Double Top Pattern Forex Strategy (ڈبل ٹاپ پیٹرن فاریکس استریٹجی)

1. Tafseelat (Details):

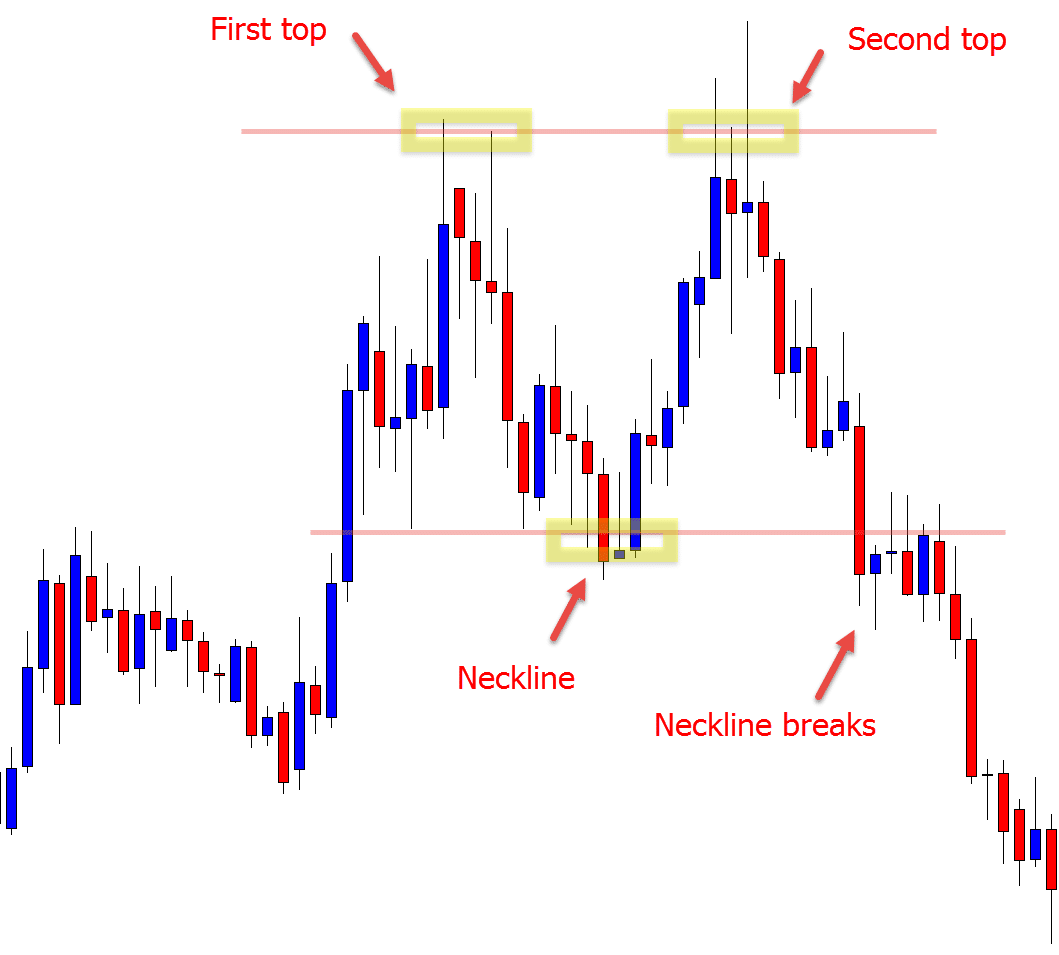

Double Top ek bearish reversal pattern hai jo market trend ko indicate karta hai. Is pattern mein price do martaba aik specific level tak pohanch kar wapis gir jati hai, is se samajh aata hai ke buyers ki strength kamzor ho sakti hai aur girawat ka imkan hai.

2. Pattern Formation (پیٹرن کی بنیاد):

- Peela Top (First Peak):

- Pehla top normal uptrend ke doran banta hai jab price aik certain level tak pohanch kar gir jata hai.

- Pullback (Retracement):

- Peela top ke baad aksar kisi had tak price wapis gir sakta hai, jise pullback kehte hain.

- Dusra Top (Second Peak):

- Pullback ke baad, price dobara wohi pehle wale level tak pohanch kar doosra top bana sakta hai. Yeh do tops ek dosre ke qareeb hote hain aur yeh pattern complete hota hai.

3. Trading Strategy (ٹریڈنگ استریٹجی):

- Entry Point:

- Jab doosra top ban jaye aur price ne pehle wale support level ko tora ho, toh yeh signal ho sakta hai ke bearish reversal hone ka imkan hai.

- Stop-Loss:

- Stop-loss order ko thori deri ke liye pehle wale support level ke oper rakha jata hai.

- Target Price (Goal):

- Target price ko woh level rakha jata hai jahan se pehla top ban raha tha, ya us se thora neeche.

4. Tawun (Considerations):

- Is pattern ko confirm karne ke liye, volume ko bhi monitor karna ahem hai. Agar doosra top kam volume ke sath banta hai, toh ye bearish reversal signal ko confirm karta hai.

- Double Top pattern ko samajhne ke liye traders ko market ki overall conditions aur trend analysis karni chahiye.

5. Caveats (تنبیہات):

- Har pattern ki tarah, double top pattern bhi 100% confirm nahi hota. Market conditions ka zaroori tawun karna ahem hai.

- Stop-loss orders ka istemal zaroori hai taake nuksan ko control mein rakha ja sake.

Final Words (آخری الفاظ):

Double Top pattern bearish trend reversal ko darust karta hai, lekin isay sahi tarah se samajhna aur uski confirmation ke liye market analysis ka sahara lena zaroori hai. Trading mein apni strategies ko test karna aur risk management ka khayal rakhna hamesha ahem ha

تبصرہ

Расширенный режим Обычный режим