Forex market ek dynamic aur complex environment hai jahan currencies pairs mein trade hoti hain. Yeh samajhna ke in currency pairs ke darmiyan kya rishte hain, traders ke liye bohot zaroori hai jo effective trading strategies banana chahte hain. Correlation ek key concept hai jo do currency pairs ke movement ka taluq maloom karta hai. Correlations ka analysis karke, traders market movements ka andaza laga sakte hain, risk ko behtar tareeke se manage kar sakte hain aur apni trading performance ko enhance kar sakte hain.

Correlation aur Types

Forex market mein correlation ek statistical measure hai jo batata hai ke do currency pairs ek doosre ke sath kis had tak move karte hain. Correlation coefficient -1 se +1 tak hota hai. +1 ka matlab hai perfect positive correlation, yani jab ek currency pair move karta hai, to doosra bhi same direction mein aur same proportion se move karta hai. -1 ka matlab hai perfect negative correlation, yani jab ek currency pair move karta hai, to doosra opposite direction mein same degree se move karta hai. Aur 0 ka matlab hai ke dono currency pairs ke movements mein koi taluq nahi hai.

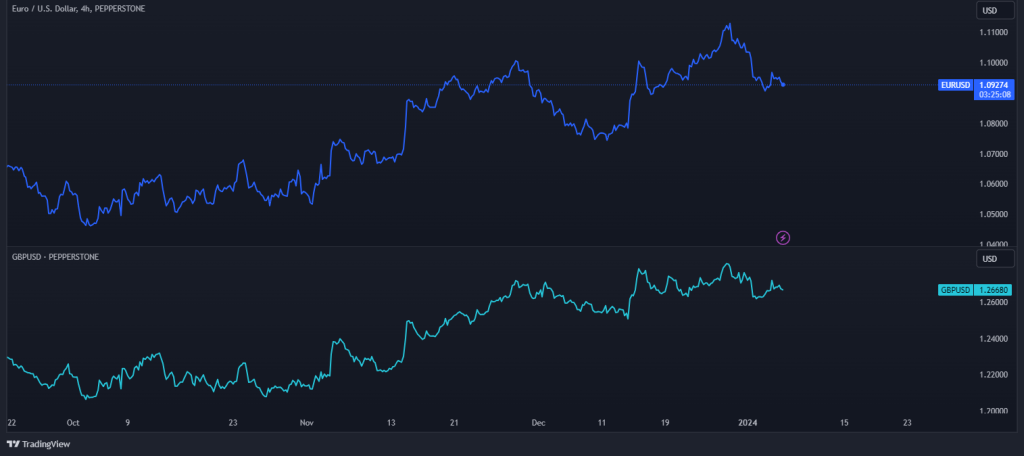

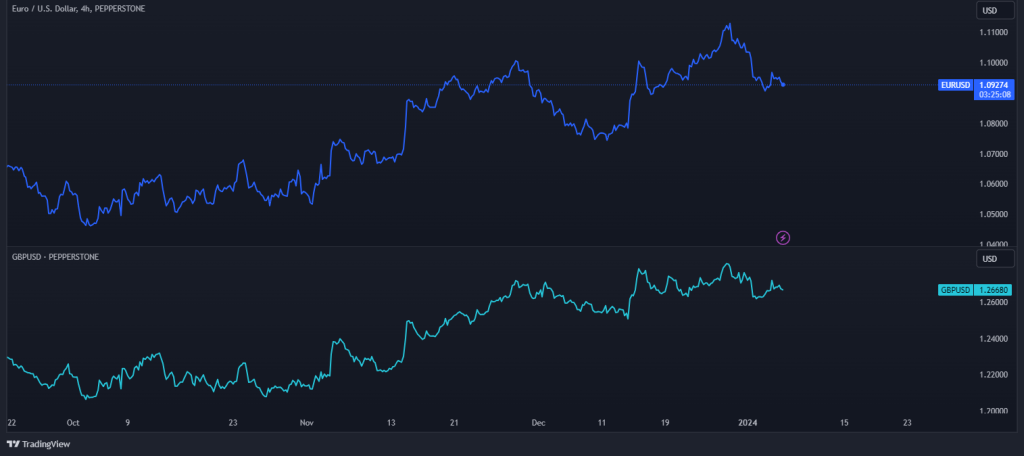

Correlation ke teen main types hain: positive correlation, negative correlation, aur no correlation. Positive correlation tab hota hai jab do currency pairs ek sath same direction mein move karte hain. Misal ke taur par, agar EUR/USD aur GBP/USD dono ek sath barh rahe hain, to inka positive correlation hai. Negative correlation tab hota hai jab do currency pairs opposite directions mein move karte hain. Misal ke taur par, agar USD/JPY barh raha hai aur EUR/USD gir raha hai, to inka negative correlation hai. Aur no correlation tab hota hai jab do currency pairs ke movements independent hote hain.

Currency Pair Correlations ke Causes

Currency pairs ke darmiyan correlations ke kai factors hote hain. Primary factors mein economic ties, major global currencies ka influence, aur market sentiment shamil hain.

Traders various statistical tools use karte hain correlation measure karne ke liye, jin mein se sabse common Pearson correlation coefficient hai. Yeh coefficient do currency pairs ke darmiyan linear relationship ko quantify karta hai aur ek value provide karta hai jo -1 se +1 tak hoti hai. Positive coefficient direct relationship indicate karta hai, jabke negative coefficient inverse relationship indicate karta hai.

Historical price data use karke Pearson correlation coefficient calculate kiya jata hai. Short-term aur long-term relationships ko identify karne ke liye different time frames mein correlation coefficient calculate kiya jata hai. Short-term correlations day traders ke liye useful ho sakti hain, jabke long-term correlations swing traders ya position traders ko strategic decisions lene mein madad kar sakti hain.

Correlation ka Practical Application

Correlation ko samajhna aur leverage karna trading strategy ko bohot enhance kar sakta hai, risk management, diversification, aur strategy development mein.

Limitations aur Challenges

Correlation analysis powerful tool hai lekin ismein kuch limitations bhi hain. Currency pairs ke darmiyan correlations static nahi hote; market conditions, economic policies, aur geopolitical events ki wajah se yeh change hote rehte hain. Is liye sirf historical correlation data par rely karna misleading ho sakta hai.

Correlation aur Types

Forex market mein correlation ek statistical measure hai jo batata hai ke do currency pairs ek doosre ke sath kis had tak move karte hain. Correlation coefficient -1 se +1 tak hota hai. +1 ka matlab hai perfect positive correlation, yani jab ek currency pair move karta hai, to doosra bhi same direction mein aur same proportion se move karta hai. -1 ka matlab hai perfect negative correlation, yani jab ek currency pair move karta hai, to doosra opposite direction mein same degree se move karta hai. Aur 0 ka matlab hai ke dono currency pairs ke movements mein koi taluq nahi hai.

Correlation ke teen main types hain: positive correlation, negative correlation, aur no correlation. Positive correlation tab hota hai jab do currency pairs ek sath same direction mein move karte hain. Misal ke taur par, agar EUR/USD aur GBP/USD dono ek sath barh rahe hain, to inka positive correlation hai. Negative correlation tab hota hai jab do currency pairs opposite directions mein move karte hain. Misal ke taur par, agar USD/JPY barh raha hai aur EUR/USD gir raha hai, to inka negative correlation hai. Aur no correlation tab hota hai jab do currency pairs ke movements independent hote hain.

Currency Pair Correlations ke Causes

Currency pairs ke darmiyan correlations ke kai factors hote hain. Primary factors mein economic ties, major global currencies ka influence, aur market sentiment shamil hain.

- Economic Interdependencies: Jin mulkon ke darmiyan strong trade relationships ya similar economic conditions hoti hain, unki currencies ka correlation hota hai. Misal ke taur par, Canadian dollar CAD aur U.S. dollar USD ka positive correlation hota hai kyunke Canada aur United States ke darmiyan trade volume bohot zyada hai. Isi tarah, Euro EUR aur British Pound GBP ka positive correlation ho sakta hai kyunke Eurozone aur United Kingdom ke darmiyan close economic ties hain.

- Influence of Major Currencies: Major currencies jese ke U.S. dollar USD ka dominance aksar various currency pairs mein correlations create karta hai. USD ek global benchmark ke taur par act karta hai aur doosri currencies ke movements ko influence karta hai. Misal ke taur par, USD/JPY aur EUR/USD ka correlation is liye ho sakta hai kyunke dono pairs USD ke sath linked hain. Jab USD strengthen hota hai, to multiple currency pairs ko simultaneously impact karta hai.

- Market Sentiment aur Risk Appetite: Investor sentiment aur risk appetite bhi currency correlations ko drive karte hain. Jab market uncertainty ya risk aversion hoti hai, to traders safe-haven currencies jese ke USD ya Japanese yen JPY mein invest karte hain. Yeh behavior safe-haven currencies ke sath currency pairs mein correlations create kar sakta hai. Waisi hi, jab economic stability aur high risk appetite hoti hai, to higher-yielding currencies mein positive correlations ho sakte hain kyunke traders greater returns ke liye in currencies ko prefer karte hain.

Traders various statistical tools use karte hain correlation measure karne ke liye, jin mein se sabse common Pearson correlation coefficient hai. Yeh coefficient do currency pairs ke darmiyan linear relationship ko quantify karta hai aur ek value provide karta hai jo -1 se +1 tak hoti hai. Positive coefficient direct relationship indicate karta hai, jabke negative coefficient inverse relationship indicate karta hai.

Historical price data use karke Pearson correlation coefficient calculate kiya jata hai. Short-term aur long-term relationships ko identify karne ke liye different time frames mein correlation coefficient calculate kiya jata hai. Short-term correlations day traders ke liye useful ho sakti hain, jabke long-term correlations swing traders ya position traders ko strategic decisions lene mein madad kar sakti hain.

Correlation ka Practical Application

Correlation ko samajhna aur leverage karna trading strategy ko bohot enhance kar sakta hai, risk management, diversification, aur strategy development mein.

- Risk Management: Correlation analysis Forex trading mein risk manage karne ke liye bohot zaroori hai. Correlation samajh ke traders specific market movements ke exposure ko avoid kar sakte hain. Misal ke taur par, agar ek trader ke paas EUR/USD aur GBP/USD dono mein long positions hain, jo ke positively correlated hain, to uska market risk exposure amplified hota hai. Is risk ko mitigate karne ke liye trader negatively correlated pairs ya uncorrelated pairs apne portfolio mein shamil kar sakta hai.

- Portfolio Diversification: Effective diversification adverse market movements ke impact ko trading portfolio par reduce karta hai. Negatively correlated ya uncorrelated currency pairs ko shamil karke, traders potential losses ko balance kar sakte hain. Misal ke taur par, EUR/USD mein long position ko USD/JPY mein short position ke sath pair karna ek hedging effect create kar sakta hai, kyunke yeh pairs aksar negative correlation show karte hain.

- Strategy Development: Correlation analysis robust trading strategies develop karne mein madad karta hai. Traders correlation data use karke pairs identify kar sakte hain jo ek sath move karte hain, jisse pair trading jese strategies implement ki ja sakti hain. Pair trading mein trader simultaneously do correlated currency pairs ko buy aur sell karta hai, relative movements ka fayda uthane ke liye. Misal ke taur par, agar EUR/USD aur GBP/USD positively correlated hain, to trader EUR/USD ko long aur GBP/USD ko short kar sakta hai jab usse in dono ke darmiyan divergence ka andaza ho.

- Event-Based Trading: Major economic events, jese ke central bank announcements ya geopolitical developments, aksar multiple currency pairs ko simultaneously impact karte hain. Correlations samajh ke traders broader market reactions ka andaza laga sakte hain aur accordingly position le sakte hain. Misal ke taur par, Federal Reserve se dovish statement aane par USD multiple currencies ke against weaken ho sakta hai. Correlations ke aware traders several pairs mein trades plan karke anticipated movements ka fayda utha sakte hain.

Limitations aur Challenges

Correlation analysis powerful tool hai lekin ismein kuch limitations bhi hain. Currency pairs ke darmiyan correlations static nahi hote; market conditions, economic policies, aur geopolitical events ki wajah se yeh change hote rehte hain. Is liye sirf historical correlation data par rely karna misleading ho sakta hai.

- Dynamic Nature of Correlations: Currency correlations kai factors se influenced hote hain jo rapidly change ho sakte hain. Interest rates mein sudden change ya geopolitical crisis jese events correlations ko alter kar sakte hain. Traders ko correlation analysis ko continuously monitor aur adjust karna chahiye taake current market environment ko reflect kar sakein.

- Over-reliance on Historical Data: Historical correlation data future relationships ko accurately predict nahi kar sakta. Market conditions evolve hoti hain aur past performance future results ki guarantee nahi hoti. Traders ko correlation analysis ke sath sath technical aur fundamental analysis bhi use karna chahiye taake informed trading decisions le sakein.

- Complexity in Multi-Currency Portfolios: Multi-currency portfolios mein correlations manage karna increasingly complex ho jata hai. Different currency pairs ke darmiyan interplay intricate aur contradictory relationships create kar sakta hai. Advanced statistical tools aur software in complex relationships ko analyze karne mein madad kar sakte hain, lekin yeh higher level of expertise bhi demand karte hain.

- Spurious Correlations: Kabhi kabhi do currency pairs high correlation show karte hain due to coincidental ya non-economic reasons. Yeh spurious correlations traders ko incorrect assumptions aur potentially harmful trading decisions ki taraf le ja sakte hain. Yeh samajhna zaroori hai ke correlation ko drive karne wale underlying economic aur political factors kya hain taake misled hone se bach sakein.

تبصرہ

Расширенный режим Обычный режим