Gold market analysis

Definition

Sona (gold) ek ahem commodity hai jo global markets mein trading hoti hai aur iski analysis karke investors aur traders market trends ko samajhne ka try karte hain. Sona ki market analysis ke liye kuch ahem factors hote hain jo market ke dynamics ko influence karte hain. Sona ka market supply and demand ke asar par hota hai. Agar demand ziada hoti hai aur supply kam hai, toh sona ki keemat mein izafa hota hai. Ulati situation mein, jab demand kam hoti hai aur supply ziada, toh sona ki keemat ghat sakti hai.

Global economic conditions

Inflation and deflation

Interest rates

Currency strength

Market sentiment

Mining production

Jewelry demand

Definition

Sona (gold) ek ahem commodity hai jo global markets mein trading hoti hai aur iski analysis karke investors aur traders market trends ko samajhne ka try karte hain. Sona ki market analysis ke liye kuch ahem factors hote hain jo market ke dynamics ko influence karte hain. Sona ka market supply and demand ke asar par hota hai. Agar demand ziada hoti hai aur supply kam hai, toh sona ki keemat mein izafa hota hai. Ulati situation mein, jab demand kam hoti hai aur supply ziada, toh sona ki keemat ghat sakti hai.

Global economic conditions

- Sona ka market global economic conditions se bhi directly influence hota hai. Economic instability, geopolitical tensions, ya financial crises ke waqt log sona ko ek safe-haven asset ki tarah dekhte hain, jiski wajah se uski keemat badh sakti hai.

Inflation and deflation

- Sona ek hedge (bachao) bhi provide karta hai against inflation. Jab currency ki value kam hoti hai, tab log sona mein apna maal rakhna pasand karte hain kyunki sona ki keemat inflation ke asar mein kam badhti hai.

Interest rates

- Central banks ki monetary policy aur interest rates bhi sona ke market par asar daal sakte hain. Jab interest rates kam hote hain, toh sona ki demand badh sakti hai kyunki alternative investments ki attractiveness kam ho jati hai.

Currency strength

- Sona ko USD (United States Dollar) mein evaluate kiya jata hai, is liye currency ki strength aur weakness bhi sona ke market par asar daal sakti hai. Jab dollar strong hota hai, toh sona ki keemat mein girawat ho sakti hai, aur jab dollar weak hota hai, toh sona ki keemat badh sakti hai.

Market sentiment

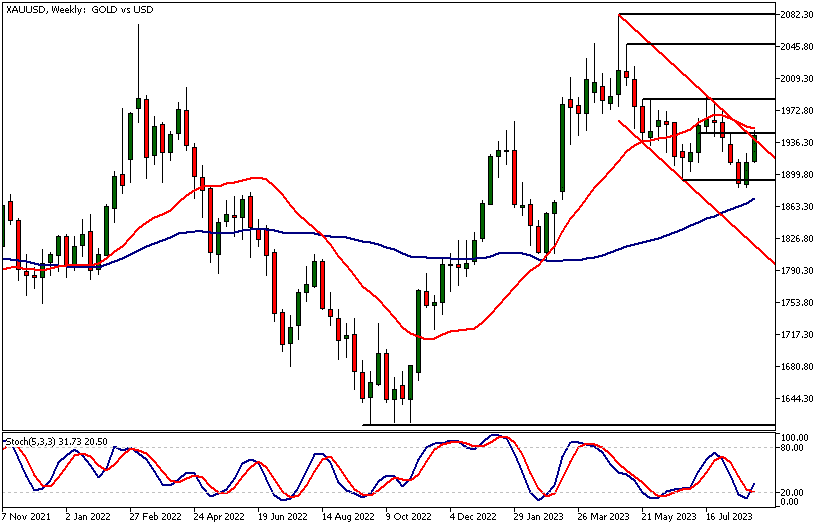

- Investor aur trader sentiment bhi sona ke market mein ahem hota hai. Agar log economic uncertainty ya financial instability ka samna kar rahe hain, toh sona ki demand badh sakti hai. Market mein fear ka mahaul bana rehta hai, jise log sona ko safe-haven ke tor par dekhte hain. Technical analysis bhi sona ke market mein istemal hoti hai. Traders sona ke historical price movements, chart patterns, aur technical indicators ka istemal karke future price movements ka try karte hain.

Mining production

- Sona ki market mein production levels bhi ahem role play karte hain. Mining companies ke production levels aur new discoveries sona ki supply par asar daal sakte hain.

Jewelry demand

- Sona ka ek important use jewelry hai. Sona ki keemat ko influence karne mein jewelry demand ka bhi role hota hai, jo ki cultural aur economic factors par depend karta hai.Market analysis mein, in factors ko samajh kar aur unka impact evaluate kar ke traders aur investors sona ke market mein positions lete hain. Har ek factor ka samajhna aur unke inter-relationships ko consider karna sona market analysis ka ek integral hissa hai. Hamesha yaad rahe ke market conditions dynamic hote hain aur traders ko regularly update rehna zaroori hai taki woh sahi trading decisions le sakein.

تبصرہ

Расширенный режим Обычный режим