Technical Analysis

Forex market me technical analysis ki kya ehmiyat hy?

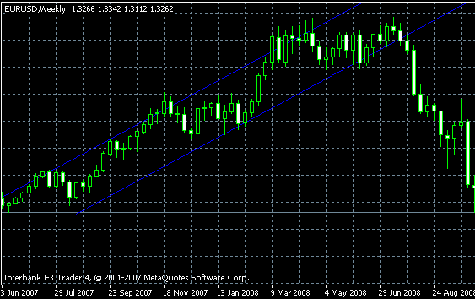

As salam o alaikum dosto, Forex market me technical analysis Forex trading discipline ky liye bohut he important hotay hain jo keh Forex market mei investor ka jaiza lanay ky liye estamal kiya ja sakta hy.Forex trade ky chance ko identiFy karnay ky liye estamal ke jate hy Forex market me technical analysis ka khyal yeh hota maze ky trader ke activities or securities ke prices me tabdele ko identiFy kar sakta hy anay ke price ke movement ke tabdele kabel e kadar indicator ko indicate kar sakta hy.

Technical analysis ky faidy:

- Dear friends, technical analysis Forex main signals generate karny k lye use hota ha or ye Forex trading ki base ha tmam bary traders trade karny k lye technical analysis ko use kr k hi market k trend or price ki prediction karty hain.

- Dear,Technical analysis hr pair py apply hoti ha.

- Dosto,agr ap esko seekh kr use karen to apki trading kafi bhtr ho skti ha or profitable ho skti ha.

Technical analysisko kesy samjha jaye:

Dear buddies, Forex market me technical analysis ke technique ka selsala hota hy jo keh Forex market ke tarekh prices ke movement or techniqle ko indicate kar sakte hy or Forex market ke paishan goi karnay ky liye estamal kiya ja sakta hy movement ko azmanay or paishan goi karnay me bhe madad kar saktay hain.Forex market ke technique ka estamal kar saktay hain technical analysis me wedge chart pattern , triangle chart pattern head and shoulder chart pattern or Forex market ke meqdare or imtazaj ke tchnique ka estamal kiya ja sakta hy Forex market me Bollinger band indicator or moving average indicator ka he estamal kiya ja sakta hy RSI or Stochastics oscillator ka he estamal kiya ja sakta hy technical analysis ka 2 maqbol tareen indicator ka he estamal kiya ja sakta hy.

تبصرہ

Расширенный режим Обычный режим