek hi candlestick pattern par pura bharosa na karein, aur additional technical indicators aur analysis ka istemal karein confirmation ke liye.

Risk Management: Har trading decision ke saath risk management ka bhi dhyan rakhna zaroori hai. Stop-loss orders ka istemal karein taki nuksan se bacha ja sake, agar market expectations ke khilaf chala gaya.

Is tarah se, piercing candlestick pattern traders ko market ke potential trend reversal ka pata lagane mein madad karta hai, lekin hamesha saavdhaan rahein aur doosre technical factors ko bhi madde nazar rakhein trading decisions mein.

تبصرہ

Расширенный режим Обычный режим