Forex trading mein candlestick patterns technical analysis ke liye ek ahem tool hain. Ye patterns traders ko market ke behavior aur potential price movements ke bare mein insights dete hain. Ek aise pattern mein se ek hai piercing candlestick, jo ek bullish reversal pattern hai aur downtrend se uptrend ki potential reversal ko darust karti hai.

Formation of Piercing Candlestick Pattern

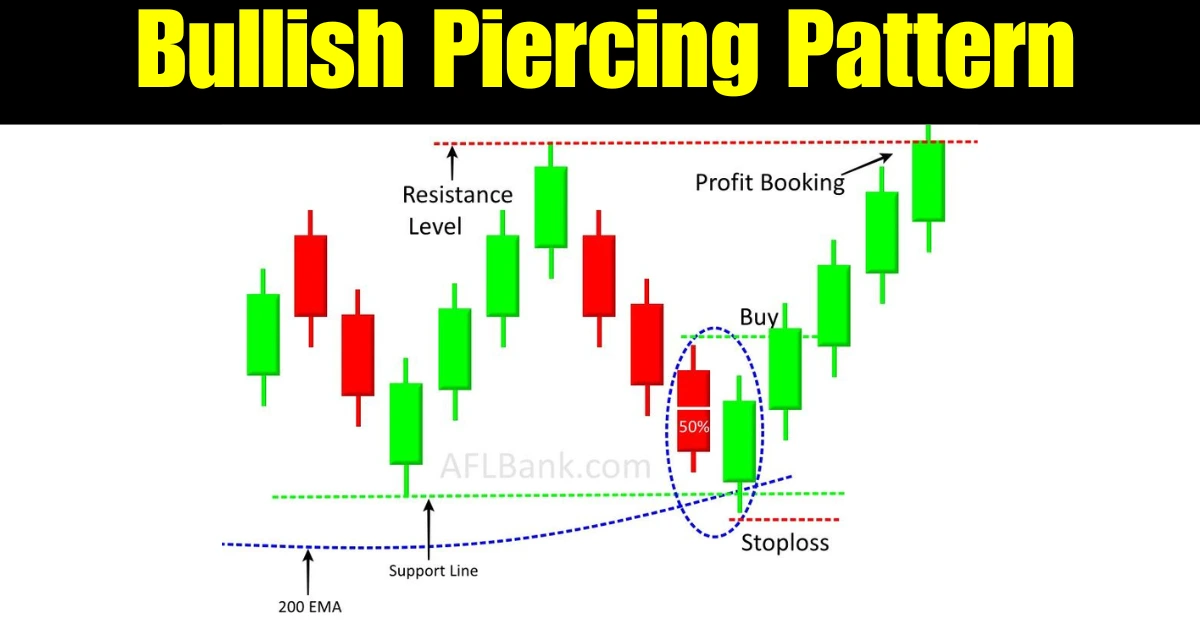

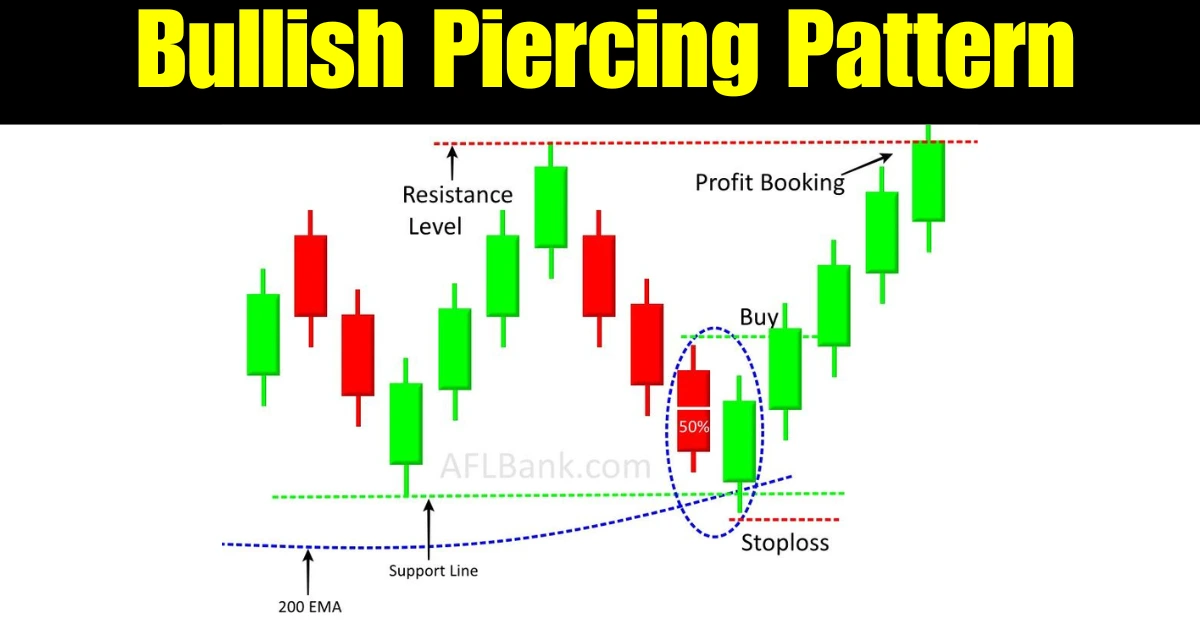

Piercing candlestick pattern do candles se bana hota hai. Pehli candle lambi hoti hai, siyah ya laal rang ki, jo bearish trend ko darust karti hai. Ye candle pichli candle ke high ke qareeb khulti hai aur uske low ke qareeb band hoti hai, jo ek mazboot bechne ki dabav ko darust karta hai. Dusri candle, jo piercing candle hai, pichli candle ke low ke neeche khulti hai lekin uske midpoint ke upar band hoti hai, jo ek kharidari ki dabav ko darust karta hai. Is candle ka jism chhota hota hai aur uske upper shadow lamba hota hai, jo dikhata hai ke prices ko upar dhakel gaya, lekin phir woh wapas kheencha gaya, jab tak ke midpoint ke upar band ho gaya.

Interpretation of Piercing Candlestick Pattern

Piercing candlestick pattern ek bullish reversal pattern hai jo ek potential price reversal ko darust karta hai, downtrend se uptrend ki taraf. Ye ishara karta hai ke bechne ki dabav kamzor hua hai, aur kharidari ki dabav barh gayi hai, jo ek mumkin price izafay ko dikhata hai. Piercing candle ka chhota jism aur lamba upper shadow dikhata hai ke kharidari ne prices ko upar dhakelne mein kamyabi haasil ki hai, lekin bechne ki dabav ke bawajood woh raily ko barqarar nahi rakh saki. Lekin, ye fact ke candle midpoint ke upar band hua, dikhata hai ke kharidari ne dobara control hasil kiya hai, jo ek positve ishara hai.

Trading Strategies for Piercing Candlestick Pattern

Formation of Piercing Candlestick Pattern

Piercing candlestick pattern do candles se bana hota hai. Pehli candle lambi hoti hai, siyah ya laal rang ki, jo bearish trend ko darust karti hai. Ye candle pichli candle ke high ke qareeb khulti hai aur uske low ke qareeb band hoti hai, jo ek mazboot bechne ki dabav ko darust karta hai. Dusri candle, jo piercing candle hai, pichli candle ke low ke neeche khulti hai lekin uske midpoint ke upar band hoti hai, jo ek kharidari ki dabav ko darust karta hai. Is candle ka jism chhota hota hai aur uske upper shadow lamba hota hai, jo dikhata hai ke prices ko upar dhakel gaya, lekin phir woh wapas kheencha gaya, jab tak ke midpoint ke upar band ho gaya.

Interpretation of Piercing Candlestick Pattern

Piercing candlestick pattern ek bullish reversal pattern hai jo ek potential price reversal ko darust karta hai, downtrend se uptrend ki taraf. Ye ishara karta hai ke bechne ki dabav kamzor hua hai, aur kharidari ki dabav barh gayi hai, jo ek mumkin price izafay ko dikhata hai. Piercing candle ka chhota jism aur lamba upper shadow dikhata hai ke kharidari ne prices ko upar dhakelne mein kamyabi haasil ki hai, lekin bechne ki dabav ke bawajood woh raily ko barqarar nahi rakh saki. Lekin, ye fact ke candle midpoint ke upar band hua, dikhata hai ke kharidari ne dobara control hasil kiya hai, jo ek positve ishara hai.

Trading Strategies for Piercing Candlestick Pattern

- Confirmation ka Intezar Karein: Piercing candlestick pattern par mabni trade mein dakhil hone se pehle confirmation ka intezar karna zaroori hai. Confirmation ek aisi bullish candle ke roop mein aati hai jo piercing candle ke high ke upar khulti hai. Ye candle piercing candle se bada jism rakhti hai, jo ek zor se kharidari ki dabav ko darust karta hai.

- Stop Loss aur Take Profit Set Karein: Piercing candlestick pattern par mabni trade mein dakhil hone par, stop loss aur take profit set karna bohot zaroori hai. Stop loss piercing candle ke low ke neeche rakha jana chahiye, jabke take profit ko ek munasib maqami, jaise ke resistance level ya Fibonacci retracement level par set kiya ja sakta hai.

- Market News aur Events Ka Nigraan Rakhein: Zaroori hai ke aap market news aur events ko nigraan rakhein jo currency pair ke price movement ko mutassir kar sakte hain. For example, agar koi ahem iktisadi release ya bara event ho toh, ye achanak ki price movement ka sabab ban sakta hai, jo trade ka nateeja prabhavit kar sakta hai.

- Piercing Candlestick Pattern Ko Dusre Indicators Ke Saath Istemal Karein: Mashwara diya jata hai ke piercing candlestick pattern ko dusre technical indicators ke saath istemal kiya jaye, jaise ke moving averages, oscillators, aur support aur resistance levels. Ye tajaweez aapko market ke behavior aur potential price movements ka tafseeli jayeza dene mein madad karegi.

- Risk Management Ki Amal Karein: Forex trading mein risk management bohot zaroori hai, aur jab piercing candlestick pattern par mabni trade mein dakhil hota hai, to isay amal mein lana bhi zaroori hai. Is mein risk-reward ratio set karna shamil hai, jo potential profit ka potential loss ke mutabiq hota hai. Acha risk-reward ratio 1:2 hai, jo dikhata hai ke potential profit potential loss ka do guna hai.

:max_bytes(150000):strip_icc():format(webp)/PiercingPattern1-4a52690ddbb642838f5ca6a5b6d360c6.png)

:max_bytes(150000):strip_icc():format(webp)/PiercingPattern2-db540caea4cb45c6953f68db1d57eb55.png)

تبصرہ

Расширенный режим Обычный режим