Asslam O Alaikum

dosto aaj hum bat karne wale hain aik ayse strategy jis ko nickline pattern ke nam se jana jata hay ayen is par tafseli guftagu karte hain

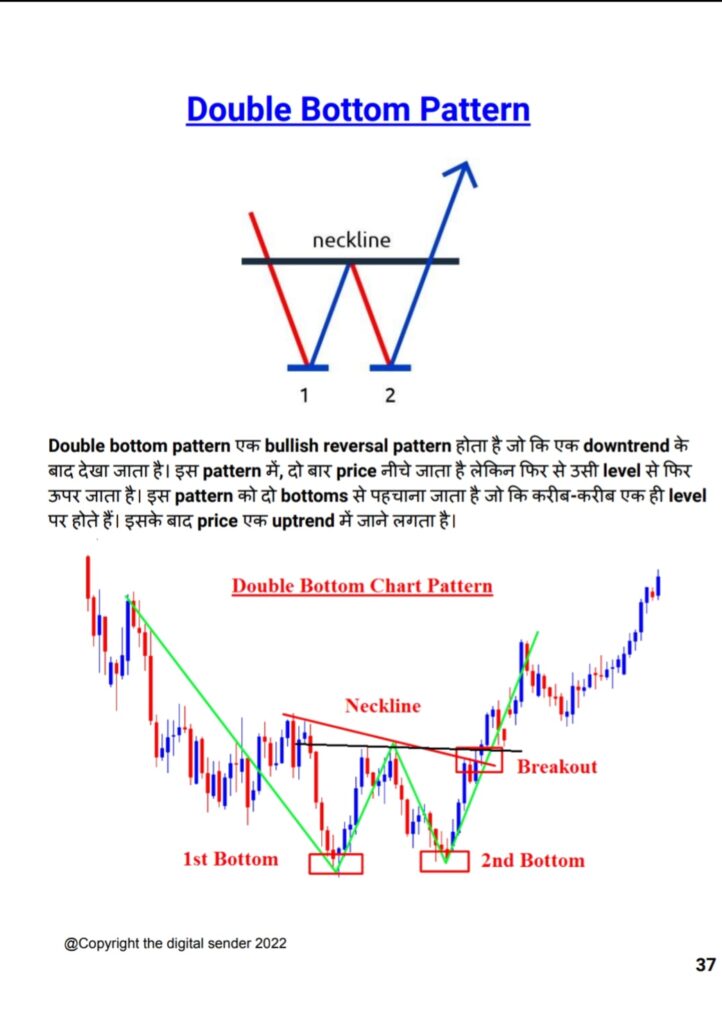

Neckline Pattern ek Technical Analysis Pattern hai jo support ya resistance line ke breakage se banta hai. Neckline Pattern ka use market ki trend ko predict karne ke liye kiya jata hai.

Neckline Pattern ke do prakar hote hain:

Neckline Pattern ko Forex main use karne ke liye aapko niche diye gaye steps follow karne chahiye:

Neckline Pattern ka use karke aap market ki trend ko predict kar sakte hain aur profitable trade kar sakte hain.

Yahan Neckline Pattern ko Forex main use karne ke kuchh tips diye gaye hain:

Neckline Pattern ek powerful Technical Analysis Pattern hai jo aapko market ki trend ko predict karne mein madad kar sakta hai. Lekin, is pattern ka use karne se pehle aapko is pattern ke bare mein poori tarah se knowledge hona chahiye.

Mujhe umeed hai ki yah jankari aapke liye helpful rahi hogi. Agar aapke koi aur sawal hain to mujhe batayein.

dosto aaj hum bat karne wale hain aik ayse strategy jis ko nickline pattern ke nam se jana jata hay ayen is par tafseli guftagu karte hain

Neckline Pattern ek Technical Analysis Pattern hai jo support ya resistance line ke breakage se banta hai. Neckline Pattern ka use market ki trend ko predict karne ke liye kiya jata hai.

Neckline Pattern ke do prakar hote hain:

- Upward Neckline: Yah support line ka breakage hota hai. Yah pattern market ki bullish trend ko indicate karta hai.

- Downward Neckline: Yah resistance line ka breakage hota hai. Yah pattern market ki bearish trend ko indicate karta hai.

Neckline Pattern ko Forex main use karne ke liye aapko niche diye gaye steps follow karne chahiye:

- Ek uptrend ya downtrend ki pahchan karein.

- Support ya resistance line ko identify karein.

- Support ya resistance line ke breakage ko observe karein.

- Neckline Pattern ka breakage confirm hone ke baad trade open karein.

Neckline Pattern ka use karke aap market ki trend ko predict kar sakte hain aur profitable trade kar sakte hain.

Yahan Neckline Pattern ko Forex main use karne ke kuchh tips diye gaye hain:

- Neckline Pattern ka use karne ke liye aapke pass minimum 2-3 candles ka data hona chahiye.

- Neckline Pattern ka use karne se pehle aap market ki liquidity aur volatility ka bhi analysis kar lena chahiye.

- Neckline Pattern ka use karke trade open karne se pehle aap stop loss aur take profit level set kar lena chahiye.

Neckline Pattern ek powerful Technical Analysis Pattern hai jo aapko market ki trend ko predict karne mein madad kar sakta hai. Lekin, is pattern ka use karne se pehle aapko is pattern ke bare mein poori tarah se knowledge hona chahiye.

Mujhe umeed hai ki yah jankari aapke liye helpful rahi hogi. Agar aapke koi aur sawal hain to mujhe batayein.

:max_bytes(150000):strip_icc()/dotdash-INV-final-Neckline-Mar-2021-01-2189437539844c5194af3863cb8b3c4a.jpg)

تبصرہ

Расширенный режим Обычный режим