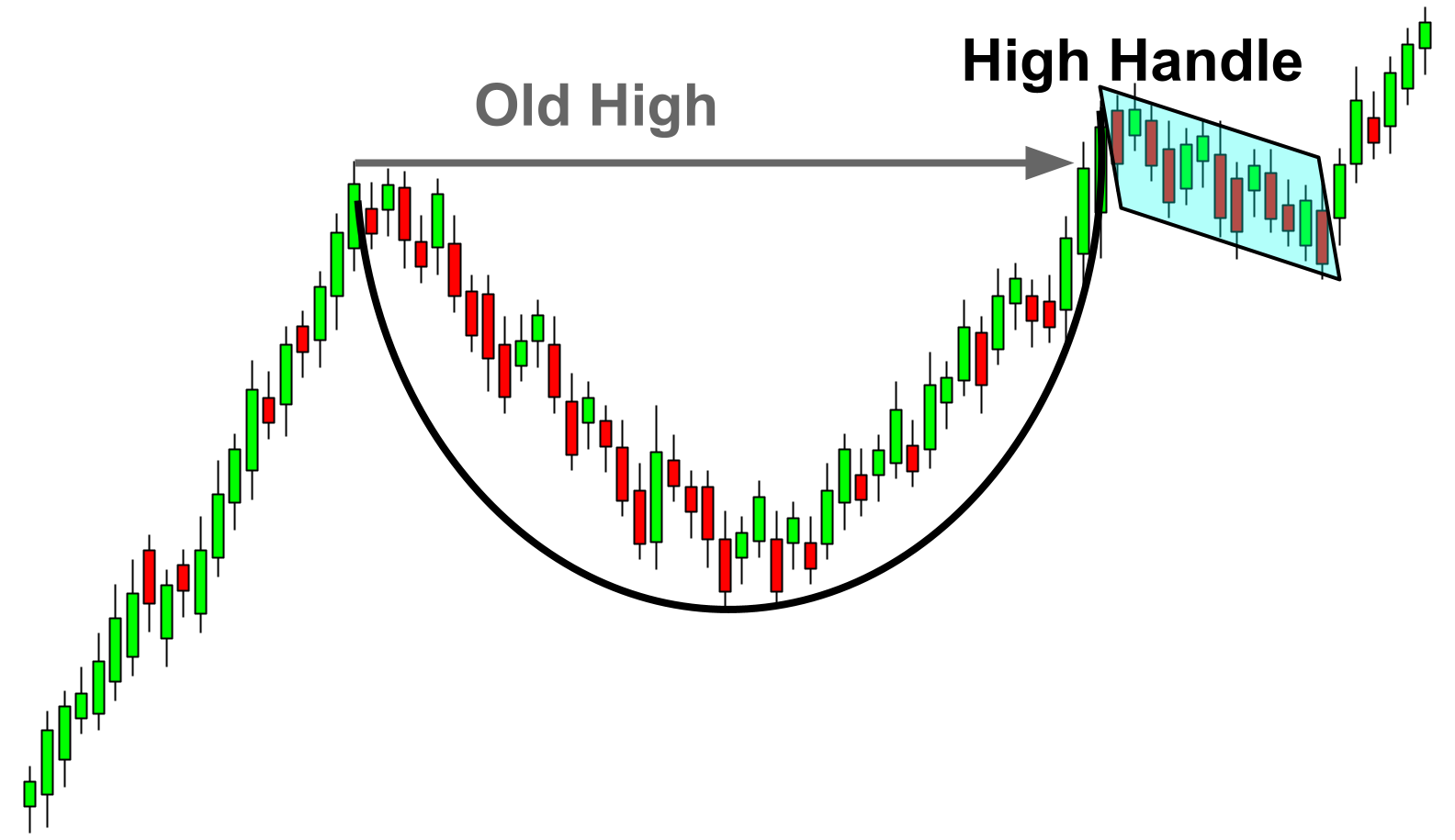

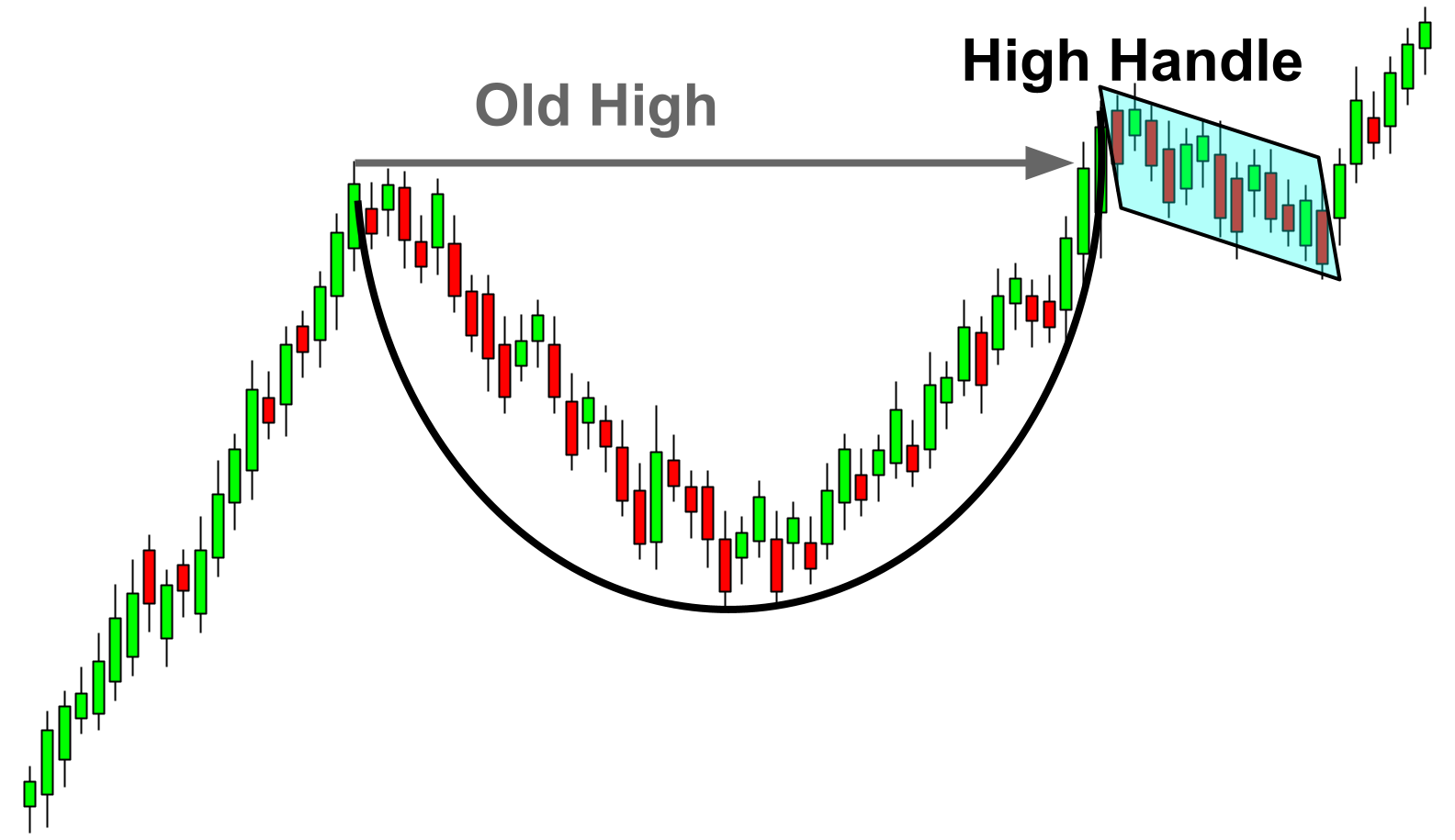

CUP and HANDLE pattern ek aisi chart pattern hai jo ek uptrend ya downtrend mein nazar aati hai. Yeh ek reversal pattern hai jo ek khaas raaste mein lambe samay tak chalne ke baad potential price reversal ko signal karta hai. Is pattern mein do hisse hote hain: cup aur handle.

Cup ek aisi rounding top ya bottom formation hai jo ek cup ki shakal mein hoti hai. Yeh trend mein ek taqatwar move ke baad hone wala consolidation ka dor hota hai. Cup ka khaas pehlu yeh hai ke price range mein dhire dhire kam hone se nazar aata hai, jo trend mein momentum ki kami ko darust karta hai.

Handle cup ke baad aane wala chhota price move hota hai. Yeh ek aisi sideways ya neeche ki taraf hone wali price move hoti hai jo cup se juda hua handle ki shakal mein hoti hai. Handle ek consolidation ka dor hota hai jo price reversal se pehle hota hai.

CUP and HANDLE Pattern ki Khasoosiyat

CUP and HANDLE pattern ki kuch khasoosiyat hain jo traders ko apne charts mein is pattern ko pehchaanne mein madad karti hain. In khasoosiyaton mein shamil hain:

Cup ek aisi rounding top ya bottom formation hai jo ek cup ki shakal mein hoti hai. Yeh trend mein ek taqatwar move ke baad hone wala consolidation ka dor hota hai. Cup ka khaas pehlu yeh hai ke price range mein dhire dhire kam hone se nazar aata hai, jo trend mein momentum ki kami ko darust karta hai.

Handle cup ke baad aane wala chhota price move hota hai. Yeh ek aisi sideways ya neeche ki taraf hone wali price move hoti hai jo cup se juda hua handle ki shakal mein hoti hai. Handle ek consolidation ka dor hota hai jo price reversal se pehle hota hai.

CUP and HANDLE Pattern ki Khasoosiyat

CUP and HANDLE pattern ki kuch khasoosiyat hain jo traders ko apne charts mein is pattern ko pehchaanne mein madad karti hain. In khasoosiyaton mein shamil hain:

- Uptrend ya Downtrend: CUP and HANDLE pattern uptrend ya downtrend mein nazar aata hai. Yeh ek reversal pattern hai jo ek khaas raaste mein lambe samay tak chalne ke baad potential price reversal ko signal karta hai.

- Rounding Top/Bottom Formation (Cup): Cup ek aisi rounding top/bottom formation hai jo cup ki shakal mein hoti hai. Yeh trend mein ek taqatwar move ke baad hone wala consolidation ka dor hota hai. Cup ka khaas pehlu yeh hai ke price range mein dhire dhire kam hone se nazar aata hai, jo trend mein momentum ki kami ko darust karta hai.

- Smaller Price Move (Handle): Handle cup ke baad aane wala chhota price move hota hai. Yeh ek aisi sideways price move hoti hai jo cup se juda hua handle ki shakal mein hoti hai. Handle ek consolidation ka dor hota hai jo price reversal se pehle hota hai.

- Support/Resistance Levels (Handle): Handle cup ke support/resistance levels ke kareeb hone chahiye. Yeh alignment ek potential price reversal ko darust karta hai.

- Volume: Cup and handle formation ke doran volume kam hona chahiye, jo trend mein momentum ki kami ko darust karta hai.

- Pattern ko Pehchaan: Pehla step yeh hai ke apne charts mein CUP and HANDLE pattern ko pehchaanein. Rounding top/bottom formation (cup) aur uske baad aane wala chhota price move (handle) ko dekhein.

- Pattern ko Tasdeeq karein: Trade mein dakhil hone se pehle pattern ko tasdeeq karein, support/resistance levels aur volume ko check karke. Handle ko cup ke support/resistance levels ke kareeb hona chahiye, aur cup and handle formation ke doran volume kam hona chahiye.

- Reversal ki Raah Tay Karein: CUP and HANDLE pattern kisi bhi raaste mein potential price reversal ko signal kar sakta hai. Trend aur pattern ke maqami hone par reversal ki raah tay karein.

- Stop Loss aur Take Profit set karein: Long trade ke liye cup ke support level ke neeche aur short trade ke liye cup ke resistance level ke upar ek stop loss set karein. Take profit cup ke support/resistance levels ke opposite end par set karein.

- Risk ko Manage karein: Risk ko ek stop loss aur take profit ke istemal se manage karein. Apne trading style aur market ki shirait ke mutabiq ek risk management strategy istemal karein.

- Trade ko Nigraani Mein Rakhein: Trade ko qareeb se nigraani mein rakhein aur zarurat ke mutabiq stop loss aur take profit ko adjust karein. Jab price take profit ko choo jaye ya stop loss trigger ho jaye, tab trade se bahir nikalein.

تبصرہ

Расширенный режим Обычный режим