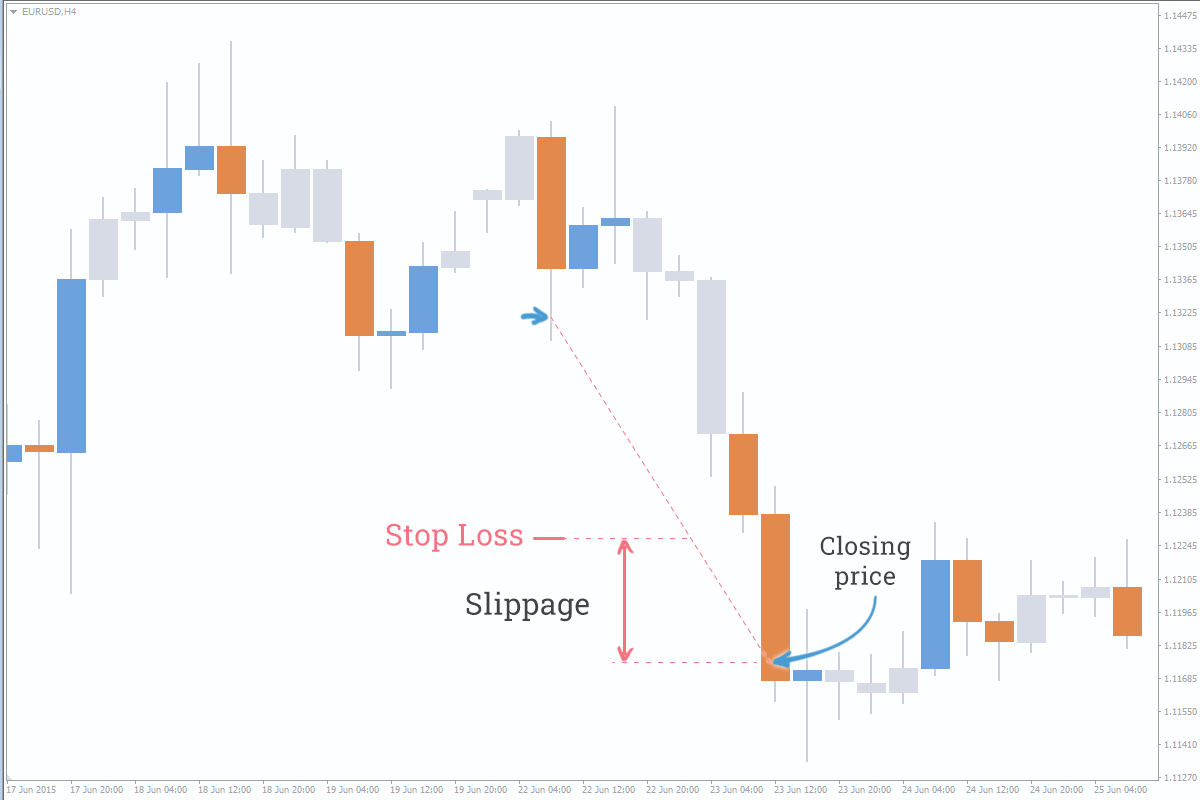

"Slippage" forex trading mein ek common term hai, jo trade execute karne ki koshish karte waqt expected price aur actual execution price ke beech mein hone wale difference ko refer karta hai.

Slippage ka mool taur par do mukhtalif scenarios mein hota hai:

- Order Execution Slippage:

- Kya Hai: Jab aap ek trade place karte hain aur market price aapke expected price se different hoti hai tab slippage hota hai.

- Kyun Hota Hai: Slippage aksar high volatility ke dauran ya market mein sudden price movements ke waqt hota hai. Jab market mein zor se harkat hoti hai, broker aapke order ko execute karne ke liye best available price dhoondhta hai, lekin is dauran price mein thoda sa difference ho sakta hai.

- Impact: Agar market mein slippage zyada hota hai, to aapko expected se zyada ya kam profit ya loss ho sakta hai. Isse aapke trading strategy par asar padta hai.

- Gap Slippage:

- Kya Hai: Gap slippage tab hota hai jab market overnight ya weekend ke baad kisi khaas price par open hoti hai aur traders ke expected prices se alag hoti hai.

- Kyun Hota Hai: Market gap slippage ke liye susceptible hoti hai jab kisi major economic event ya news release ke baad market kholta hai. Ismein traders ke expected prices aur actual opening price ke beech mein gap hota hai.

- Impact: Gap slippage aapke stop-loss ya take-profit levels ko influence kar sakta hai, aur aapko unexpected losses ya gains ka samna karna pad sakta hai.

Slippage market conditions par depend karta hai, aur ismein aapke broker ka role bhi important hota hai. Kuch brokers aapko slippage se bachane ke liye various risk management tools provide karte hain. Traders ko slippage ka impact samajhna zaroori hai, aur isse bachne ke liye risk management strategies ka istemal karna chahiye.

Slippage to ek common aspect hai jise traders face karte hain, lekin yeh market volatility aur fast price movements ka ek natural part hai. Isliye, traders ko apne trades ko manage karne aur market conditions ko dhyan mein rakhne ke liye tayyar rehna chahiye.

تبصرہ

Расширенный режим Обычный режим