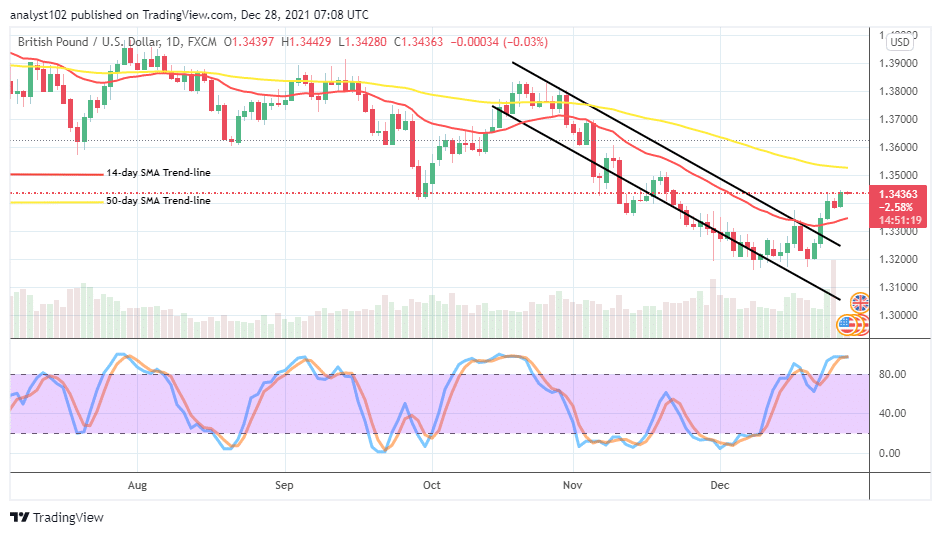

GBP/USD is still bounded in consolidation pattern from 1.2826 and intraday bias remains neutral. Deeper pull back cannot be ruled out. But downside should be contained above 1.2499 support to bring rebound. On the upside, firm break of 1.2784 resistance will suggest that consolidation pattern has completed. Further rise should be seen through 1.2826 to resume the rise from 1.2036. Next target will be 1.3141 high.

In the In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg that’s in progress. Upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2499 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again. Intraday bias in GBP/USD stays neutral first as consolidation from 1.2826 is still extending. Deeper pull back cannot be ruled out. But downside should be contained above 1.2499 support to bring rebound. On the upside, firm break of 1.2784 resistance will suggest that consolidation pattern has completed. Further rise should be seen through 1.2826 to resume the rise from 1.2036. Next target will be 1.3141 high.

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg that’s in progress. Upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2499 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again.

Immediate focus is now on 1.2784 minor resistance in GBP/USD. Decisive break there will suggest that consolidation pattern from 1.2826 has completed. Further rise should be seen through 1.2826 to resume the rise from 1.2036. Next target will be 1.3141 high. in case of another fall, downside should be contained above 1.2499 support to bring rebound.

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg that’s in progress. Upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2499 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again.

Best wishes for today's trading.

In the In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg that’s in progress. Upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2499 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again. Intraday bias in GBP/USD stays neutral first as consolidation from 1.2826 is still extending. Deeper pull back cannot be ruled out. But downside should be contained above 1.2499 support to bring rebound. On the upside, firm break of 1.2784 resistance will suggest that consolidation pattern has completed. Further rise should be seen through 1.2826 to resume the rise from 1.2036. Next target will be 1.3141 high.

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg that’s in progress. Upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2499 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again.

Immediate focus is now on 1.2784 minor resistance in GBP/USD. Decisive break there will suggest that consolidation pattern from 1.2826 has completed. Further rise should be seen through 1.2826 to resume the rise from 1.2036. Next target will be 1.3141 high. in case of another fall, downside should be contained above 1.2499 support to bring rebound.

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg that’s in progress. Upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2499 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again.

Best wishes for today's trading.

تبصرہ

Расширенный режим Обычный режим