What is Harami Candle Pattern in forex. kai hai

=

Harami Candlestick Pattern ek reversal candlestick pattern hai jo market charts par dikhai deta hai. Is pattern mein do consecutive candles hote hain, jisme pehla candle ek large range wala hota hai aur dusra candle usse chhota range ka hota hai. Harami pattern market mein trend reversal ko indicate kar sakta hai.

Types of Harami Patterns:

Hamesha yaad rahe ki kisi bhi single candlestick pattern par bharosa na karen aur doosre technical factors ko bhi madde nazar rakhen trading decisions mein.

=

Harami Candlestick Pattern ek reversal candlestick pattern hai jo market charts par dikhai deta hai. Is pattern mein do consecutive candles hote hain, jisme pehla candle ek large range wala hota hai aur dusra candle usse chhota range ka hota hai. Harami pattern market mein trend reversal ko indicate kar sakta hai.

Types of Harami Patterns:

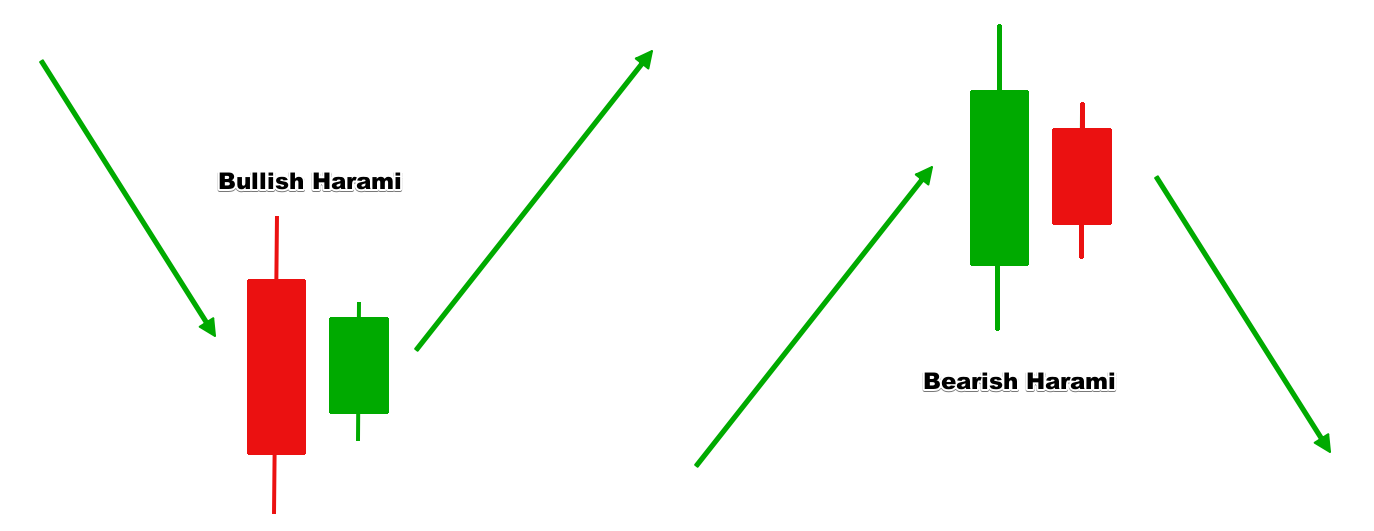

- Bullish Harami:

- Bullish Harami pattern mein pehla candle bearish hota hai, yani ki iski opening price pe closing price se zyada hoti hai, lekin closing price neeche jaati hai. Dusra candle bullish hota hai, yani ki opening price pehle candle ke closing price se neeche hoti hai, lekin closing price upar jaati hai. Dusra candle pehle candle ko engulf nahi karta, aur iska range pehle candle ke range ke andar hota hai. Bullish Harami pattern ko uptrend ke baad aane par reversal signal maana jata hai.

- Bearish Harami:

- Bearish Harami pattern mein pehla candle bullish hota hai, yani ki iski opening price pe closing price se zyada hoti hai, lekin closing price upar jaati hai. Dusra candle bearish hota hai, yani ki opening price pehle candle ke closing price se neeche hoti hai, lekin closing price neeche jaati hai. Dusra candle pehle candle ko engulf nahi karta, aur iska range pehle candle ke range ke andar hota hai. Bearish Harami pattern ko downtrend ke baad aane par reversal signal maana jata hai.

- Size Difference:

- Pehle candle ka size bada hota hai aur doosre candle ka size chhota hota hai, iska matlab hai ki market mein volatility kam ho rahi hai.

- Trend Reversal Signal:

- Harami pattern trend reversal signal provide karta hai. Agar pehle candle ka trend strong hai aur doosra candle usse chhota hai, to ye indicate karta hai ke trend weaken ho sakta hai aur reversal hone ke chances hain.

- Confirmation:

- Harami pattern ko confirm karne ke liye traders doosre technical indicators, trend lines, ya doosre candlestick patterns ka bhi istemal karte hain.

- Confirmation ke Liye Wait:

- Harami pattern ko dekhte hi trading decision na lein. Wait karein aur dekhein ki agla candle kya signal deta hai. Agar agla candle trend reversal ko confirm karta hai, to aap trading decision le sakte hain.

- Volume Analysis:

- Trading volume ka bhi analysis karna important hai. Agar Harami pattern ke formation ke samay volume kam hai, to ye indecision ko aur bhi highlight karta hai.

- Risk Management:

- Har trade ke liye stop-loss aur take-profit levels ko tay karna important hai. Traders apne risk management plan ke mutabiq in levels ko set karte hain.

Hamesha yaad rahe ki kisi bhi single candlestick pattern par bharosa na karen aur doosre technical factors ko bhi madde nazar rakhen trading decisions mein.

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Bullish_Harami_2020-8e7ee8e18daf483288e4962f3ebc8be2.jpg)

تبصرہ

Расширенный режим Обычный режим