It is important to know how to set a stop-loss and a take profit in Forex, but what do stop losses and take profits actually represent?

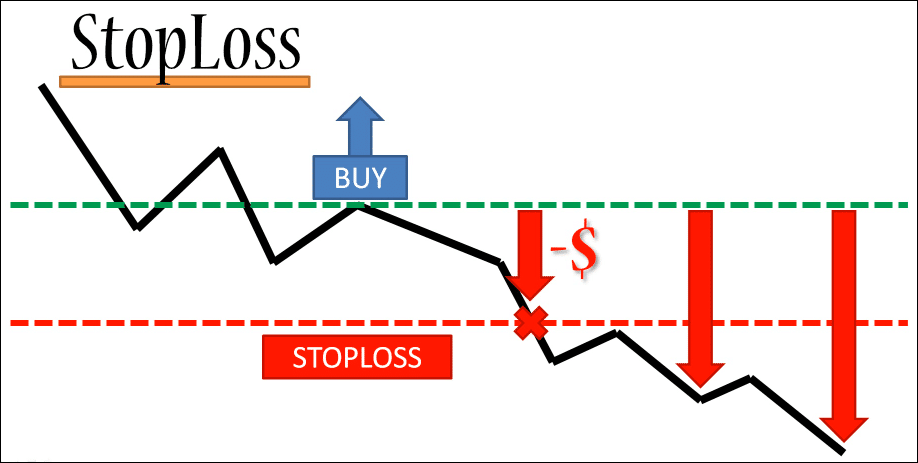

These two forms are the most significant elements of trade management. A stop loss is determined as an order that you send to your broker, instructing them to limit the losses on a particular open position or trade. It is a specified amount of pips away from your entry price. Naturally, you can apply a stop- loss to any short or long position, making it a crucial component of your forex trading strategy. Learning how to use stop loss is a key factor in your risk management.

As for the take profit or target price, it is an order that you send to your broker in the same regard as a stop loss, notifying them to close your position or trade when a certain price reaches a specified price level in profit. In this article, we will explore how to use stop loss and take profit orders appropriately in FX.

Setting Up Stop-Loss Order in Forex Trading

The first thing a trader should consider is that the stop loss must be placed at a logical level. This means a level that will both inform the trader when their trade signal is no longer valid, and that actually makes sense in the surrounding market structure. There are several tips on how to exit a trade in the right way. The first one is to let the market hit the predefined stop loss that you placed when you entered the trade. Another method is to exit manually, because the price action has generated a signal against your position.

Knowing how to calculate stop loss and take profit in Forex is important, but it is crucial to mention that exits can end up being purely emotion-based. For instance, you could end up manually closing a trade just because you think the market is going to hit your stop loss. In this case, you feel emotional, as the market is moving against your position, despite no price action-based reason to exit manually being present.

The ultimate purpose of the stop loss is to help a trader stay in a trade until the trade setup, and the original near-term directional bias are no longer valid. The aim of a professional Forex trader when placing a stop loss is to place the stop at a level that grants the trade room to move in the trader's favour.

Essentially, when you are identifying the best place to put your stop loss, you should think about the closest logical level that the market would have to hit to actually prove your trade signal wrong. Therefore, stop-loss traders want to give the market room to breathe, and to also keep the stop loss close enough to be able to exit the trade as soon as it is possible, if the market goes against them. This is one of the key rules of how to use stop loss and take profit in Forex trading.

A lot of traders cut themselves short by placing their stop loss too close to their entry point, merely because they want to trade a bigger position size. But the trap here is that when you place your stop too close, you are actually invalidating your trading edge, as you need to place your stop loss based on your trading signal and the current market conditions, and not on the basis of how much money you anticipate to make.

Therefore, your assignment is to define your stop-loss placement prior to identifying your position size. In addition, your stop loss placement should be determined by logic. Do not allow greed to lead you to losses.

These two forms are the most significant elements of trade management. A stop loss is determined as an order that you send to your broker, instructing them to limit the losses on a particular open position or trade. It is a specified amount of pips away from your entry price. Naturally, you can apply a stop- loss to any short or long position, making it a crucial component of your forex trading strategy. Learning how to use stop loss is a key factor in your risk management.

As for the take profit or target price, it is an order that you send to your broker in the same regard as a stop loss, notifying them to close your position or trade when a certain price reaches a specified price level in profit. In this article, we will explore how to use stop loss and take profit orders appropriately in FX.

Setting Up Stop-Loss Order in Forex Trading

The first thing a trader should consider is that the stop loss must be placed at a logical level. This means a level that will both inform the trader when their trade signal is no longer valid, and that actually makes sense in the surrounding market structure. There are several tips on how to exit a trade in the right way. The first one is to let the market hit the predefined stop loss that you placed when you entered the trade. Another method is to exit manually, because the price action has generated a signal against your position.

Knowing how to calculate stop loss and take profit in Forex is important, but it is crucial to mention that exits can end up being purely emotion-based. For instance, you could end up manually closing a trade just because you think the market is going to hit your stop loss. In this case, you feel emotional, as the market is moving against your position, despite no price action-based reason to exit manually being present.

The ultimate purpose of the stop loss is to help a trader stay in a trade until the trade setup, and the original near-term directional bias are no longer valid. The aim of a professional Forex trader when placing a stop loss is to place the stop at a level that grants the trade room to move in the trader's favour.

Essentially, when you are identifying the best place to put your stop loss, you should think about the closest logical level that the market would have to hit to actually prove your trade signal wrong. Therefore, stop-loss traders want to give the market room to breathe, and to also keep the stop loss close enough to be able to exit the trade as soon as it is possible, if the market goes against them. This is one of the key rules of how to use stop loss and take profit in Forex trading.

A lot of traders cut themselves short by placing their stop loss too close to their entry point, merely because they want to trade a bigger position size. But the trap here is that when you place your stop too close, you are actually invalidating your trading edge, as you need to place your stop loss based on your trading signal and the current market conditions, and not on the basis of how much money you anticipate to make.

Therefore, your assignment is to define your stop-loss placement prior to identifying your position size. In addition, your stop loss placement should be determined by logic. Do not allow greed to lead you to losses.

تبصرہ

Расширенный режим Обычный режим