Flag Chart Pattern in Trading,

Flag chart pattern ek trading strategy hai jo ke technical analysis mein istemal hoti hai. Ye pattern market ke trend ko identify karne aur trading opportunities ko dhundhne mein madadgar hota hai.

Flag chart pattern ek continuation pattern hai jo ke price action ke zariye market mein dekhne ko milta hai. Ye pattern usually ek trend ke doran develop hota hai jab market temporarily consolidate hota hai.Flag chart pattern ek powerful trading tool hai jo ke traders ko market mein hone wale trends ko identify karne aur trading opportunities ko capture karne mein madad karta hai. Is pattern ko samajhna aur sahi tareeke se istemal karna traders ke liye profitabe ho sakta hai.

Flag Chart Pattern's Components,

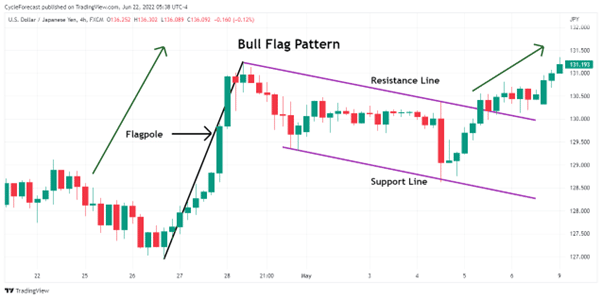

Bullish Flag, Bullish flag pattern ek uptrend ke doran develop hota hai. Isme pole ke baad ek small, sideways price consolidation hoti hai jo flag ke roop mein appear hoti hai.

Bearish Flag, Bearish flag pattern ek downtrend ke doran develop hota hai. Isme pole ke baad ek small, sideways price consolidation hoti hai jo flag ke roop mein appear hoti hai.

Flag Chart Pattern's Trading Strategies,

3. Target ka calculation pole ki length ke basis par kiya jata hai. Agar bull flag pattern hai toh traders pole ki length ko flag breakout point se add karke target ka level calculate karte hain. Agar bear flag pattern hai toh traders pole ki length ko flag breakout point se subtract karke target ka level calculate karte hain.

Flag chart pattern ek trading strategy hai jo ke technical analysis mein istemal hoti hai. Ye pattern market ke trend ko identify karne aur trading opportunities ko dhundhne mein madadgar hota hai.

Flag chart pattern ek continuation pattern hai jo ke price action ke zariye market mein dekhne ko milta hai. Ye pattern usually ek trend ke doran develop hota hai jab market temporarily consolidate hota hai.Flag chart pattern ek powerful trading tool hai jo ke traders ko market mein hone wale trends ko identify karne aur trading opportunities ko capture karne mein madad karta hai. Is pattern ko samajhna aur sahi tareeke se istemal karna traders ke liye profitabe ho sakta hai.

Flag Chart Pattern's Components,

- Pole, Flag pattern ka pehla component pole hota hai. Ye pole uptrend ya downtrend ke doran ban sakta hai aur ek sharp price move ko represent karta hai.

- Flag, Flag pattern ka doosra component flag hota hai. Ye pole ke baad market mein hone wale consolidation phase ko represent karta hai. Flag usually ek rectangle ya parallelogram ke roop mein appear hota hai.

Bullish Flag, Bullish flag pattern ek uptrend ke doran develop hota hai. Isme pole ke baad ek small, sideways price consolidation hoti hai jo flag ke roop mein appear hoti hai.

Bearish Flag, Bearish flag pattern ek downtrend ke doran develop hota hai. Isme pole ke baad ek small, sideways price consolidation hoti hai jo flag ke roop mein appear hoti hai.

Flag Chart Pattern's Trading Strategies,

- Flag pattern mein entry point usually flag breakout ke baad hota hai. Agar price flag ke upper side se breakout karta hai (bullish flag) toh traders long positions lete hain. Agar price flag ke lower side se breakout karta hai (bearish flag) toh traders short positions lete hain

- Stop loss ko lagana important hota hai taake traders apni positions ko protect kar sakein. Agar long position li gayi hai toh stop loss usualy flag ke lower side ke neeche lagaya jata hai. Agar short position li gayi hai toh stop loss usualy flag ke upper side ke upar lagaya jata hai.

3. Target ka calculation pole ki length ke basis par kiya jata hai. Agar bull flag pattern hai toh traders pole ki length ko flag breakout point se add karke target ka level calculate karte hain. Agar bear flag pattern hai toh traders pole ki length ko flag breakout point se subtract karke target ka level calculate karte hain.

تبصرہ

Расширенный режим Обычный режим