Dow theory and forex trading

difination

Dow Theory forex trading mein ek mahatva purna technical analysis theory hai, jise Charles Dow ne late 19th century mein develop kiya. Yeh theory stock market ke liye banayi gayi thi, lekin iske principles ko forex trading mein bhi apply kiya ja sakta hai. Dow Theory ka istemal market trends, reversals, aur price movements ko samajhne ke liye hota hai.

Dow theory ke principle

Dow Theory ka forex trading mein istemal:

Dow theory and combine indecator

difination

Dow Theory forex trading mein ek mahatva purna technical analysis theory hai, jise Charles Dow ne late 19th century mein develop kiya. Yeh theory stock market ke liye banayi gayi thi, lekin iske principles ko forex trading mein bhi apply kiya ja sakta hai. Dow Theory ka istemal market trends, reversals, aur price movements ko samajhne ke liye hota hai.

Dow theory ke principle

- Price Discounts Everything: Dow Theory ke mutabiq, market mein sab kuch pehle se hi price mein shamil hota hai. Yani ke current prices market participants ke collective expectations aur information ka reflection hote hain. Is principle ke mutabiq, traders ko current price action ko analyze karte waqt market ke future direction ka idea milta hai.

- Market Moves in Trends: Dow Theory kehti hai ke market trends mein move karta hai, jo ke primary, secondary, aur minor trends mein divide kiye ja sakte hain. Primary trend long-term hota hai, secondary trend intermediate-term hota hai, aur minor trend short-term hota hai. Trend lines ke istemal se in trends ko identify kiya ja sakta hai.

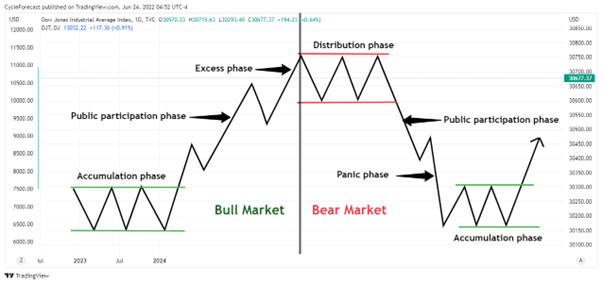

- Trend Has Three Phases: Dow Theory ke mutabiq, ek trend teen phases mein hota hai: accumulation phase, public participation phase, aur distribution phase. Accumulation phase mein smart money positions lete hain, public participation phase mein general public aur institutional investors positions lete hain, aur distribution phase mein smart money apne positions ko sell karte hain.

- Price Confirmation: Dow Theory mein trend confirmation ke liye multiple indices ka istemal hota hai. Agar ek trend ko confirm karne ke liye multiple indices mein price movements dekhe jaate hain, toh woh trend strong consider kiya jata hai.

- Volume Confirmation: Volume analysis bhi Dow Theory ka ahem hissa hai. Trend ke direction mein volume ke consistent changes ko dekhte hue confirm kiya jata hai. Volume ke sath price ke changes ka sambandh dekha jata hai.

Dow Theory ka forex trading mein istemal:

- Identifying Trends: Dow Theory ke principles ka istemal karke traders forex market mein trends ko identify kar sakte hain. Trend lines, support aur resistance levels ka use karke, traders market trends ko determine karke apne trading decisions le sakte hain.

- Confirmation through Multiple Pairs: Forex market mein multiple currency pairs ka use karke Dow Theory ke trend confirmations ko strengthen kiya ja sakta hai. Agar ek currency pair mein trend dekh raha hai, aur doosre pairs mein bhi similar trend dikh raha hai, toh yeh confirmation ke liye powerful hota hai.

- Volume Analysis: Forex market mein volume data nahi hota, lekin traders price movements ko observe karke volume ke absence mein bhi Dow Theory principles ko apply kar sakte hain. Price movements aur trend direction ke consistent changes ko dekhte hue traders trend ko samajh sakte hain.

- Market Phases: Forex market mein bhi Dow Theory ke hisaab se market phases ko identify kiya ja sakta hai. Currency pairs mein price movements aur market participation ko closely monitor karke traders accumulation, distribution, aur public participation phases ko identify kar sakte hai

Dow theory and combine indecator

- l Dow Theory ko dusre technical indicators ke sath combine karke traders apni analysis ko aur bhi strong bana sakte hain. Moving averages, RSI (Relative Strength Index), aur Fibonacci retracement levels ka istemal Dow Theory ke sath kiya ja sakta hai.Hamesha yaad rakhein ke Dow Theory ek tool hai jise traders apni analysis mein incorporate kar sakte hain. Lekin, kisi bhi single indicator par pura bharosa na karein aur apni analysis ko validate karne ke liye doosre technical tools ka bhi istemal karein.

تبصرہ

Расширенный режим Обычный режим