Forex Best strategy

doato aaj ka hamar topic aik ayse strategy ke talash main hay jo forex main acha munafa hasil karne main madad kare

Short Term Trading

Agar aap ek long-term trader hain aur aapko badi profits chahiye hain, to aapke liye trend trading ek achhi strategy ho sakti hai. Trend trading mein, aap market ke trend ko follow karte hain aur is trend ke sath trade karte hain.

Long Term Tradin

Agar aap ek short-term trader hain aur aapko adhik trades karna hai, to aapke liye scalping ya intraday trading ek achhi strategy ho sakti hai. Scalping mein, aap market mein bahut shor time ke liye trade karte hain aur aapki profits ka target bahut kam hota hai. Intraday trading mein, aap market mein ek din ya ek se adhik din ke liye trade karte hain.

Risk-Averss Trader

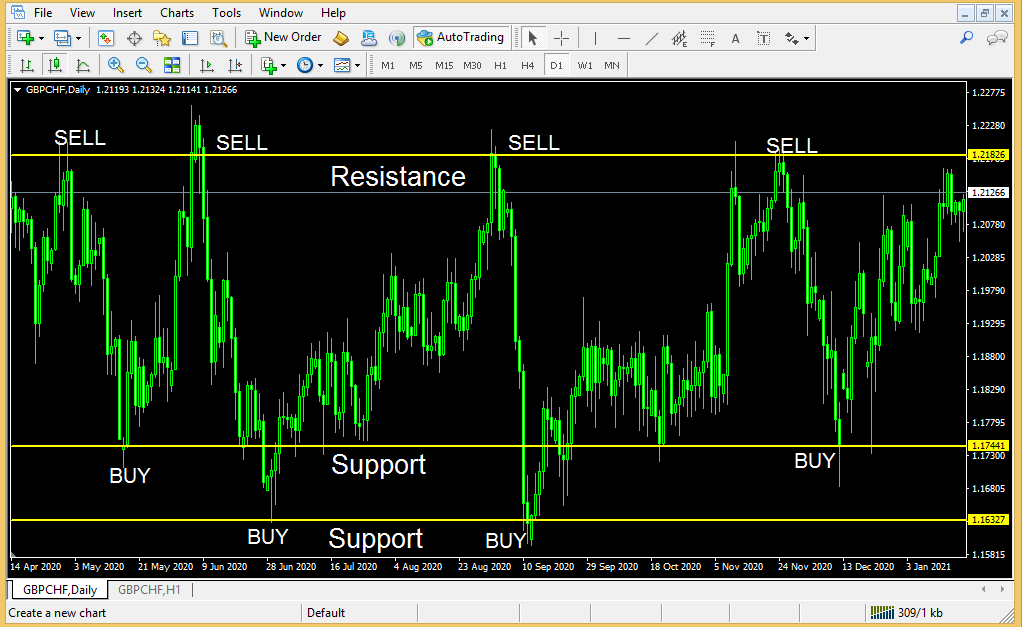

Agar aap ek risk-averse trader hain, to aapke liye range trading ek achhi strategy ho sakti hai. Range trading mein, aap market mein ek range ko identify karte hain aur is range ke andar trade karte hain. Range trading mein, aapki profits ka target bahut kam hota hai, lekin aapki losses ka risk bhi kam hota hai.

Popular Trading Strategy

Yahan kuchh aur popular forex trading strategies hain:

How To Choose AStrategy

Yahan kuchh tips hain jo aapko forex trading strategy choose karne mein madad kar sakti hain:

Umeed hai ki yeh information aapke liye helpful rahi hogi

doato aaj ka hamar topic aik ayse strategy ke talash main hay jo forex main acha munafa hasil karne main madad kare

Short Term Trading

Agar aap ek long-term trader hain aur aapko badi profits chahiye hain, to aapke liye trend trading ek achhi strategy ho sakti hai. Trend trading mein, aap market ke trend ko follow karte hain aur is trend ke sath trade karte hain.

Long Term Tradin

Agar aap ek short-term trader hain aur aapko adhik trades karna hai, to aapke liye scalping ya intraday trading ek achhi strategy ho sakti hai. Scalping mein, aap market mein bahut shor time ke liye trade karte hain aur aapki profits ka target bahut kam hota hai. Intraday trading mein, aap market mein ek din ya ek se adhik din ke liye trade karte hain.

Risk-Averss Trader

Agar aap ek risk-averse trader hain, to aapke liye range trading ek achhi strategy ho sakti hai. Range trading mein, aap market mein ek range ko identify karte hain aur is range ke andar trade karte hain. Range trading mein, aapki profits ka target bahut kam hota hai, lekin aapki losses ka risk bhi kam hota hai.

Popular Trading Strategy

Yahan kuchh aur popular forex trading strategies hain:

- Carry trade: Is strategy mein, aap ek low-yielding currency ko borrow karte hain aur ek high-yielding currency mein invest karte hain.

- News trading: Is strategy mein, aap economic news announcements ko follow karte hain aur is news ke basis per trade karte hain.

- Retracement trading: Is strategy mein, aap market mein ek trend ki retracement ko identify karte hain aur is retracement ke sath trade karte hain.

How To Choose AStrategy

Yahan kuchh tips hain jo aapko forex trading strategy choose karne mein madad kar sakti hain:

- Apne trading goals ko define karen. Aap forex se kya hasil karna chahte hain? Aap long-term profits chahte hain ya short-term?

- Apne risk appetite ko assess karen. Aap kitna risk lena chahte hain?

- Apne research karen. Different strategies ke bare mein research karen aur unki strengths aur weaknesses ko samajhen.

- Apni practice karen. Kisi bhi strategy ko choose karne se pehle, uski practice karen.

Umeed hai ki yeh information aapke liye helpful rahi hogi

تبصرہ

Расширенный режим Обычный режим