Hello friends

What is take profit & stop loss

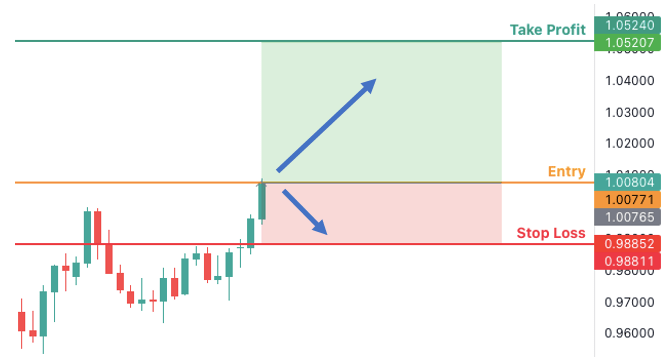

Take Profit (TP) aur Stop Loss (SL) dono hi forex trading mein istemal hone wale risk management tools hain jo traders ko apne trades ko control karne mein madad karte hain. In dono concepts ka istemal karte hue traders apne positions ko manage karte hain taki unka risk kam ho aur profits maximize ho sake.

Take Profit

Take Profit ka matlab hota hai woh level ya price point jahan se trader apne trade ko close karke profit secure karna chahta hai. Jab trader ek position open karta hai, toh usay ek specific target set karta hai jise woh achieve karna chahta hai. Jab market price us target level tak pahunchti hai, toh trader apne position ko automatically close karke profit book kar leta hai.

For example

For example, agar trader ne ek long position (buy order) li hai USD/EUR currency pair par aur uska Take Profit level 1.2050 hai, toh jab market price 1.2050 tak pahunchti hai, trader ka order automatically execute ho jata hai aur woh profit lock kar leta hai.Take Profit ka istemal traders ke liye zaroori hota hai taake unka profit maximize ho sake. Is tool ke istemal se trader apne trades ko actively monitor nahi karna padta, aur jab market desired level tak pahunchta hai, order automatically execute ho jata hai.

Stop Loss

Stop Loss ka matlab hota hai woh level ya price point jahan se trader apne trade ko close karke loss se bachna chahta hai. Jab trader ek position open karta hai, toh usay ek specific risk level set karta hai jise woh tolerate kar sakta hai. Agar market price us risk level tak pahunchti hai, toh trader ka order automatically execute ho jata hai aur woh apna loss control kar leta hai.

For example

For example, agar trader ne ek short position (sell order) li hai USD/EUR currency pair par aur uska Stop Loss level 1.1980 hai, toh jab market price 1.1980 tak pahunchti hai, trader ka order automatically execute ho jata hai aur woh apna loss minimize kar leta hai.Stop Loss ka istemal traders ke liye risk management ka crucial hissa hai. Is tool ki madad se trader apne losses ko control mein rakh sakta hai aur apni trading strategy ko follow karke apne capital ko protect kar sakta hai.

How to use take profit and stop loss

Take Profit aur Stop Loss ka istemal karke traders apne trading plan ko systematic aur disciplined taur par follow kar sakte hain. Yeh dono tools unhein market volatility se bachane mein aur emotional decision-making se bachane mein madad karte hain.Ek sahi Take Profit aur Stop Loss level tay karna traders ke liye mahatva purna hai. Iske liye traders ko market analysis karna hota hai taki woh sahi level tay kar sakein. Kuch traders risk-reward ratio ka bhi dhyan rakhte hain, jisme woh apne expected profit ko apne risk se compare karte hain.

Important tool

In conclusion, Take Profit aur Stop Loss forex trading mein risk management ke important tools hain. Inka istemal karke traders apne positions ko control mein rakhte hain, apne profits secure karte hain aur apne losses ko minimize karte hain. Har trader ko apne trading plan mein in dono tools ka sahi taur par istemal karne ka tajaweez diya jata hai.

What is take profit & stop loss

Take Profit (TP) aur Stop Loss (SL) dono hi forex trading mein istemal hone wale risk management tools hain jo traders ko apne trades ko control karne mein madad karte hain. In dono concepts ka istemal karte hue traders apne positions ko manage karte hain taki unka risk kam ho aur profits maximize ho sake.

Take Profit

Take Profit ka matlab hota hai woh level ya price point jahan se trader apne trade ko close karke profit secure karna chahta hai. Jab trader ek position open karta hai, toh usay ek specific target set karta hai jise woh achieve karna chahta hai. Jab market price us target level tak pahunchti hai, toh trader apne position ko automatically close karke profit book kar leta hai.

For example

For example, agar trader ne ek long position (buy order) li hai USD/EUR currency pair par aur uska Take Profit level 1.2050 hai, toh jab market price 1.2050 tak pahunchti hai, trader ka order automatically execute ho jata hai aur woh profit lock kar leta hai.Take Profit ka istemal traders ke liye zaroori hota hai taake unka profit maximize ho sake. Is tool ke istemal se trader apne trades ko actively monitor nahi karna padta, aur jab market desired level tak pahunchta hai, order automatically execute ho jata hai.

Stop Loss

Stop Loss ka matlab hota hai woh level ya price point jahan se trader apne trade ko close karke loss se bachna chahta hai. Jab trader ek position open karta hai, toh usay ek specific risk level set karta hai jise woh tolerate kar sakta hai. Agar market price us risk level tak pahunchti hai, toh trader ka order automatically execute ho jata hai aur woh apna loss control kar leta hai.

For example

For example, agar trader ne ek short position (sell order) li hai USD/EUR currency pair par aur uska Stop Loss level 1.1980 hai, toh jab market price 1.1980 tak pahunchti hai, trader ka order automatically execute ho jata hai aur woh apna loss minimize kar leta hai.Stop Loss ka istemal traders ke liye risk management ka crucial hissa hai. Is tool ki madad se trader apne losses ko control mein rakh sakta hai aur apni trading strategy ko follow karke apne capital ko protect kar sakta hai.

How to use take profit and stop loss

Take Profit aur Stop Loss ka istemal karke traders apne trading plan ko systematic aur disciplined taur par follow kar sakte hain. Yeh dono tools unhein market volatility se bachane mein aur emotional decision-making se bachane mein madad karte hain.Ek sahi Take Profit aur Stop Loss level tay karna traders ke liye mahatva purna hai. Iske liye traders ko market analysis karna hota hai taki woh sahi level tay kar sakein. Kuch traders risk-reward ratio ka bhi dhyan rakhte hain, jisme woh apne expected profit ko apne risk se compare karte hain.

Important tool

In conclusion, Take Profit aur Stop Loss forex trading mein risk management ke important tools hain. Inka istemal karke traders apne positions ko control mein rakhte hain, apne profits secure karte hain aur apne losses ko minimize karte hain. Har trader ko apne trading plan mein in dono tools ka sahi taur par istemal karne ka tajaweez diya jata hai.

تبصرہ

Расширенный режим Обычный режим