What is Price Action Trading

"Price Action Trading" ek trading approach hai jo market ke current aur past price movements ko analyze karne par tawajju deta hai. Isme traders chart patterns, candlestick formations, support aur resistance levels, aur price bars ki movement par concentrate karte hain, taki future price movements ka idea mil sake.

Price Action Trading ka Tareeqa:

- Candlestick Patterns:

- Candlestick patterns ka istemal karke traders price action ko interpret karte hain. Isme bullish aur bearish reversal patterns, jese ke dojis, engulfing patterns, aur hammers, ko samajhna shamil hai.

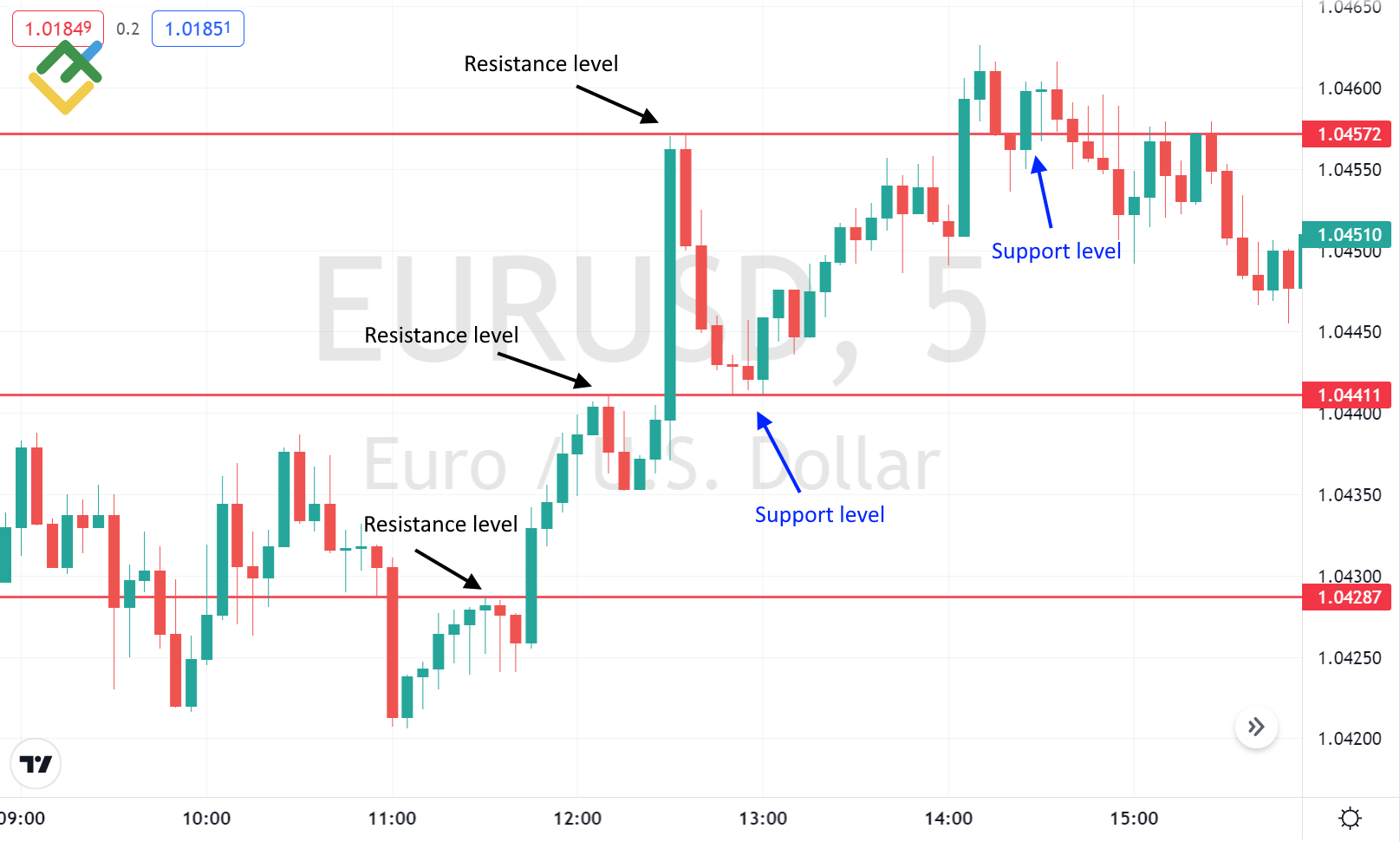

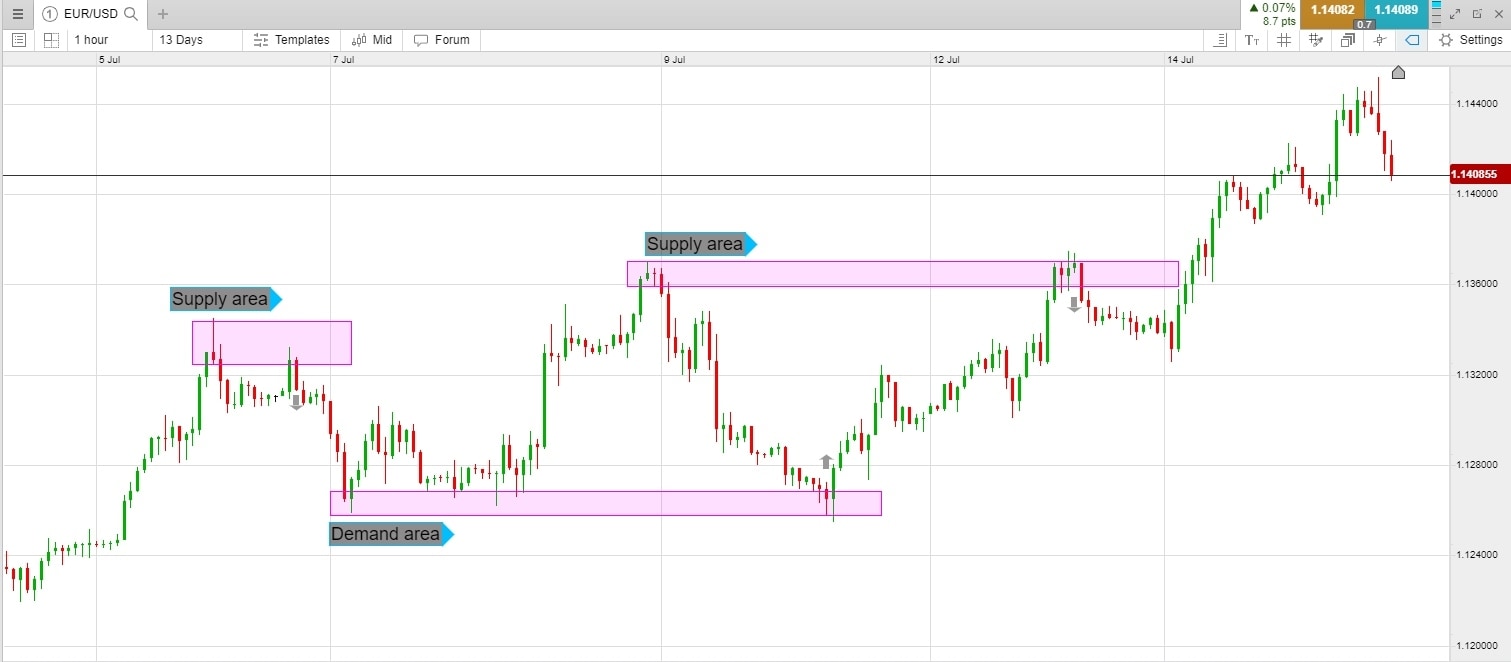

- Support aur Resistance:

- Price action traders support aur resistance levels ko dekhte hain, jo market mein important turning points ko darust karte hain. In levels ko samajh kar traders future price movements ka faisla karte hain.

- Trend Analysis:

- Trend analysis price action ka ahem hissa hai. Traders uptrends, downtrends, aur sideways trends ko identify karte hain taki woh market ke sath trade kar sakein.

- Price Bars aur Chart Patterns:

- Price action traders price bars aur chart patterns, jese ke head and shoulders, triangles, aur channels, ko dekhte hain. In patterns se market ka mood aur potential future movements ka idea milta hai.

- Swing Points aur Pivot Levels:

- Swing points, jese ke higher highs aur lower lows, aur pivot levels, jese ke Fibonacci retracement levels, price action traders ke liye important hote hain.

- Volume Analysis:

- Kuch price action traders volume analysis ka bhi istemal karte hain. Volume, market ke strength aur conviction ko darust karta hai.

- Naked Trading:

- Kuch price action traders "naked trading" karte hain, matlab ke woh indicators ka kam istemal karte hain aur sirf price action patterns par focus rakhte hain.

Price action trading mein traders apne decisions ko sirf price charts aur market movements par base karte hain, bina kisi complex indicator ke. Ye approach traders ko market dynamics ko better samajhne mein madad karta hai. Hamesha yaad rahe ke har trading strategy ke sath risk management ka bhi dhyan rakhna zaroori hai.

تبصرہ

Расширенный режим Обычный режим