Pin bar candlestick patterns ek technical analysis ka aik tareeqa hain jo stocks, forex, commodities, wagera jese financial instruments ki trading mein istemal hota hai. Pin bars reversal patterns hote hain jo ek potential trend direction change ko darust karte hain, ya toh upar ya neeche, financial market ki price action mein.

Pin Bar Candlestick Patterns Ki Formation

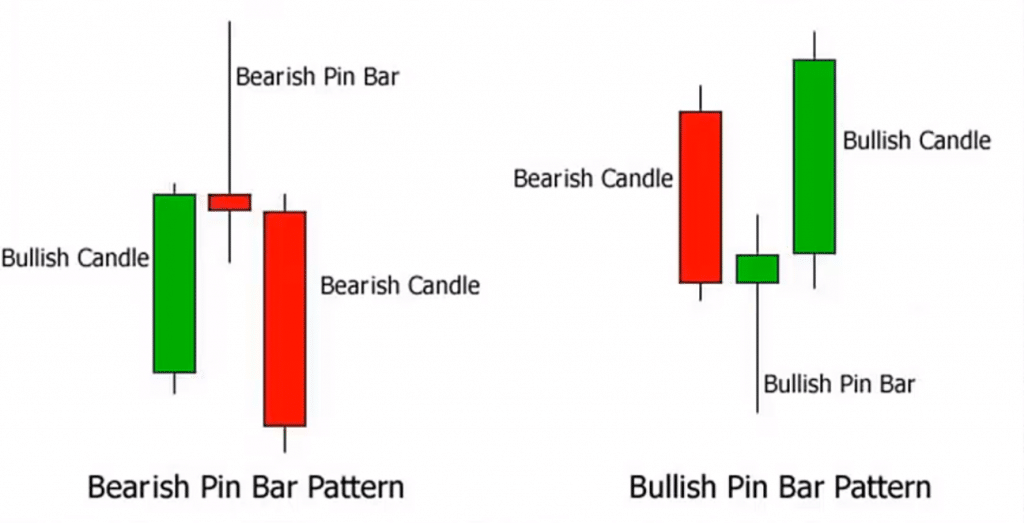

Pin bar candlestick patterns ek single candlestick se bante hain jo ek lambi upper shadow aur choti lower shadow ke saath hoti hai, sath hi ek chhota ya bilkul na hone wala body hota hai. Upper shadow bechnay ki pressure ko darust karta hai, jabke lower shadow us waqt ke market mein kharidari ki pressure ko darust karta hai. Candle ki body aam taur par choti hoti hai ya bilkul nahi hoti kyunki yeh darust karta hai ki us doran koi significant price movement nahi hua.

Pin bar candlestick pattern ko reversal candlestick bhi kehte hain kyunki iska signal market price action chart ya financial instruments ki price movements ko samay intervals ya candle intervals ke mutabiq darust karta hai. Yeh price reversal ya trend direction change ko signal karta hai.

Pin Bar Candlestick Patterns Ki Interpretation

Pin bar candlestick patterns ka interpretation is tarah hota hai:

Pin bar candlestick pattern ek potential price reversal ya trend direction change ko indicate karta hai kyunki yeh dikhata hai ki kharidari aur bechnay walay barabar ki sthiti mein hain, aur price ne resistance ya support ke level ko chhua hai.

Lambi upper shadow yeh dikhata hai ki bechnay walay us waqt active thay, aur unhone price ko upar ki taraf dabaaya, lekin kharidari bhi mojood thi jo neeche jaane se rok rahi thi.

Chhoti lower shadow yeh dikhata hai ki kharidari us waqt active thi, aur unhone price ko neeche dabaaya, lekin bechnay bhi mojood the jo price ko zyada neeche jaane se rok rahe thay.

Candle ki body ki adbiyat ya uski chhoti size yeh dikhata hai ki us waqt koi significant price movement nahi hua, aur price bechnay aur kharidnay walay ke darmiyan barabar thi.

Pin bar candlestick patterns tab zyada reliable aur sahi hote hain jab woh resistance ya support ke significant levels par bante hain, jaise ke round numbers, psychological levels, ya peechlay price levels.

Trading Strategies Pin Bar Candlestick Patterns Ke Istemaal Se

Pin bar candlestick patterns ko financial instruments ke positions mein dakhil aur bahar hone ke liye trading strategy ka hissa banaya ja sakta hai. Yahan kuch trading strategies hain jo pin bar candlestick patterns ka istemaal karti hain:

Pin Bar Candlestick Patterns Ki Formation

Pin bar candlestick patterns ek single candlestick se bante hain jo ek lambi upper shadow aur choti lower shadow ke saath hoti hai, sath hi ek chhota ya bilkul na hone wala body hota hai. Upper shadow bechnay ki pressure ko darust karta hai, jabke lower shadow us waqt ke market mein kharidari ki pressure ko darust karta hai. Candle ki body aam taur par choti hoti hai ya bilkul nahi hoti kyunki yeh darust karta hai ki us doran koi significant price movement nahi hua.

Pin bar candlestick pattern ko reversal candlestick bhi kehte hain kyunki iska signal market price action chart ya financial instruments ki price movements ko samay intervals ya candle intervals ke mutabiq darust karta hai. Yeh price reversal ya trend direction change ko signal karta hai.

Pin Bar Candlestick Patterns Ki Interpretation

Pin bar candlestick patterns ka interpretation is tarah hota hai:

Pin bar candlestick pattern ek potential price reversal ya trend direction change ko indicate karta hai kyunki yeh dikhata hai ki kharidari aur bechnay walay barabar ki sthiti mein hain, aur price ne resistance ya support ke level ko chhua hai.

Lambi upper shadow yeh dikhata hai ki bechnay walay us waqt active thay, aur unhone price ko upar ki taraf dabaaya, lekin kharidari bhi mojood thi jo neeche jaane se rok rahi thi.

Chhoti lower shadow yeh dikhata hai ki kharidari us waqt active thi, aur unhone price ko neeche dabaaya, lekin bechnay bhi mojood the jo price ko zyada neeche jaane se rok rahe thay.

Candle ki body ki adbiyat ya uski chhoti size yeh dikhata hai ki us waqt koi significant price movement nahi hua, aur price bechnay aur kharidnay walay ke darmiyan barabar thi.

Pin bar candlestick patterns tab zyada reliable aur sahi hote hain jab woh resistance ya support ke significant levels par bante hain, jaise ke round numbers, psychological levels, ya peechlay price levels.

Trading Strategies Pin Bar Candlestick Patterns Ke Istemaal Se

Pin bar candlestick patterns ko financial instruments ke positions mein dakhil aur bahar hone ke liye trading strategy ka hissa banaya ja sakta hai. Yahan kuch trading strategies hain jo pin bar candlestick patterns ka istemaal karti hain:

- Resistance levels par pin bar candlestick patterns: Jab pin bar candlestick pattern ek resistance level par banta hai, toh yeh dikhata hai ki kharidnay walon ne price ko upar dabaane mein asafalta ka samna kiya hai, aur bechnay walay control mein hain. Traders ek short position mein dakhil ho sakte hain aur pin bar ki unchi ke upar ek stop loss aur neeche ek take profit set kar sakte hain.

- Support levels par pin bar candlestick patterns: Jab pin bar candlestick pattern ek support level par banta hai, toh yeh dikhata hai ki bechnay walon ne price ko neeche dabaane mein asafalta ka samna kiya hai, aur kharidari wale control mein hain. Traders ek long position mein dakhil ho sakte hain aur pin bar ki neeche ki taraf ek stop loss aur upar ek take profit set kar sakte hain.

- Downtrend mein pin bar candlestick patterns: Jab pin bar candlestick pattern downtrend mein banta hai, toh yeh dikhata hai ki kharidnay walon ki garmi barh rahi hai aur woh trend ko palat sakte hain. Traders ek long position mein dakhil ho sakte hain aur pin bar ki neeche ek stop loss aur upar ek take profit set kar sakte hain.

- Uptrend mein pin bar candlestick patterns: Jab pin bar candlestick pattern uptrend mein banta hai, toh yeh dikhata hai ki bechnay walon ki garmi barh rahi hai aur woh trend ko palat sakte hain. Traders ek short position mein dakhil ho sakte hain aur pin bar ki unchi ke upar ek stop loss aur neeche ek take profit set kar sakte hain.

تبصرہ

Расширенный режим Обычный режим