Spining top candlestick pattern in forex kai hai

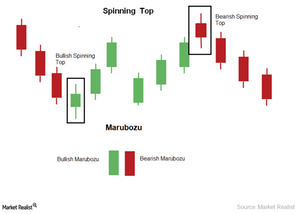

Spinning Top Candlestick Pattern ek technical analysis pattern hai jo market charts par dikhai deta hai. Ye pattern market mein uncertainty ya indecision ko darust karta hai. Spinning Top ek chhota candlestick hota hai jisme opening price aur closing price ke beech ka difference bahut kam hota hai.

Spinning Top Candlestick Pattern Ki Kuch Key Characteristics:

- Small Real Body:

- Spinning Top ka real body (the difference between opening and closing prices) bahut chhota hota hai, iska matlab hai ki buyers aur sellers ke darmiyan mein equilibrium hai.

- Upper aur Lower Shadows:

- Spinning Top ke upper aur lower shadows (wicks) bhi chhote hote hain, indicating that the high and low prices during the period are not significantly different.

- Market Indecision:

- Is pattern ka formation market mein indecision ya uncertainty ko represent karta hai. Ye traders ke darmiyan ek balance bataata hai.

- Indecision Indicator:

- Spinning Top pattern market mein indecision ko darust karta hai. Traders is pattern ko dekhte hain jab market mein trend weaken hota hai ya reversal hone ke chances hote hain.

- Market Reversal Signal:

- Agar Spinning Top bearish trend ke baad aata hai, to ye indicate kar sakta hai ke selling pressure kamzor ho raha hai aur bullish reversal hone ke chances hain. Agar ye uptrend ke baad aata hai, to ye bullish momentum ki kami ya bearish reversal ki indication ho sakta hai.

- Confirmation ke Liye Wait:

- Spinning Top ko confirm karne ke liye traders doosre indicators, jaise ki volume analysis, trend lines, ya doji patterns, ka istemal karte hain.

- Confirmation ke Liye Wait:

- Spinning Top pattern ko trading decision ke liye istemal karne se pehle, traders ko confirmation ke liye wait karna chahiye. Additional technical indicators ka istemal kiya ja sakta hai.

- Volume Analysis:

- Trading volume ka bhi analysis karna important hai. Agar Spinning Top ke formation ke samay volume kam hai, to ye indecision ko aur bhi highlight karta hai.

- Market Context:

- Spinning Top ko samajhne ke liye overall market context, jaise ki trend direction aur support/resistance levels, ko bhi dekha jana chahiye.

Spinning Top aur Doji patterns similar hote hain, lekin unmein chand fark hote hain. Doji mein opening aur closing prices barabar ya bahut kam farq hota hai, jabki Spinning Top mein thoda sa difference hota hai. Iske alawa, Spinning Top ke upper aur lower shadows bhi Doji se thoda bade hote hain.

Hamesha yaad rahe ki kisi bhi single candlestick pattern par bharosa na karen aur doosre technical factors ko bhi madde nazar rakhen trading decisions mein.

pattern

pattern

تبصرہ

Расширенный режим Обычный режим