Introduction: Forex Market Geometry ek technical analysis approach hai jo market movements ko geometric shapes aur patterns ke zariye samajhne ka tariqa hai. Is technique ka istemal traders aur analysts market trends, support aur resistance levels, aur potential reversals ko identify karne ke liye karte hain. Is article mein, hum Forex Market Geometry ke tafseel se baat karenge aur iske istemal ka tajaweezat aur challenges ko explore karenge.

Forex Market Geometry Kya Hai: Forex Market Geometry ka asal maqsad market movements ko geometric shapes aur patterns ke through analyze karna hai. Is approach mein traders market charts par lines, angles, aur shapes ka istemal karte hain taake woh market ki trends aur key levels ko samajh saken. Market Geometry ka concept ye hai ke price movements, jab geometric shapes mein represent kiye jate hain, toh unme certain patterns aur correlations nazar aate hain jo traders ko future movements ke liye guidance dete hain.

Market Geometry ka istemal support aur resistance levels tay karne mein, trendlines draw karne mein, aur potential reversals ko pehchanne mein hota hai. Traders is technique ka istemal karke market ke complexities ko aasan taur par samajh sakte hain.

Forex Market Geometry Ke Tareeqe:

- Trendlines:

- Trendlines Forex Market Geometry ka aham hissa hain. Traders trendlines ka istemal karke price ke movements ko analyze karte hain aur trend directions ko identify karte hain. Trendlines draw karke, woh support aur resistance levels tay kar sakte hain.

- Channels:

- Price movements ko channels mein represent karke bhi Market Geometry ka istemal hota hai. Channels draw karke traders market ke boundaries ko samajh sakte hain aur ye dekhte hain ke price kis range mein move kar raha hai.

- Fibonacci Retracements:

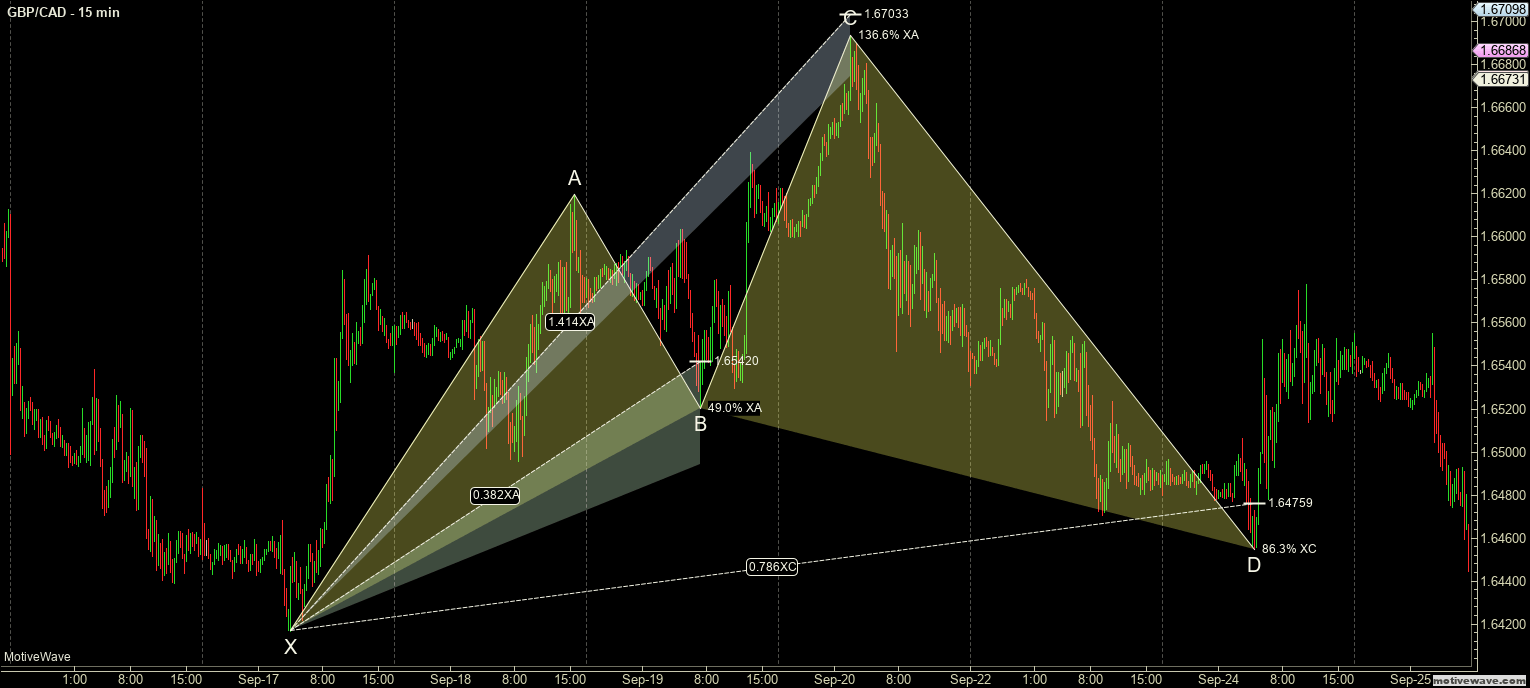

- Fibonacci retracements bhi ek Market Geometry tool hai jo traders ko support aur resistance levels tay karne mein madad karta hai. Fibonacci levels, geometric proportions ka istemal karte hain aur inka istemal price retracements ko measure karne mein hota hai.

- Chart Patterns:

- Geometric chart patterns jaise ke triangles, wedges, aur rectangles bhi Market Geometry ka hissa hote hain. In patterns ka istemal karke traders potential trend reversals aur breakouts ko identify kar sakte hain.

Forex Market Geometry Ke Fayde Aur Tafseelat:

- Trend Identification:

- Market Geometry ka istemal karke traders asani se trend ko identify kar sakte hain. Trendlines aur geometric patterns se woh market ke direction ko samajh sakte hain.

- Support Aur Resistance Levels:

- Traders support aur resistance levels ko tay karne mein Market Geometry ka istemal karte hain. Isse unhein pata chalta hai ke price kis levels par bounce kar sakta hai ya phir break kar sakta hai.

- Entry Aur Exit Points:

- Market Geometry ka istemal karke traders apne entry aur exit points ko tay kar sakte hain. Geometric patterns aur trendlines se woh potential reversal aur breakout points ko identify karke apne trading strategies ko refine kar sakte hain.

- Risk Management:

- Fibonacci retracements aur geometric patterns ka istemal risk management mein bhi hota hai. Traders apne stop loss levels ko geometric levels par set karke apne risk ko control kar sakte hain.

Forex Market Geometry Ka Istemal Pakistan Ki Chat Language Mein: Pakistan ki chat language mein, Forex Market Geometry ka istemal trading community mein aam hai. Traders is technique par frequently discussion karte hain aur iske tajaweezat ko samajhne ka tajaweezat dete hain. Market Geometry ki tafheem hona traders ke liye zaroori hai, kyun ke iske istemal se woh market ke movements ko aasan taur par samajh sakte hain.

Chat language mein, traders ek dusre se Market Geometry ke baray mein mashawarat karte hain aur apne observations ko share karte hain. Isse unki technical analysis mein improvement hoti hai aur woh market ke complexities ko samajhne mein maharat hasil karte hain. Pakistan ke trading community mein, Forex Market Geometry ka popular istemal hai aur is par discussions hona roz marra ka hai.

Conclusion: Forex Market Geometry ek useful aur visual approach hai jo traders ko market trends aur key levels ko samajhne mein madad karta hai. Pakistan ki chat language mein, is approach par baat cheet aur tajaweezat hona trading community ke liye zaroori hai. Forex Market Geometry ki samajh, traders ko market ke uncertainties ko handle karne mein madad karti hai aur unhein behtar trading decisions lene mein saksham banati hai. Is liye, har ek trader ko chahiye ke is technique ko seekhe aur apne trading journey mein iska istemal kare.

تبصرہ

Расширенный режим Обычный режим