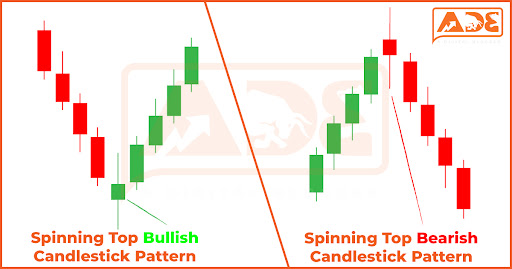

Assalam o alikum.! Umeed krta hun ap sub loog khariyat sy hungy or enjoy kr rahy hungy apni trading life ko dosto "Spinning Top" candlestick pattern ek market trend ya indecision ko represent karta hai. Isme candle ka body chhota hota hai aur upper shadow aur lower shadow dono lambe hote hain. Iska matlab hai ki opening price aur closing price ke beech me bahut kam difference hota hai.Ye pattern market ke indecision ko dikhata hai, kyun ki buyers aur sellers dono active hote hain, lekin koi clear direction nahi hoti. Agar ye pattern ek strong trend ke baad aata hai, toh ye indicate kar sakta hai ki market mein uncertainty hai aur potential reversal ho sakta hai. Lekin confirmatory signals aur market context bhi consider karna important hai.

Important Points

1.Indecision Ko Darust Karta Hai:

Dosto Spinning Top market mein uncertainty ko represent karta hai, jisme buyers aur sellers mein koi clear dominance nahi hoti, aur price range chhota hota hai.

2. Small Body:

Dosto Iski body chhoti hoti hai jisme closing price opening price ke kafi paas hota hai, indicating ke kisi bhi ek group ka strong control nahi hai.

3. Lambi Wicks:

Dosto Upper aur lower wicks dono lambi hote hain, jisse volatility aur price fluctuations ka pata chalta hai.

4. Market Reversal:

Dosto Agar Spinning Top ek strong trend ke baad aata hai, to ye market reversal ya trend ki kamzori ka sign ho sakta hai.

5. Confirmation Ki Zarurat:

Dosto Traders usually is pattern ke base par trading decisions lene se pehle, subsequent price action ka wait karte hain for confirmation.

6. Market Context:

Dosto Is pattern ko samajhne ke liye overall market context, trend direction, aur doosre technical indicators ko bhi consider karna important hai.

Hamisha Yad rakhein:

Dosto successful trading ke liye comprehensive analysis aur risk management bhi crucial hote hain.

Important Points

1.Indecision Ko Darust Karta Hai:

Dosto Spinning Top market mein uncertainty ko represent karta hai, jisme buyers aur sellers mein koi clear dominance nahi hoti, aur price range chhota hota hai.

2. Small Body:

Dosto Iski body chhoti hoti hai jisme closing price opening price ke kafi paas hota hai, indicating ke kisi bhi ek group ka strong control nahi hai.

3. Lambi Wicks:

Dosto Upper aur lower wicks dono lambi hote hain, jisse volatility aur price fluctuations ka pata chalta hai.

4. Market Reversal:

Dosto Agar Spinning Top ek strong trend ke baad aata hai, to ye market reversal ya trend ki kamzori ka sign ho sakta hai.

5. Confirmation Ki Zarurat:

Dosto Traders usually is pattern ke base par trading decisions lene se pehle, subsequent price action ka wait karte hain for confirmation.

6. Market Context:

Dosto Is pattern ko samajhne ke liye overall market context, trend direction, aur doosre technical indicators ko bhi consider karna important hai.

Hamisha Yad rakhein:

Dosto successful trading ke liye comprehensive analysis aur risk management bhi crucial hote hain.

تبصرہ

Расширенный режим Обычный режим