Forex Trading Mein Downside Tasuki Gap Pattern:

Downside Tasuki Gap Pattern ek technical analysis tool hai jo forex trading mein istemal hota hai. Yeh pattern bearish (girawat ki taraf) market trends ko pehchane mein madad karta hai. Chaliye samajhte hain ke downside Tasuki Gap Pattern kya hota hai.

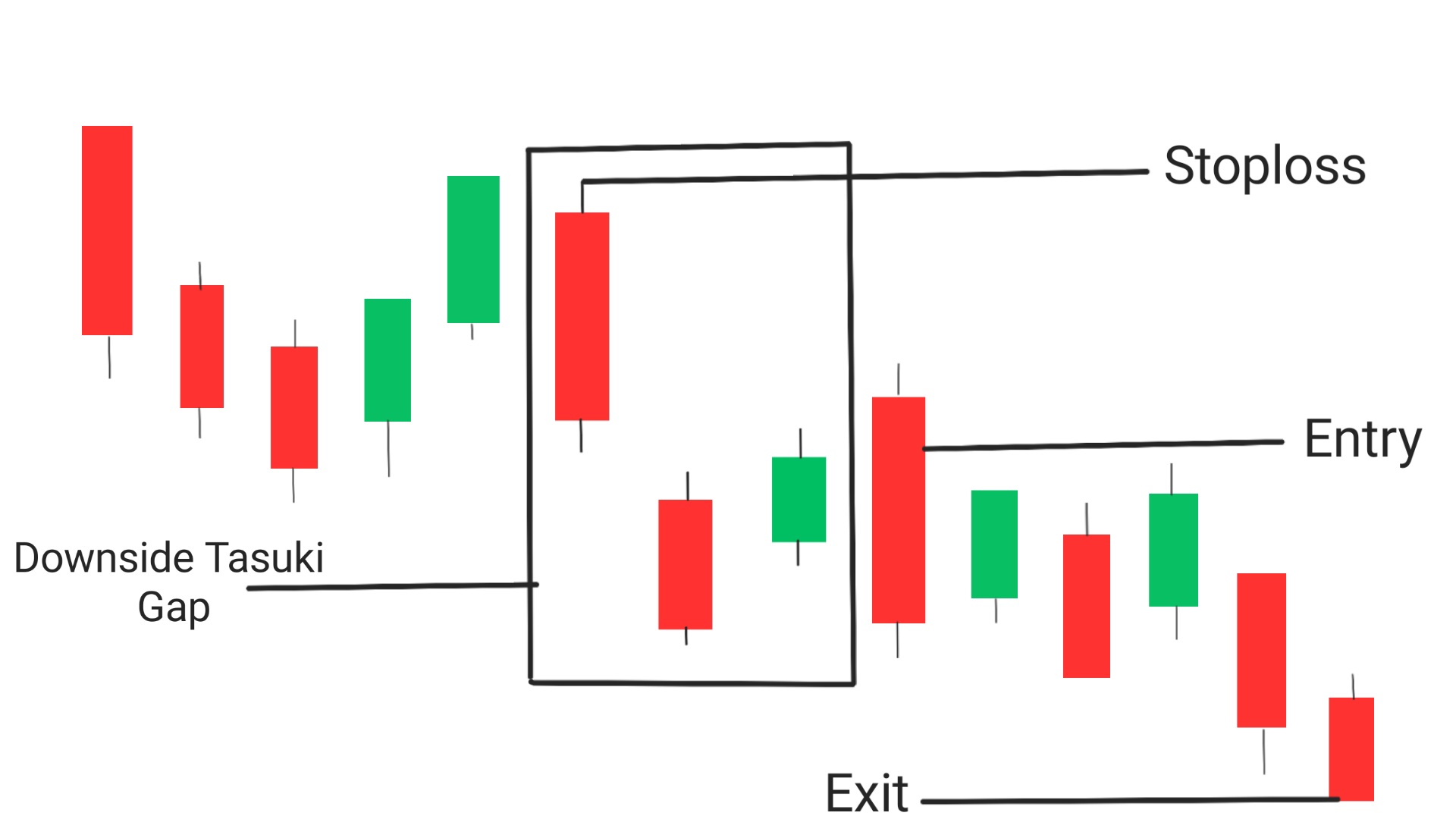

Downside Tasuki Gap Pattern, teen candlesticks se bana hota hai aur ek bearish trend ko darust karti hai. Is pattern ki pehchan karne ke liye niche diye gaye steps ko follow kiya jata hai:

• Pehli Candlestick (Bearish): Pehli candlestick ek downtrend ke doran aati hai, jise bearish candle kehte hain. Is candlestick ki closing price kam hoti hai.

• Dusri Candlestick (Bullish): Dusri candlestick gap down ke saath shuru hoti hai, yaani ke uski opening price pehli candlestick ki closing price se kam hoti hai. Is candlestick ki body pehli candlestick ke andar rehti hai, lekin iski closing price pehli candlestick ki body ke neeche hoti hai.

• Teeni Candlestick (Bearish): Teeni candlestick phir se bearish hoti hai aur pehli candlestick ki taraf gap down ke saath shuru hoti hai. Is candlestick ki closing price dusri candlestick ki closing price ke qareeb hoti hai.

Downside Tasuki Gap Pattern Ki Tafsiliyat:

Downside Tasuki Gap Pattern ka matlub hota hai ke market mein girawat ka trend hai, lekin doosri candlestick ne gap down ke baad show kiya hai ke selling pressure kam ho sakti hai. Teesri candlestick ki closing price pehli ki taraf qareeb hoti hai, lekin phir bhi market mein bearish sentiment qaim rehti hai.

Trading Strategies:

• Confirmation Ke Liye Wait Karein: Downside Tasuki Gap Pattern ko samajhne ke baad traders ko confirmation ke liye wait karna chahiye. Agar agla candlestick bhi bearish hai aur downtrend jaari hai, toh ye pattern mazbooti se confirm hota hai.

• Stop-Loss Aur Target Levels Tey Karna: Har trading strategy mein stop-loss aur target levels tay karna zaroori hai. Is pattern ke istemal mein bhi traders ko apne positions ke liye stop-loss aur target levels set karna chahiye.

• Market Conditions Ko Madde Nazar Rakhein: Downside Tasuki Gap Pattern ke istemal mein hamesha market conditions ko madde nazar rakhein. Kabhi-kabhi false signals bhi hosakti hain, is liyetarah, downside Tasuki Gap Pattern ek bearish trend ko pehchane mein madad karta hai aur traders ko market analysis mein guide karta hai. Lekin, hamesha yaad rakhein ke har pattern ki tarah, ye bhi sirf ek tool hai aur is par pura bharosa karne se pehle doosre factors ko bhi madde nazar rakhein.

:max_bytes(150000):strip_icc()/tasukigapdown-6f707b53589b4179b5814820d323df51.png)

تبصرہ

Расширенный режим Обычный режим