Moving Average (Harkat Pazeer) Aur Iske Types

Moving Average ek aham technical indicator hai jo financial markets, jese ke forex, stocks, ya commodities, mein istemal hota hai. Yeh indicator market ki trend ko samajhne aur analyze karne mein madad karta hai. Chaliye samajhte hain ke Moving Average kya hota hai aur iske kis tarah ke types hote hain.

Moving Average Kya Hai?

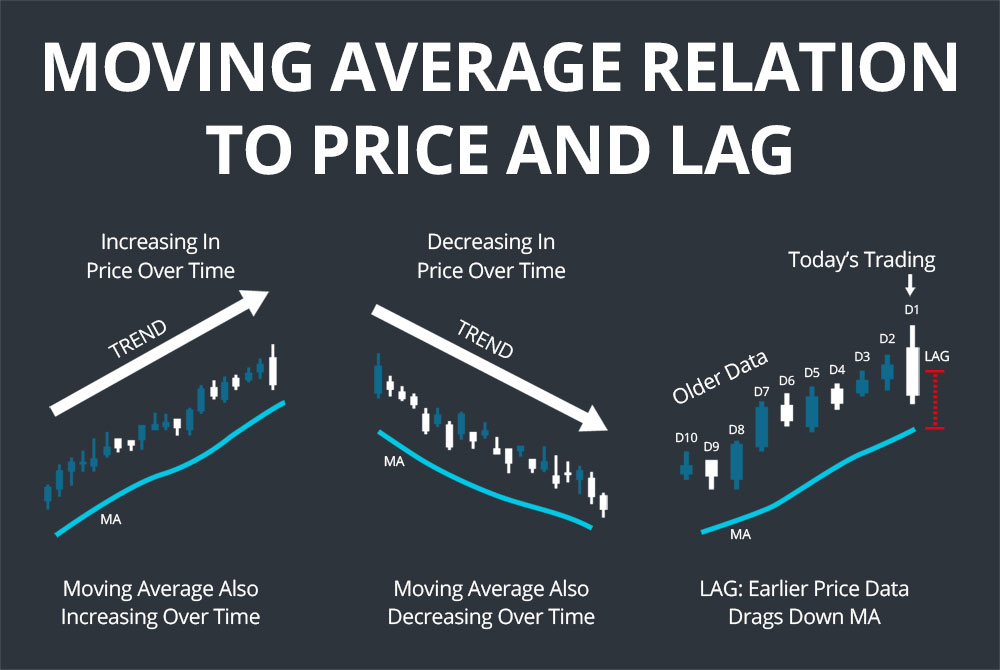

Moving Average (MA) ek statistical calculation hai jo market prices ka average har naye point par banata hai, taki market ki overall trend ko smoothen kiya ja sake. Yeh ek trend-following indicator hai jo traders ko market ke direction ke bare mein idea deta hai.

Types of Moving Averages

- Simple Moving Average (SMA): Simple Moving Average market prices ka simple average hota hai, jisme her point ka equal weight hota hai. Formula:

SMA=(P1+P2+P3+...+Pn)/nSMA=(P1+P2+P3+...+Pn)/n

Yahan, PP prices ko darust karta hai aur nn total periods ko. - Exponential Moving Average (EMA): Exponential Moving Average recent prices ko zyada weight deta hai, is tarah ke yeh jaldi current market conditions ko reflect karta hai. Formula:

EMA=(P∗Multiplier)+(EMA∗(1−Multiplier))EMA=(P∗Mult iplier)+(EMA∗(1−Multiplier))

Yahan, PP current price ko, EMAEMA previous period ka exponential moving average ko aur MultiplierMultiplier ek smoothing factor ko darust karta hai. - Weighted Moving Average (WMA): Weighted Moving Average mein har point ko alag weight diya jata hai. Recent prices ko zyada importance di jati hai. Formula:

WMA=(P1∗W1)+(P2∗W2)+...+(Pn∗Wn)WMA=(P1∗W1)+(P2∗W2) +...+(Pn∗Wn)

Yahan, PP prices ko aur WW weights ko darust karta hai.

- Trend Identification: Moving averages se market ki trend ko identify kiya ja sakta hai. Agar prices moving average ke upar hain, to trend bullish hai aur agar neeche hain, to trend bearish hai.

- Support and Resistance: Moving averages support aur resistance levels tay karne mein bhi madadgar ho sakte hain. Prices jab moving average ke qareeb hote hain, toh woh support ya resistance provide kar sakte hain.

- Crossovers: Moving averages ke crossovers, jese ke short-term aur long-term moving averages ka crossover, trading signals provide karte hain. Isse traders ko entry aur exit points mil sakte hain.

- Volatility Measurement: Moving averages volatility ko bhi measure karte hain. Agar prices moving average ke qareeb hain, toh market zyada volatile ho sakti hai.

Moving averages market analysis mein versatile tool hote hain aur inka istemal traders aur investors ke liye aham hota hai. Inke different types ka istemal market conditions ke mutabiq hota hai, aur inko dusre indicators ke saath mila kar istemal karke traders market trends ko samajh sakte hain. Hamesha yaad rahe ke moving averages bhi kisi bhi indicator ki tarah perfect nahi hote aur prudent risk management ke saath istemal kiye jaayein.

تبصرہ

Расширенный режим Обычный режим