Hello,

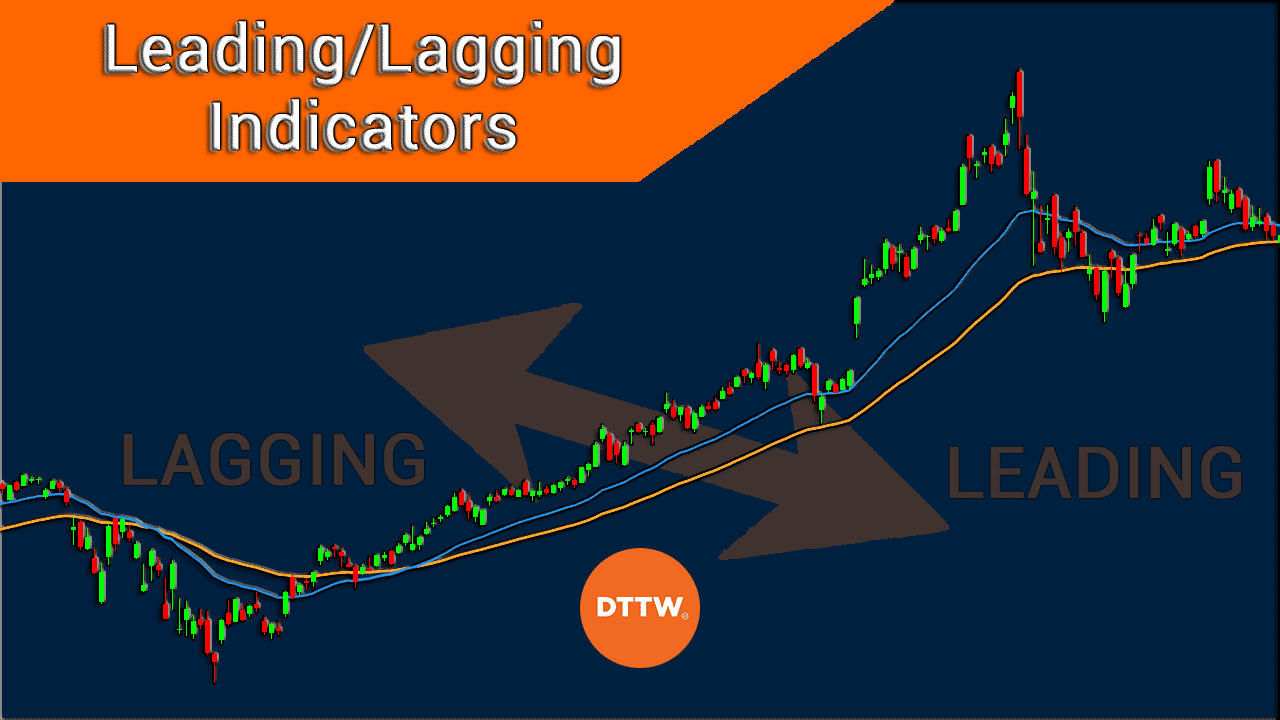

Dosto forex chart main market ke movement ko analysis karne ke liye baish tar traders lagging aur leading indicators ka use karte hain take forex analysis ko sahi se samjha ja sake aur market ke movement ke mutabi trade le ja sake aaj ke is topic main hum lagging aur leading indicators ke mabain difference ko samjhenhe gay ayye stap bay stap jante hain ke lagging aur leading indicators kya hain aur kaise market ko follow karte hain

What's Lagging And Leading Indicator?

Forex mein leading aur lagging indicators mein major difference yeh hay ke leading indicators market ki maujuda halat ke based hain aur yeh market signals dete hain ke market kitna overbought ya oversold hay. Lagging indicators market ki tarikhi halat ke based hain aur yeh market signals dete hain ke trend pahle se hi shuru ho chuka hay.

Combination Of Indicator

Leading indicators bhavishyvani karte hain ke market ki qeematon mein aage ki harkat kaisi hogi. Yeh pichhle bhavishya ki harkaton ki madad se aisa karte hain. Lagging indicators maujuda market trend ki tasdeeq karte hain. Yeh pichhle market trend ki madad se aisa karte hain Donon indicators ek dusre ke madadgar ho sakte hain, lekin yeh zyadatar ek dusre se mutasadum hote hain. Lagging indicators sideway markets mein theek tarah se kam nahin karte. Lekin leading indicators sideway markets mein behtarin kam karte hain.

Use In Market

Am taur per leading indicators ko trending markets mein aur lagging indicators ko sideway markets mein istemal karna chahiye. Yeh zaroori nahin ke ek ya dusre indicator ko akele istemal kiya jaaye, lekin har indicator ke nuksan ko samajhna zaroori hay.

Leading indicators ki kuchh misalein hain:

Lagging indicators ki kuchh misalein hain:

Aap donon tarah ke indicators ko ek sath bhi istemal kar sakte hain. Yeh aapko zyada mutmain aur mazbooh trading signals de sakta hay

Dosto forex chart main market ke movement ko analysis karne ke liye baish tar traders lagging aur leading indicators ka use karte hain take forex analysis ko sahi se samjha ja sake aur market ke movement ke mutabi trade le ja sake aaj ke is topic main hum lagging aur leading indicators ke mabain difference ko samjhenhe gay ayye stap bay stap jante hain ke lagging aur leading indicators kya hain aur kaise market ko follow karte hain

What's Lagging And Leading Indicator?

Forex mein leading aur lagging indicators mein major difference yeh hay ke leading indicators market ki maujuda halat ke based hain aur yeh market signals dete hain ke market kitna overbought ya oversold hay. Lagging indicators market ki tarikhi halat ke based hain aur yeh market signals dete hain ke trend pahle se hi shuru ho chuka hay.

Combination Of Indicator

Leading indicators bhavishyvani karte hain ke market ki qeematon mein aage ki harkat kaisi hogi. Yeh pichhle bhavishya ki harkaton ki madad se aisa karte hain. Lagging indicators maujuda market trend ki tasdeeq karte hain. Yeh pichhle market trend ki madad se aisa karte hain Donon indicators ek dusre ke madadgar ho sakte hain, lekin yeh zyadatar ek dusre se mutasadum hote hain. Lagging indicators sideway markets mein theek tarah se kam nahin karte. Lekin leading indicators sideway markets mein behtarin kam karte hain.

Use In Market

Am taur per leading indicators ko trending markets mein aur lagging indicators ko sideway markets mein istemal karna chahiye. Yeh zaroori nahin ke ek ya dusre indicator ko akele istemal kiya jaaye, lekin har indicator ke nuksan ko samajhna zaroori hay.

Leading indicators ki kuchh misalein hain:

- Stochastic oscillator

- Relative Strength Index (RSI)

- Williams %R

- Momentum indicator

Lagging indicators ki kuchh misalein hain:

- Moving averages

- Exponential moving averages

- Bollinger bands

- Moving average convergence divergence (MACD)

Aap donon tarah ke indicators ko ek sath bhi istemal kar sakte hain. Yeh aapko zyada mutmain aur mazbooh trading signals de sakta hay

تبصرہ

Расширенный режим Обычный режим