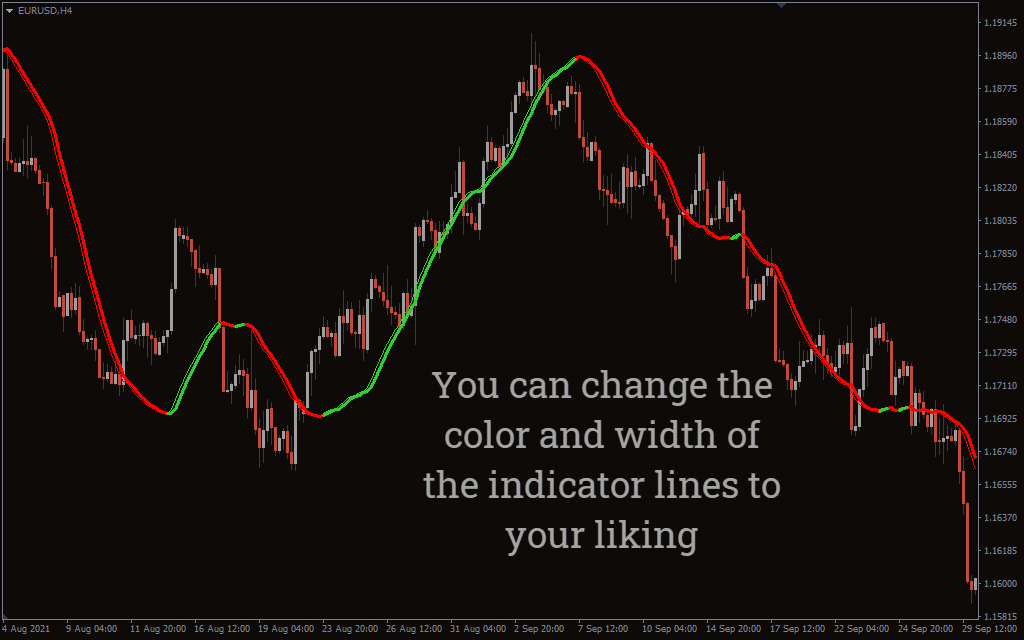

Trigger Line in Forex Trading:

Trigger Line forex trading mein ek technical indicator hai jo trading signals provide karta hai. Ye indicator market trends aur price movements ko samajhne mein madad karta hai. Chaliye samajhte hain ke Trigger Line kya hoti hai.

Trigger Line Kya Hai:

Trigger Line ek part hoti hai kisi aur indicator ya oscillator ka, jaise ke Moving Average ya MACD (Moving Average Convergence Divergence). Trigger Line ka maqsad hota hai market ke trend changes ko highlight karna aur trading signals generate karna.

Kaam Kaise Karti Hai:

- Moving Averages Ke Saath: Trigger Line aksar Moving Averages ke saath istemal hoti hai. Iski common form ka ek example hai "Signal Line" jo MACD ke sath aati hai.

- Signal Line in MACD: MACD ek popular oscillator hai jo trend changes ko indicate karta hai. Ismein hoti hai ek "Signal Line" ya "Trigger Line" jo MACD line ke saath hoti hai. Jab MACD line Signal Line ko upar se neeche cross karti hai, ya phir neeche se upar cross karti hai, toh ye ek trading signal banati hai.

Trading Signals:

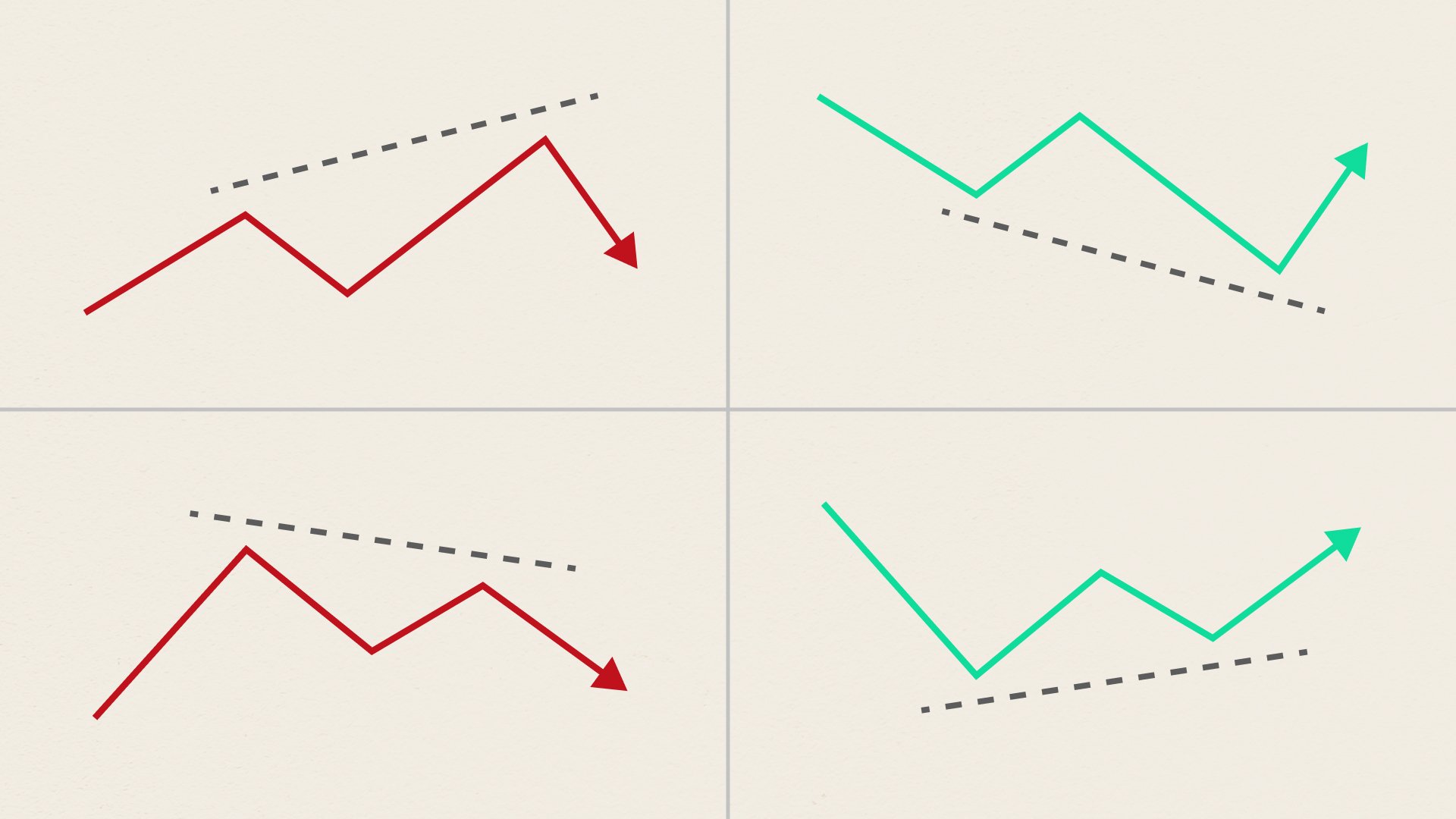

- Buy Signal: Agar market ki price MACD line se upar ja rahi hai aur MACD line Signal Line ko upar cross kar rahi hai, toh ye ek buy signal ho sakta hai. Yani ke traders ko lagta hai ke bullish trend shuru hone wala hai.

- Sell Signal: Agar market ki price MACD line se neeche ja rahi hai aur MACD line Signal Line ko neeche cross kar rahi hai, toh ye ek sell signal ho sakta hai. Yani ke traders ko lagta hai ke bearish trend shuru hone wala hai.

Istemal aur Ahmiyat:

- Trend Confirmation: Trigger Line ka istemal trend confirmation ke liye hota hai. Jab ye line kisi indicator ke saath milta hai, toh isse market trend ko samajhna asaan ho jata hai.

- Signal Confirmation: Trading signals ko confirm karne mein bhi madad hoti hai. Agar koi trader Moving Averages ke saath Trigger Line ka istemal kar raha hai, toh jab dono lines ka cross hota hai, toh ye signal ko confirm karta hai.

- Market Entry aur Exit Points: Trigger Line traders ko market entry aur exit points tajwez karne mein madad karti hai. Iske istemal se traders apne trading strategies ko refine kar sakte hain.

Har ek indicator ka istemal samajhne aur sahi tajwezat nikalne ke liye practice aur experience ki zarurat hoti hai. Trigger Line bhi ek aisa tool hai jo traders ko market movements ke bare mein behtareen malumat farahem karta hai.

:max_bytes(150000):strip_icc()/dotdash-INV-final-Trigger-Line-June-2021-01-a0f3f77cadf74daaaf6b7e5bda7f2921.jpg)

تبصرہ

Расширенный режим Обычный режим