Indicators market trends ko analyze aur interpret karne mein traders ki madad karte hain. Ye tools hain jo traders ko trade mein kab dakhil ho ya nikalna chahiye, iske bare mein suchit karte hain. Leading aur lagging indicators in tools mein se do categories hain, jo market dynamics mein unique insights dete hain.

Leading Indicators:

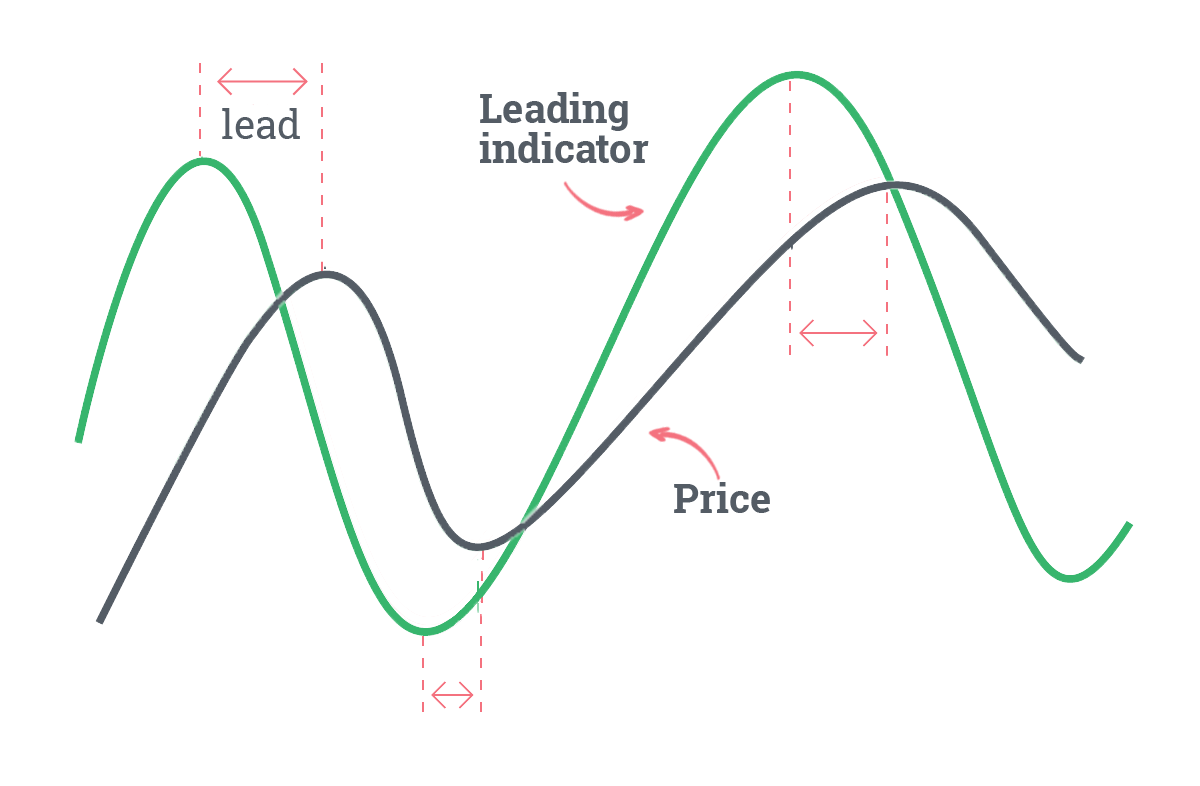

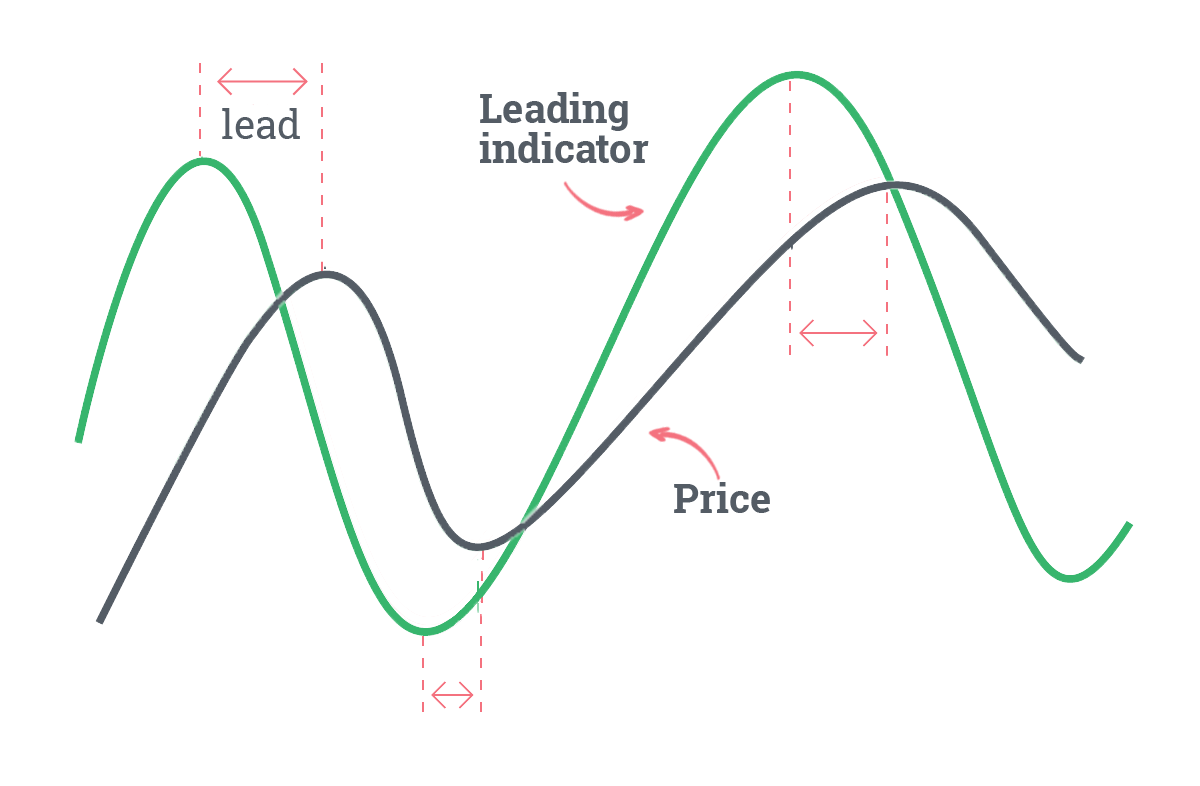

Leading indicators ki pehchaan unki kshamata se hoti hai ke ye market mein naye trend ya reversal hone se pehle signals dete hain. Traders in indicators ka istemal karke yeh try karte hain ke market kis disha mein ja raha hai.

Dusri taraf, lagging indicators trends ko confirm karte hain jo pehle shuru ho chuki hain. Ye market ka peechla view dete hain aur reactive nature ke hote hain.

Kamyab traders aksar leading aur lagging indicators ka combination istemal karte hain ek mazboot trading strategy banane ke liye. For example, wo leading indicators ka istemal potential entry points ko pehchanne ke liye aur lagging indicators ka istemal trend ki mazbooti ko confirm karne ke liye kar sakte hain.

Leading Indicators:

Leading indicators ki pehchaan unki kshamata se hoti hai ke ye market mein naye trend ya reversal hone se pehle signals dete hain. Traders in indicators ka istemal karke yeh try karte hain ke market kis disha mein ja raha hai.

- Relative Strength Index (RSI):

- RSI ek prasiddh leading indicator hai jo nedey price changes ki zyadahat ko mahsoos karne ke liye istemal hota hai, overbought ya oversold conditions ko evaluate karne ke liye. Aam taur par, 70 ke upar ka reading overbought conditions ko darust karti hai, jabki 30 ke neeche ka reading oversold conditions ko darust karti hai.

- Stochastic Oscillator:

- Ye indicator ek currency pair ke closing price ko uske price range ke saath tulna karta hai. Isse traders potential reversal points aur overbought ya oversold conditions ko pehchanne mein madad milta hai.

- Moving Averages:

- Moving averages, khaas kar chhoti avadhi wale, leading indicators ke taur par kaam kar sakte hain. Chhoti avadhi wale moving averages ka long-term moving averages ke upar cross hona aksar ek potential trend reversal ka signal samjha jata hai.

Dusri taraf, lagging indicators trends ko confirm karte hain jo pehle shuru ho chuki hain. Ye market ka peechla view dete hain aur reactive nature ke hote hain.

- Moving Averages :

- Jabki short-term moving averages leading indicators ke taur par kaam karte hain, to long-term moving averages aksar lagging indicators ke taur par istemal hote hain. Ye price data ko smooth karte hain aur overall trend ka saaf tasveer dete hain.

- Moving Average Convergence Divergence (MACD):

- MACD ek trend-following momentum indicator hai jo security ke price ke do moving averages ke darmiyan ka rishta dikhata hai. Traders aksar crossovers ko pehchanne ke liye istemal karte hain, jo potential buy ya sell signals ko darust karti hain.

- Bollinger Bands:

- Bollinger Bands mein ek middle band hota hai jo N-period simple moving average hota hai, ek upper band hota hai jo middle band ke K guna N-period standard deviation upar hota hai, aur ek lower band hota hai jo middle band ke K guna N-period standard deviation neeche hota hai. Ye volatility aur overbought ya oversold conditions ko pehchanne mein madad karte hain.

Kamyab traders aksar leading aur lagging indicators ka combination istemal karte hain ek mazboot trading strategy banane ke liye. For example, wo leading indicators ka istemal potential entry points ko pehchanne ke liye aur lagging indicators ka istemal trend ki mazbooti ko confirm karne ke liye kar sakte hain.

تبصرہ

Расширенный режим Обычный режим