Divergence Analysis in Trading.

Trading, ya tijarat, ek mazboot strategy aur soch se chalne wala aik shoba hai. Is mein kamyabi hasil karne ke liye mukhtalif tools aur techniques istemal kiye jate hain. Ek aham tajaweez, jo tijarat mein aam hai, wo hai "Divergence Analysis" ya mukhtalif raaston ka jaiza. Is technique ka istemal karke traders apni faislay mein mukhtalif signals aur trends ka tajziya karte hain.

Divergence Kya Hai?

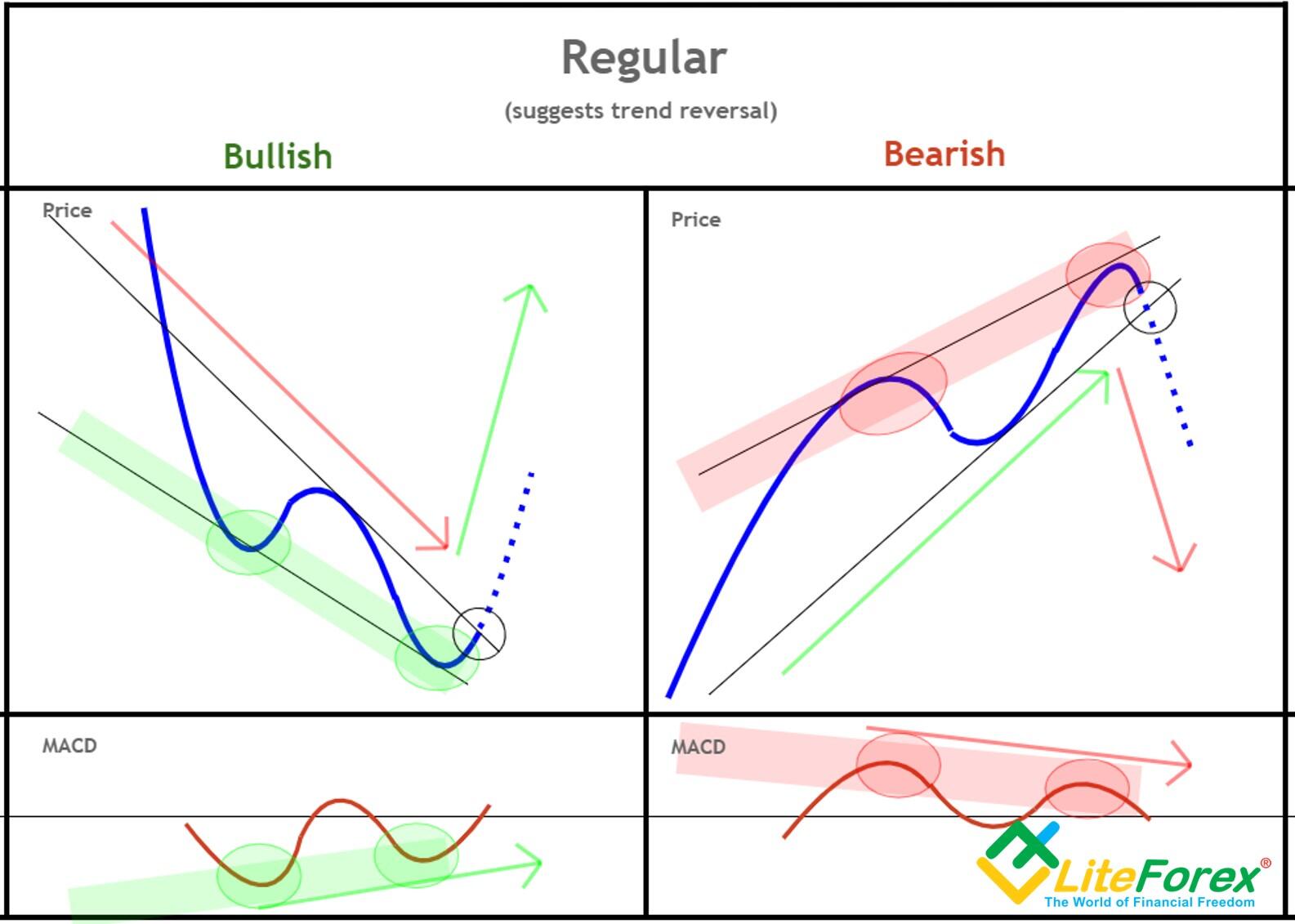

"Divergence" ka matn "mukhtalif raaste" ya "furq" hota hai. Isme trading mein, asset ki keemat aur kisi technical indicator ki movement mein farq hota hai. Jab market mein mukhtalif raaste paida hote hain, yeh signal hota hai ke trend mein tabdeeli hone wali hai.Divergence Analysis trading mein aik important tool hai jo trend reversal ka pehla nishan provide karta hai. Agar asset ki keemat aur kisi indicator ki direction mein mukhtalif raaste hain, toh yeh indicate karta hai ke ab market mein trend change hone wala hai.

Two Types of Divergence.

Divergence do qisam ki hoti hai: positive (ya bullish) divergence aur negative (ya bearish) divergence. Positive divergence mein, asset ki keemat gir rahi hoti hai lekin indicator ki direction upar ja rahi hoti hai. Iska matlab hai ke girawat mein bhi kuch taqat hai. Negative divergence mein, asset ki keemat barh rahi hoti hai lekin indicator neeche ja raha hota hai, jisse trend reversal ka andesha hota hai.

Indicator's importance.

Divergence Analysis mein, kisi bhi makhsoos indicator ka istemal hota hai. Common indicators mein RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur Stochastic Oscillator shamil hain. In indicators ki madad se traders market ki health aur trend ko samajhte hain.

Helps in Risk Management.

Divergence Analysis risk management mein bhi madadgar sabit hota hai. Jab traders divergence ka tajziya karte hain, toh unhe apne trades ko sahi samay par adjust karne ka mauka milta hai. Isse nuksan se bachne mein madad milti hai.

Confirming Other Signals.

Divergence Analysis, doosre trading signals ko bhi tasdeeq karta hai. Agar kisi asset ki keemat mein divergence aur kisi technical indicator ki taraf se confirmatory signal aata hai, toh yeh trader ko aur bhi ziada confident banata hai apne trading decisions mein.tijarat mein zehanat ka hissa bhi divergence analysis hai. Trader ko is technique ke zariye market ki movement ko samajhne mein madad milti hai, jo uski faislay mein asani aur itminan se le aati hai.

Trading, ya tijarat, ek mazboot strategy aur soch se chalne wala aik shoba hai. Is mein kamyabi hasil karne ke liye mukhtalif tools aur techniques istemal kiye jate hain. Ek aham tajaweez, jo tijarat mein aam hai, wo hai "Divergence Analysis" ya mukhtalif raaston ka jaiza. Is technique ka istemal karke traders apni faislay mein mukhtalif signals aur trends ka tajziya karte hain.

Divergence Kya Hai?

"Divergence" ka matn "mukhtalif raaste" ya "furq" hota hai. Isme trading mein, asset ki keemat aur kisi technical indicator ki movement mein farq hota hai. Jab market mein mukhtalif raaste paida hote hain, yeh signal hota hai ke trend mein tabdeeli hone wali hai.Divergence Analysis trading mein aik important tool hai jo trend reversal ka pehla nishan provide karta hai. Agar asset ki keemat aur kisi indicator ki direction mein mukhtalif raaste hain, toh yeh indicate karta hai ke ab market mein trend change hone wala hai.

Two Types of Divergence.

Divergence do qisam ki hoti hai: positive (ya bullish) divergence aur negative (ya bearish) divergence. Positive divergence mein, asset ki keemat gir rahi hoti hai lekin indicator ki direction upar ja rahi hoti hai. Iska matlab hai ke girawat mein bhi kuch taqat hai. Negative divergence mein, asset ki keemat barh rahi hoti hai lekin indicator neeche ja raha hota hai, jisse trend reversal ka andesha hota hai.

Indicator's importance.

Divergence Analysis mein, kisi bhi makhsoos indicator ka istemal hota hai. Common indicators mein RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur Stochastic Oscillator shamil hain. In indicators ki madad se traders market ki health aur trend ko samajhte hain.

Helps in Risk Management.

Divergence Analysis risk management mein bhi madadgar sabit hota hai. Jab traders divergence ka tajziya karte hain, toh unhe apne trades ko sahi samay par adjust karne ka mauka milta hai. Isse nuksan se bachne mein madad milti hai.

Confirming Other Signals.

Divergence Analysis, doosre trading signals ko bhi tasdeeq karta hai. Agar kisi asset ki keemat mein divergence aur kisi technical indicator ki taraf se confirmatory signal aata hai, toh yeh trader ko aur bhi ziada confident banata hai apne trading decisions mein.tijarat mein zehanat ka hissa bhi divergence analysis hai. Trader ko is technique ke zariye market ki movement ko samajhne mein madad milti hai, jo uski faislay mein asani aur itminan se le aati hai.

تبصرہ

Расширенный режим Обычный режим