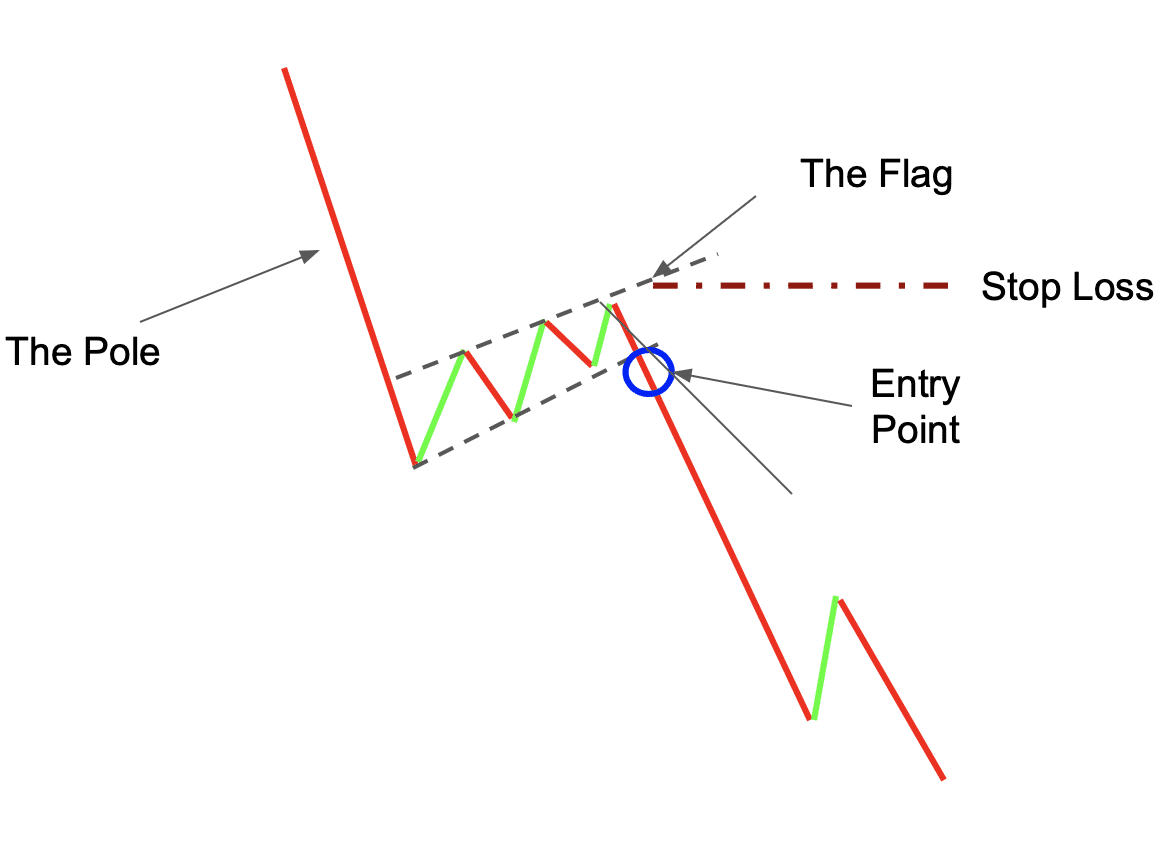

"Bearish Flag" ek technical analysis pattern hai jo forex trading mein istemal hota hai aur bearish trend ke continuation ko indicate karta hai. Ye pattern market mein short-term consolidation aur phir bearish move ke baad hota hai.

Bearish Flag Pattern Ki Pechan:

Bearish Flag pattern ko pehchanne ke liye kuch key points hote hain:

- Pehla Leg (Upar Move):

- Pehle leg mein, market mein strong bearish move hoti hai.

- Is leg mein price mein significant drop hota hai, jise "flagpole" kehte hain.

- Dusra Leg (Consolidation):

- Flagpole ke baad, price mein chhoti si consolidation hoti hai.

- Is consolidation ko "flag" kehte hain, jiska shape rectangle ya parallel lines ka hota hai.

- Teesra Leg (Bearish Move):

- Flag ke baad, market mein dobara se bearish move hota hai.

- Is bearish move ka height flagpole ke approximately equal hoti hai, ya phir usse kam hoti hai.

Bearish Flag Pattern Ka Tijarat Mein Istemal:

Bearish Flag pattern traders ko ye indication deta hai ke market mein bearish trend continue hone wala hai. Is pattern ko samajh kar, traders apne trading decisions ko improve kar sakte hain. Kuch important points hain:

- Entry Point:

- Traders flagpole ke neeche hone wale bearish move ke start par entry point decide kar sakte hain.

- Stop-Loss Aur Take-Profit Levels:

- Stop-loss levels ko set karna important hai taki nuksan control mein rahe.

- Take-profit levels ko bhi set karna zaroori hai taake traders apne profits secure kar sakein.

- Confirmation Indicators:

- Flag pattern ko confirm karne ke liye, doosre technical indicators ka bhi istemal hota hai. Jaise ke volume analysis, RSI, aur moving averages.

Conclusion:

Bearish Flag pattern, bearish trend ke continuation ko identify karne mein madad karta hai. Is pattern ko samajh kar, traders apni tijarat mein behtar decisions le sakte hain. Jaise ke har technical tool ki tarah, is pattern ko bhi sahi tarah se samajhne aur istemal karne ke liye practice aur market analysis kaafi zaroori hai.

تبصرہ

Расширенный режим Обычный режим