Momentum indicators forex trading mein istemal hone wale technical analysis tools hain jo price movements ki taqat aur rukh ko maloom karne mein madad karte hain. Ye un asoolon par mabni hote hain ke prices aam taur par usi rukh mein chalti hain jab tak kafi saboot na ho ke kuch aur ho sakta hai.

Types of Momentum Indicators

Forex trading mein istemal hone wale kai tarah ke momentum indicators hain, jin mein shaamil hain:

Momentum Indicators Ka Calculation

Momentum indicators ko price data par mabni hisaab kitaab ke mathematical formulas se calculate kiya jata hai. Formulas is baat par mabni hote hain ke kaunsa type ka indicator istemal ho raha hai. Yahan kuch misalain hain:

Momentum Indicators Ko Kaise Interpret Karein

Momentum indicators ke values aur ye ke woh kisi level ke upar ya neeche hain, in par tawajjuh di jati hai. Yahan kuch aam hidayat hain:

Momentum Indicators Ko Trading Strategies Mein Kaise Istemal Karein

Momentum indicators ko trading strategies mein istemal karke potenital dakhil aur nikaal ke points ka pata lagaya ja sakta hai. Yahan kuch misalain hain:

Types of Momentum Indicators

Forex trading mein istemal hone wale kai tarah ke momentum indicators hain, jin mein shaamil hain:

- Moving Average Convergence Divergence (MACD): Ye ek mashhoor momentum indicator hai. Iska calculation 26-period exponential moving average (EMA) ko 12-period EMA se minus karna hota hai, phir is farq ka 9-period EMA nikalna hota hai. Jo line is tarah banti hai usay MACD line kehte hain, aur is farq ko dikhane ke liye ek histogram plot hota hai jo MACD line aur 9-period EMA ke darmiyan ka farq dikhata hai.

- Relative Strength Index (RSI): Ye indicator price movements ki tezi aur tabdeeli ko napta hai. Iska calculation kisi muddat ke doraan aane wale faiday aur nuksan ka average le kar unhe percentage mein express karna hota hai. Is natije ko phir 0 se 100 ke scale par plot kiya jata hai.

- Stochastic Oscillator: Ye indicator ek suraksha ke price aur uske price range ke talluq ko napta hai. Iska calculation ek suraksha ke closing price aur uske kisi muddat ke doraan ki gayi lowest price ke darmiyan ka farq le kar hota hai, phir ise uske highest aur lowest prices ke darmiyan ke farq se taqseem karna hota hai. Jo natija nikalta hai, use phir 0 se 100 ke scale par plot kiya jata hai.

Momentum Indicators Ka Calculation

Momentum indicators ko price data par mabni hisaab kitaab ke mathematical formulas se calculate kiya jata hai. Formulas is baat par mabni hote hain ke kaunsa type ka indicator istemal ho raha hai. Yahan kuch misalain hain:

- MACD:

- 12-period EMA: Close[t] - Close[t-12]

- 26-period EMA: Close[t] - Close[t-26]

- MACD line: 12-period EMA - 26-period EMA

- 9-period EMA of MACD line: Close[t] - Close[t-9]

- RSI:

- Average gains: Kisi muddat ke doraan up-bars ki tadad ka average

- Average losses: Kisi muddat ke doraan down-bars ki tadad ka average

- RSI: (Average gains - Average losses) / (Average gains + Average losses)

- Stochastic Oscillator:

- %K: (Close[t] - Low[t-n]) / (High[t-n] - Low[t-n])

- %D: %K ka 3-period moving average

Momentum Indicators Ko Kaise Interpret Karein

Momentum indicators ke values aur ye ke woh kisi level ke upar ya neeche hain, in par tawajjuh di jati hai. Yahan kuch aam hidayat hain:

- MACD:

- MACD line signal line (9-period EMA) ke upar ho: Bullish momentum

- MACD line signal line ke neeche ho: Bearish momentum

- Histogram zero ke upar ho: Bullish momentum

- Histogram zero ke neeche ho: Bearish momentum

- RSI:

- RSI 70 ke upar ho: Overbought (price correction ke liye mumkinat)

- RSI 30 ke neeche ho: Oversold (price rebound ke liye mumkinat)

- Stochastic Oscillator:

- %K 80 ke upar ho: Overbought (price correction ke liye mumkinat)

- %K 20 ke neeche ho: Oversold (price rebound ke liye mumkinat)

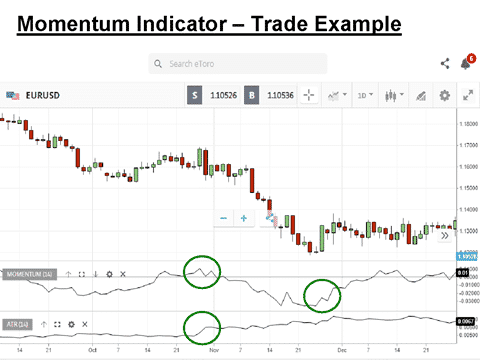

Momentum Indicators Ko Trading Strategies Mein Kaise Istemal Karein

Momentum indicators ko trading strategies mein istemal karke potenital dakhil aur nikaal ke points ka pata lagaya ja sakta hai. Yahan kuch misalain hain:

- MACD:

- Khareedari ka signal: MACD line signal line ke upar cross karti hai aur histogram zero ke upar ho

- Farokht ka signal: MACD line signal line ke neeche cross karti hai aur histogram zero ke neeche ho

- RSI:

- Khareedari ka signal: RSI 30 ke neeche gir ke phir se 30 ke upar chali jaye

- Farokht ka signal: RSI 70 ke upar chali jaye phir se 70 ke neeche gir jaye

- Stochastic Oscillator:

- Khareedari ka signal: %K 20 ke neeche gir ke phir se 20 ke upar chali jaye

- Farokht ka signal: %K 80 ke upar chali jaye phir se 80 ke neeche gir jaye

تبصرہ

Расширенный режим Обычный режим