Gold price (XAU/USD) struggles to capitalize on its modest intraday uptick on Thursday and languishes near the weekly low touched the previous day. The downside, however, seems limited as traders might opt to wait for the release of the Advance US Q4 GDP growth figures for cues about the Federal Reserve's (Fed) timeline for interest rate cuts, which will influence the non-yielding yellow metal. Heading into the key data risk, the US Dollar (USD) bulls remain on the defensive, which could further lend some support to the commodity. Apart from this, the risk of a further escalation of geopolitical tensions in the Middle East might turn out to be another factor acting as a tailwind for the safe-haven Gold price. That said, reduced bets for a more aggressive policy easing by the Fed and an early interest rate cut remain supportive of elevated US Treasury bond yields, which should cap the precious metal. The mixed fundamental backdrop warrants some caution before placing aggressive directional bets ahead of the US Personal Consumption Expenditures (PCE) Price Index on Friday.

Daily Digest Market Movers:

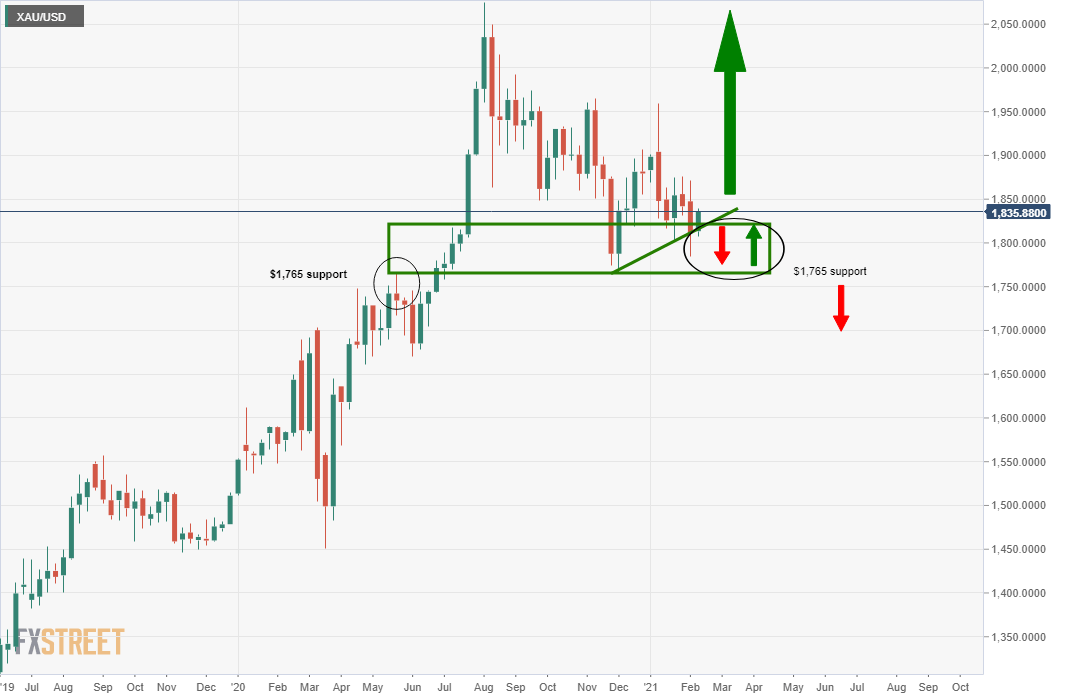

Gold price struggles to attract buyers amid reduced bets for a March Fed rate cut The US Dollar bulls remain on the defensive, which, along with geopolitical tensions stemming from conflicts in the Middle East, lend some support to the safe-haven Gold price. Iran-backed Houthi rebels in Yemen targeted two US-owned commercial ships sailing close to the Gulf of Aden on Wednesday in the face of multiple rounds of US military airstrikes. This comes after the US military carried out pre-emptive strikes against the Houthis to stave off what it said was an imminent attack on shipping lanes in the important Red Sea trade route. The S&P Global flash US Composite PMI Output Index increased to 52.3 this month, or the highest since June, suggesting that the economy kicked off 2024 on a stronger note. The flash US Manufacturing PMI rebounded from 47.9 to a 15-month high of 50.3 in January, while the gauge for the services sector climbed to 52.9, or the highest reading since last June. The data further pointed to a still-resilient US economy and forced investors to further pare their bets for a more aggressive monetary policy easing by the Federal Reserve in 2024. The yield on the benchmark 10-year US government bond hovers near the monthly peak, which should act as a tailwind for the Greenback and cap gains for the non-yielding yellow metal. The Advance US Q4 GDP print is due this Thursday and is expected to show that growth in the world's largest economy slowed to a 2% annualized pace from 4.9% in the previous quarter. Thursday's US economic docket also features the release of Durable Goods Orders and the usual Weekly Initial Jobless Claims, which might influence the Greenback and the XAU/USD. Apart from this, the outcome of the highly-anticipated European Central Bank meeting might infuse volatility in the markets and produce short-term trading opportunities. The market focus, meanwhile, will remain glued to the US Personal Consumption Expenditures Price Index data – the Fed's preferred inflation gauge – on Friday. Technical Analysis: Gold price holds above $2,000 psychological mark, seems vulnerable to slide further From a technical perspective, the recent repeated failures near the $2,040-2,042 supply zone and the overnight downfall favour bearish traders. Moreover, oscillators on the daily chart have just started gaining negative traction and suggest that the path of least resistance for the Gold price is to the downside. That said, it will still be prudent to wait for some follow-through selling below the $2,000 psychological mark before positioning for any further losses. The XAU/USD might then accelerate the slide towards the $1,988 intermediate support en route to the 100-day Simple Moving Average (SMA), currently around the $1,975-1,974 area, and the 200-day SMA, near the $1,964-1,963 region. On the flip side, immediate resistance is pegged near the $2,025 zone, or the 50-day SMA, above which the Gold price could climb back to the $2,040-2.042 barrier. A sustained strength beyond the latter might trigger a short-covering rally and lift the Gold price to the $2,077 area. The momentum could extend further and allow bulls to aim back to reclaim the $2,100 round-figure mark.

Daily Digest Market Movers:

Gold price struggles to attract buyers amid reduced bets for a March Fed rate cut The US Dollar bulls remain on the defensive, which, along with geopolitical tensions stemming from conflicts in the Middle East, lend some support to the safe-haven Gold price. Iran-backed Houthi rebels in Yemen targeted two US-owned commercial ships sailing close to the Gulf of Aden on Wednesday in the face of multiple rounds of US military airstrikes. This comes after the US military carried out pre-emptive strikes against the Houthis to stave off what it said was an imminent attack on shipping lanes in the important Red Sea trade route. The S&P Global flash US Composite PMI Output Index increased to 52.3 this month, or the highest since June, suggesting that the economy kicked off 2024 on a stronger note. The flash US Manufacturing PMI rebounded from 47.9 to a 15-month high of 50.3 in January, while the gauge for the services sector climbed to 52.9, or the highest reading since last June. The data further pointed to a still-resilient US economy and forced investors to further pare their bets for a more aggressive monetary policy easing by the Federal Reserve in 2024. The yield on the benchmark 10-year US government bond hovers near the monthly peak, which should act as a tailwind for the Greenback and cap gains for the non-yielding yellow metal. The Advance US Q4 GDP print is due this Thursday and is expected to show that growth in the world's largest economy slowed to a 2% annualized pace from 4.9% in the previous quarter. Thursday's US economic docket also features the release of Durable Goods Orders and the usual Weekly Initial Jobless Claims, which might influence the Greenback and the XAU/USD. Apart from this, the outcome of the highly-anticipated European Central Bank meeting might infuse volatility in the markets and produce short-term trading opportunities. The market focus, meanwhile, will remain glued to the US Personal Consumption Expenditures Price Index data – the Fed's preferred inflation gauge – on Friday. Technical Analysis: Gold price holds above $2,000 psychological mark, seems vulnerable to slide further From a technical perspective, the recent repeated failures near the $2,040-2,042 supply zone and the overnight downfall favour bearish traders. Moreover, oscillators on the daily chart have just started gaining negative traction and suggest that the path of least resistance for the Gold price is to the downside. That said, it will still be prudent to wait for some follow-through selling below the $2,000 psychological mark before positioning for any further losses. The XAU/USD might then accelerate the slide towards the $1,988 intermediate support en route to the 100-day Simple Moving Average (SMA), currently around the $1,975-1,974 area, and the 200-day SMA, near the $1,964-1,963 region. On the flip side, immediate resistance is pegged near the $2,025 zone, or the 50-day SMA, above which the Gold price could climb back to the $2,040-2.042 barrier. A sustained strength beyond the latter might trigger a short-covering rally and lift the Gold price to the $2,077 area. The momentum could extend further and allow bulls to aim back to reclaim the $2,100 round-figure mark.

تبصرہ

Расширенный режим Обычный режим