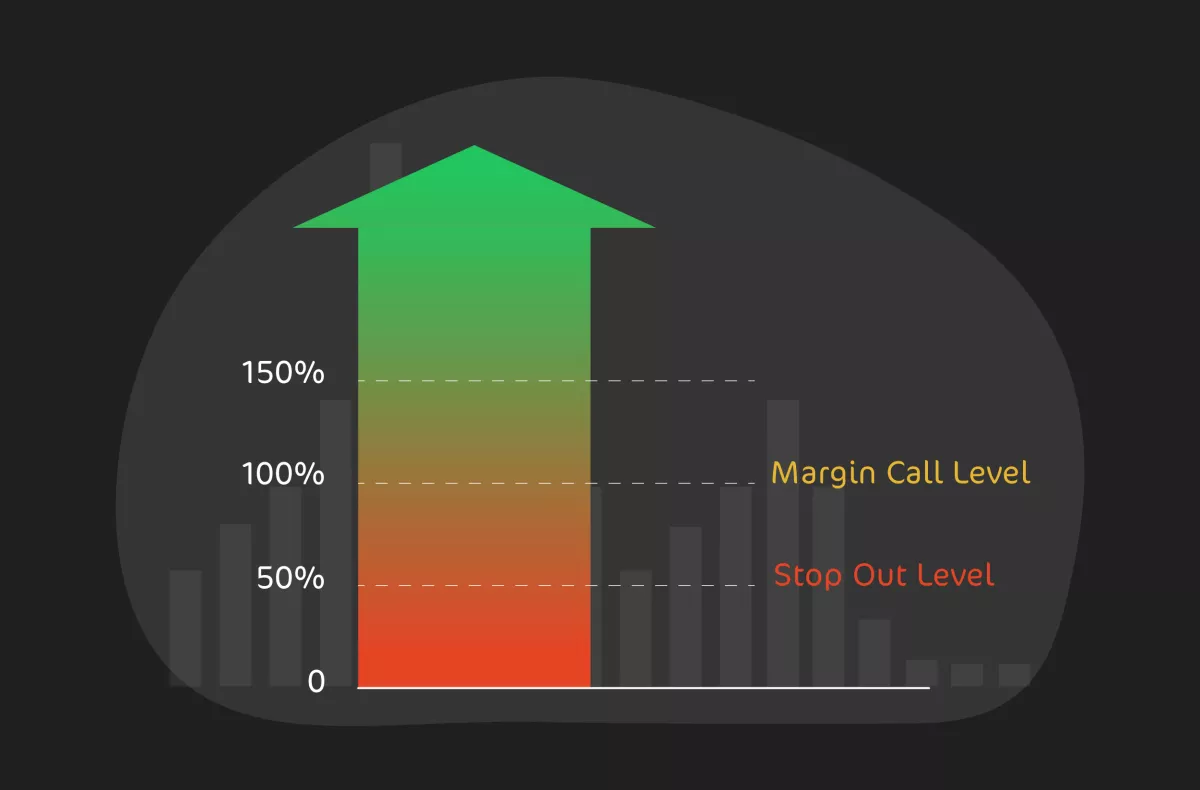

Stop Out Level forex market mein ek important concept hai jo traders ke liye crucial hota hai. Ye level woh point hai jab aapka trading account margin requirements ko pura nahi kar pata aur broker forced liquidation yaani ke stop out kar deta hai. Is level ka determination trading platform par depend karta hai aur ye market conditions ke mutabiq badal sakta hai.

Jab aap forex market mein trade karte hain, aap apne account mein margin rakhte hain. Margin essentially ek security deposit hoti hai jo broker ko assure karti hai ki aap market movements ke against handle karne ke liye financially capable hain. Stop Out Level woh point hai jab aapka account ka equity margin requirements se gir jata hai aur broker ko compelled karta hai ki aapke open positions ko automatically close karde takay aapke account ko negative balance se bachaya ja sake.

Har broker apne Stop Out Level ko define karta hai, lekin aam taur par ye level 20% se 50% ke beech hota hai. Maan lijiye agar aapka broker 30% Stop Out Level rakhta hai, to jab aapka account ka equity margin requirements se 30% tak gir jata hai, tab broker aapke positions ko liquidate kar dega.

Stop Out Level ka main purpose risk management hai. Ye traders ko protect karta hai taaki unka account negative balance mein na chala jaye. Forex market mein volatility kaafi high hoti hai aur sudden price movements aapke positions ko nuksan mein daal sakte hain. Stop Out Level ke through broker account ko automatically close karke trader ko loss se bachane ka ek mechanism provide karta hai

Traders ko ye bhi yaad rakhna important hai ke Stop Out Level sirf ek risk management tool hai aur iske istemal se total loss ka khatra hamesha nahi hat sakta. Market conditions ke rapid changes ke beech, stop out level activate hone par bhi losses ho sakti hain

Isliye, har trader ko apne trading strategy ke hisab se Stop Out Level ka dhyan rakhna chahiye. Position sizes aur stop-loss orders ko carefully manage karna bhi zaroori hai taaki account ko protect kiya ja sake. Stop Out Level ke rules aur conditions broker ke terms and conditions mein clearly mentioned hote hain, isliye har trader ko apne broker ke policies ko samajhna important hai

Jab aap forex market mein trade karte hain, aap apne account mein margin rakhte hain. Margin essentially ek security deposit hoti hai jo broker ko assure karti hai ki aap market movements ke against handle karne ke liye financially capable hain. Stop Out Level woh point hai jab aapka account ka equity margin requirements se gir jata hai aur broker ko compelled karta hai ki aapke open positions ko automatically close karde takay aapke account ko negative balance se bachaya ja sake.

Har broker apne Stop Out Level ko define karta hai, lekin aam taur par ye level 20% se 50% ke beech hota hai. Maan lijiye agar aapka broker 30% Stop Out Level rakhta hai, to jab aapka account ka equity margin requirements se 30% tak gir jata hai, tab broker aapke positions ko liquidate kar dega.

Stop Out Level ka main purpose risk management hai. Ye traders ko protect karta hai taaki unka account negative balance mein na chala jaye. Forex market mein volatility kaafi high hoti hai aur sudden price movements aapke positions ko nuksan mein daal sakte hain. Stop Out Level ke through broker account ko automatically close karke trader ko loss se bachane ka ek mechanism provide karta hai

Traders ko ye bhi yaad rakhna important hai ke Stop Out Level sirf ek risk management tool hai aur iske istemal se total loss ka khatra hamesha nahi hat sakta. Market conditions ke rapid changes ke beech, stop out level activate hone par bhi losses ho sakti hain

Isliye, har trader ko apne trading strategy ke hisab se Stop Out Level ka dhyan rakhna chahiye. Position sizes aur stop-loss orders ko carefully manage karna bhi zaroori hai taaki account ko protect kiya ja sake. Stop Out Level ke rules aur conditions broker ke terms and conditions mein clearly mentioned hote hain, isliye har trader ko apne broker ke policies ko samajhna important hai

تبصرہ

Расширенный режим Обычный режим