Hello dear friends

What is Crab chart pattern in forex Trading

Crab Chart Pattern, forex trading mein ek technical analysis pattern hai jo market mein possible reversals ko identify karne mein madad karta hai. Ye pattern Harmonic Trading ka hissa hai aur Scott Carney ne introduce kiya tha. Crab pattern, Fibonacci retracement levels par based hota hai aur market mein hone wale trend reversals ko anticipate karne mein istemal hota hai.

Crab chart pattern ki khasiyat

Fibonacci Levels:

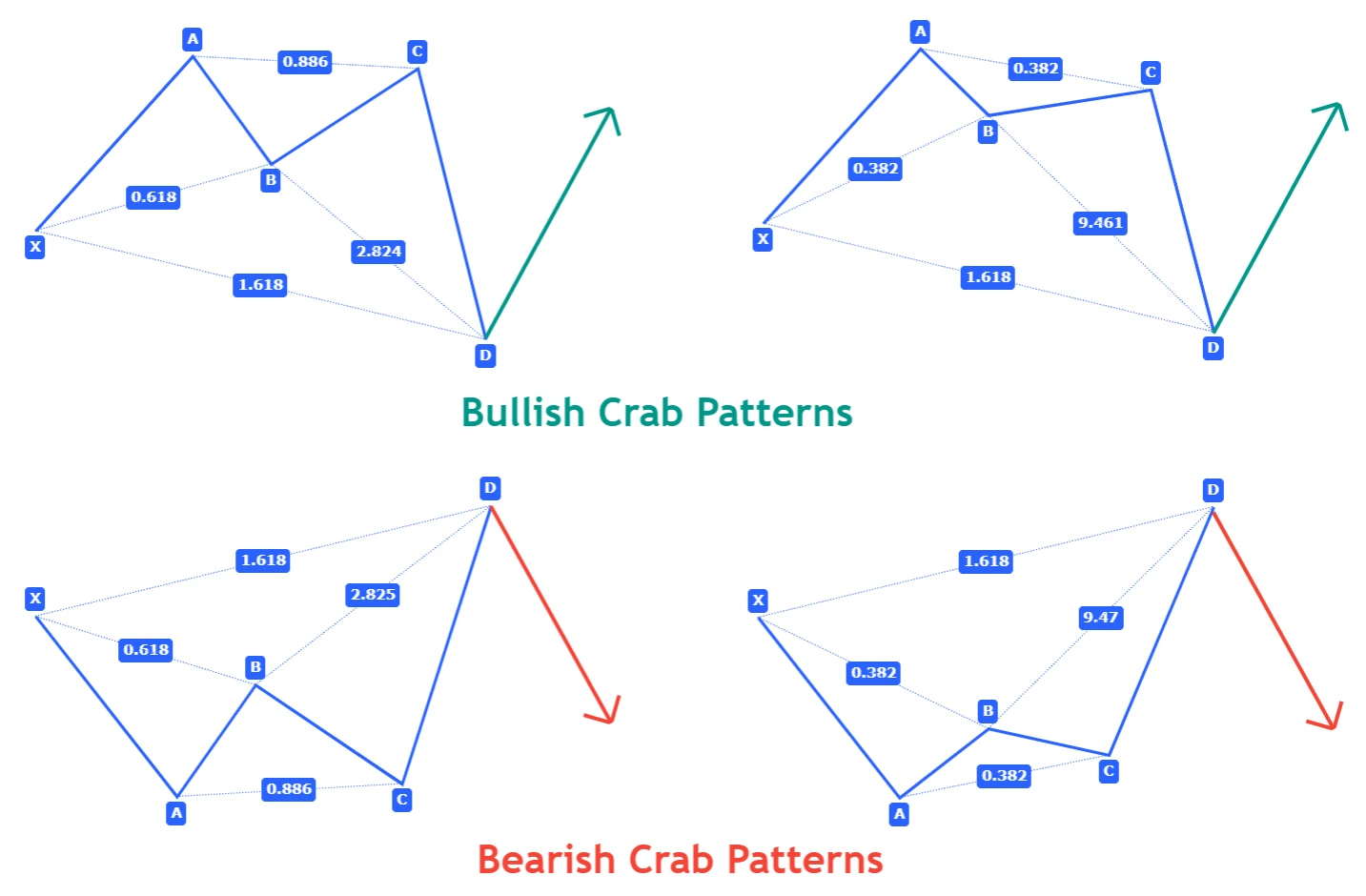

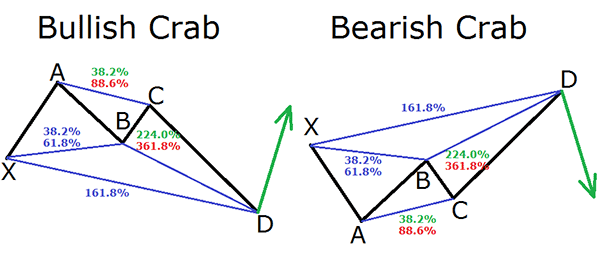

Crab pattern mein Fibonacci retracement levels ka istemal hota hai, specifically 0.382, 0.618, 1.618, aur 2.24 levels par. In levels ka combination ek specific geometric shape banata hai jo crab pattern ko define karta hai.

Crab patterns trading strategies

Traders crab pattern ka istemal karke entry aur exit points determine karte hain. Agar market crab pattern complete karta hai aur Point D confirm hota hai, to traders long position le sakte hain. Stop loss placement aur target levels ko define karne mein Fibonacci retracement aur extension levels ka istemal hota hai.Crab pattern trading mein bhi risk management ka hona zaroori hai. Market uncertainties aur unexpected movements ka dhyan rakh kar traders ko apne positions ko monitor karna chahiye.

Practice and experience

Is pattern ki samajh aur istemal mein practice aur experience ki zarurat hoti hai. Traders ko market conditions aur price action ko dhyan se observe kar ke crab pattern ko sahi tarah se identify karna seekhna chahiye.

What is Crab chart pattern in forex Trading

Crab Chart Pattern, forex trading mein ek technical analysis pattern hai jo market mein possible reversals ko identify karne mein madad karta hai. Ye pattern Harmonic Trading ka hissa hai aur Scott Carney ne introduce kiya tha. Crab pattern, Fibonacci retracement levels par based hota hai aur market mein hone wale trend reversals ko anticipate karne mein istemal hota hai.

Crab chart pattern ki khasiyat

Fibonacci Levels:

Crab pattern mein Fibonacci retracement levels ka istemal hota hai, specifically 0.382, 0.618, 1.618, aur 2.24 levels par. In levels ka combination ek specific geometric shape banata hai jo crab pattern ko define karta hai.

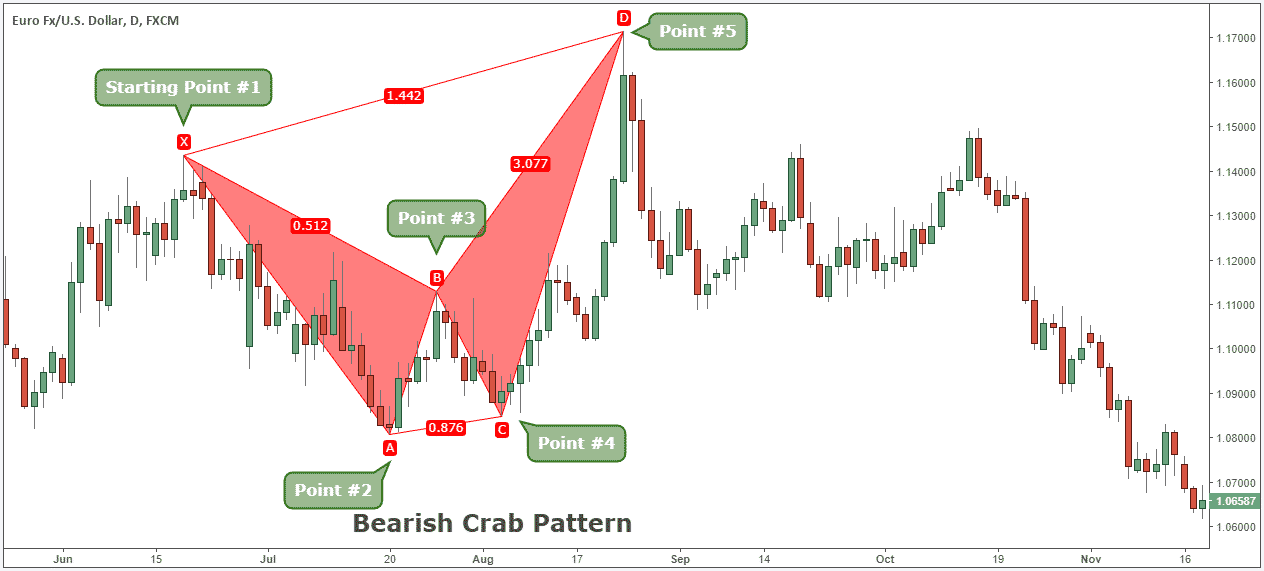

- Dusre Harmonic Patterns Se Mukhtalif: Crab pattern dusre harmonic patterns, jaise ki Butterfly aur Gartley, se mukhtalif hota hai apne ratios aur structure mein. Ye uniqueness isey traders ke liye ek alag pehchan banati hai.

- Point D Extension: Crab pattern ka ek crucial point hota hai "Point D" jo ke Fibonacci level 1.618 se 2.618 ke darmiyan hota hai. Is point ki extension crab pattern ki confirmation mein ahem role ada karta hai.

- Crab Chart Pattern Formations

- AB Leg: Pehla leg AB hota hai jo ek strong price move ko represent karta hai. Is move ke baad market retraces aur ye retracement AB leg ke Fibonacci levels par hone chahiye.

- BC Leg: BC leg market ki retracement ko darust karta hai. BC leg ka extension 1.618 Fibonacci level tak hota hai. Is leg ka size BC leg ke first point se lekar retracement ke end point tak measure kiya jata hai.

- CD Leg: CD leg market ke direction mein ek aur move ko darust karta hai. Is leg ka extension 2.24 Fibonacci level tak hota hai. Is leg ka size BC leg ke starting point se lekar extension ke end point tak measure kiya jata hai.

- Point D: Point D, crab pattern ki completion ko indicate karta hai. Ye point Fibonacci level 1.618 se 2.618 ke darmiyan hota hai aur crab pattern complete hone ke baad traders ko potential reversal ke liye alert karta hai.

Crab patterns trading strategies

Traders crab pattern ka istemal karke entry aur exit points determine karte hain. Agar market crab pattern complete karta hai aur Point D confirm hota hai, to traders long position le sakte hain. Stop loss placement aur target levels ko define karne mein Fibonacci retracement aur extension levels ka istemal hota hai.Crab pattern trading mein bhi risk management ka hona zaroori hai. Market uncertainties aur unexpected movements ka dhyan rakh kar traders ko apne positions ko monitor karna chahiye.

Practice and experience

Is pattern ki samajh aur istemal mein practice aur experience ki zarurat hoti hai. Traders ko market conditions aur price action ko dhyan se observe kar ke crab pattern ko sahi tarah se identify karna seekhna chahiye.

تبصرہ

Расширенный режим Обычный режим