Stop Loss (Nuqsaan Rok) in Forex:

Stop Loss ek threat control tool hai jo forex trading mein istemal hota hai. Iska maqsad yeh hota hai ke tistemaal karna aam taur par akalmand hazard control strategy samjha jata haiAgar dealer ne kisi foreign money pair ko khareeda hai (buy kiya hai) to usko ek unique price level par forestall loss set karna hoga. Agar market us degree tak gir jata hai to exchange mechanically band ho jayegi.. Yeh investors ko unke capital ko bachane mein aur unke trading technique mein nizaam banaye rakhne mein madad karta hai. Lekin, prevent loss ke saath yaAgar marketplace fashion opposite ho jata hai, to Stop Loss lagana trader ko is trade se bachane mein madad karta hai. Stop Loss ka istemal karke traders apne trading plan ko systematic aur disciplined banate hain, jisse unka universal buying and selling performance behtar ho sakta hai. Bina forestall loss ke trading karne ka faisla aakhir mein har ek dealer ki apni hazard bardasht, buying and selling tareeqa, aur universal strategy par depend karta harader apne trade ko nuqsaan se bachane ke liye ek precise rate degree tay karta hai. Stop loss order marketplace mein aapke exchange ke liye ek protection internet ka kaam karta hai.

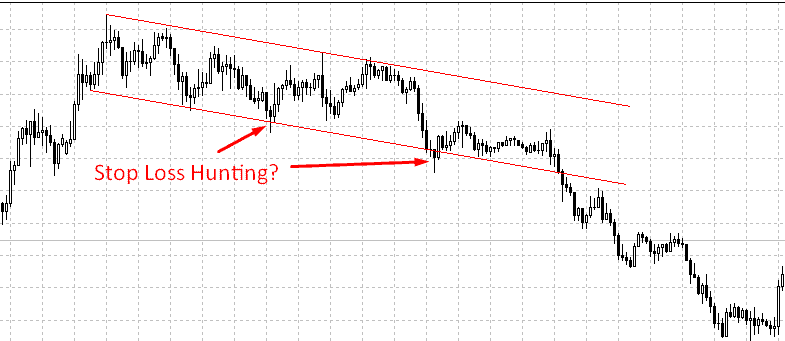

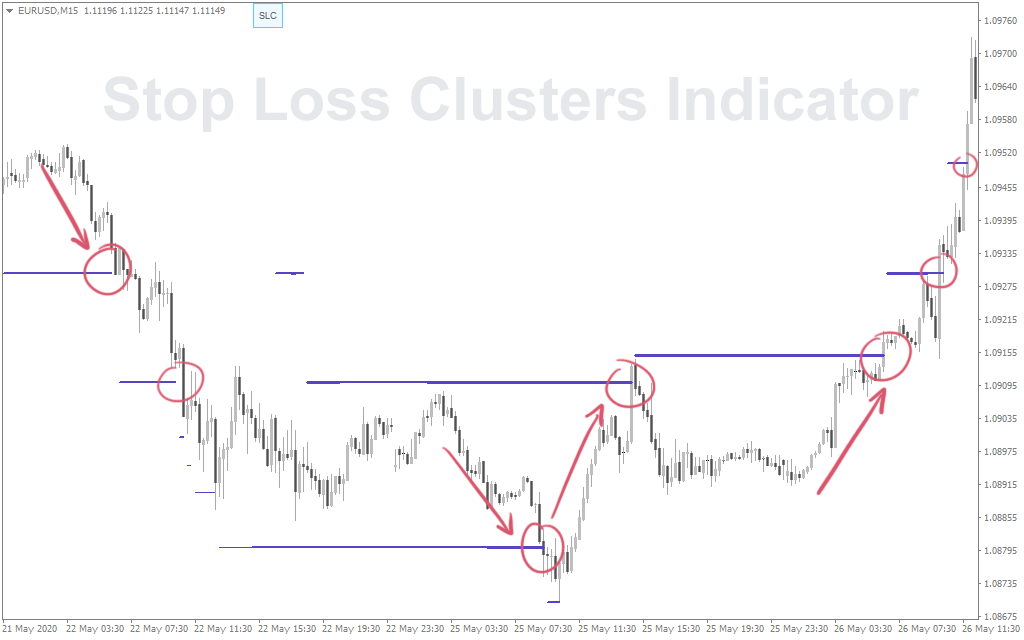

Trading WITHOUT a Stop Loss:

Some traders may additionally select to change with out a forestall loss, believing that it offers the market greater room to vary and finally pass of their want. However, this approach comes with significant dangers, as a surprising and detrimental market movement can bring about giant losses without a predefined go out factor.In Roman Urdu:Stop loss ke saath trading karna ek aam hazard management practice hai. Stop loss ek pehle se tay ki gayi degree hai jahan par trader tay karta hai ke woh apne nuksan mein hone wale change se bahar nikal jayega, takay potential nuksan ko had mein rakha ja sake. Yeh ek suraksha jaal ki tarah kaam karta hai, jo investors ko madad karta hai hazard ko manipulate karne mein aur apne buying and selling capital mein zyada nuksan se bachne mei "Kuch investors yeh faisla kar sakte hain ke bina prevent loss ke trading karein, unko yeh vishwaas hai ke isse marketplace ko zyada mauqa milta hai apne rukh mein badalne ka. Lekin, yeh tareeqa khatraat ke saath aata hai, kyun ke achanak se hone wale marketplace motion mein bina pehle se tay kiye gaye exit point ke khaas nuksan ho sakta hai."

Stop Loss ek threat control tool hai jo forex trading mein istemal hota hai. Iska maqsad yeh hota hai ke tistemaal karna aam taur par akalmand hazard control strategy samjha jata haiAgar dealer ne kisi foreign money pair ko khareeda hai (buy kiya hai) to usko ek unique price level par forestall loss set karna hoga. Agar market us degree tak gir jata hai to exchange mechanically band ho jayegi.. Yeh investors ko unke capital ko bachane mein aur unke trading technique mein nizaam banaye rakhne mein madad karta hai. Lekin, prevent loss ke saath yaAgar marketplace fashion opposite ho jata hai, to Stop Loss lagana trader ko is trade se bachane mein madad karta hai. Stop Loss ka istemal karke traders apne trading plan ko systematic aur disciplined banate hain, jisse unka universal buying and selling performance behtar ho sakta hai. Bina forestall loss ke trading karne ka faisla aakhir mein har ek dealer ki apni hazard bardasht, buying and selling tareeqa, aur universal strategy par depend karta harader apne trade ko nuqsaan se bachane ke liye ek precise rate degree tay karta hai. Stop loss order marketplace mein aapke exchange ke liye ek protection internet ka kaam karta hai.

Trading WITHOUT a Stop Loss:

Some traders may additionally select to change with out a forestall loss, believing that it offers the market greater room to vary and finally pass of their want. However, this approach comes with significant dangers, as a surprising and detrimental market movement can bring about giant losses without a predefined go out factor.In Roman Urdu:Stop loss ke saath trading karna ek aam hazard management practice hai. Stop loss ek pehle se tay ki gayi degree hai jahan par trader tay karta hai ke woh apne nuksan mein hone wale change se bahar nikal jayega, takay potential nuksan ko had mein rakha ja sake. Yeh ek suraksha jaal ki tarah kaam karta hai, jo investors ko madad karta hai hazard ko manipulate karne mein aur apne buying and selling capital mein zyada nuksan se bachne mei "Kuch investors yeh faisla kar sakte hain ke bina prevent loss ke trading karein, unko yeh vishwaas hai ke isse marketplace ko zyada mauqa milta hai apne rukh mein badalne ka. Lekin, yeh tareeqa khatraat ke saath aata hai, kyun ke achanak se hone wale marketplace motion mein bina pehle se tay kiye gaye exit point ke khaas nuksan ho sakta hai."

تبصرہ

Расширенный режим Обычный режим