Maliyaat Ki Khabar Aur Market Ka Rawiya:

Maliyaat ki khabar aur market ka rawiya dono hi ahem tajaweezat hain jo ek dusre se mutasir hote hain. Yeh dono asoolon ka tawun market participants ko sahayata pohanchata hai taki woh behtareen faislay kar sakein. Chaliye samajhte hain ke maliyaat ki khabar kya hoti hai aur kaise woh market ke rawiya ko mutasir karti hai.

Maliyaat Ki Khabar:

Maliyaat ki khabar woh malumat hoti hai jo mali idaron, sarkon, ya dusre maliyaati entities se mutasir hoti hai. Ismein shamil ho sakti hain:

- Arthik Indicators: Jaise ke GDP growth rate, employment figures, aur inflation rate.

- Corporate Earnings: Companies ki munafaat, revenue, aur future projections.

- Interest Rates: Central banks ke policy decisions jo interest rates ko mutasir karte hain.

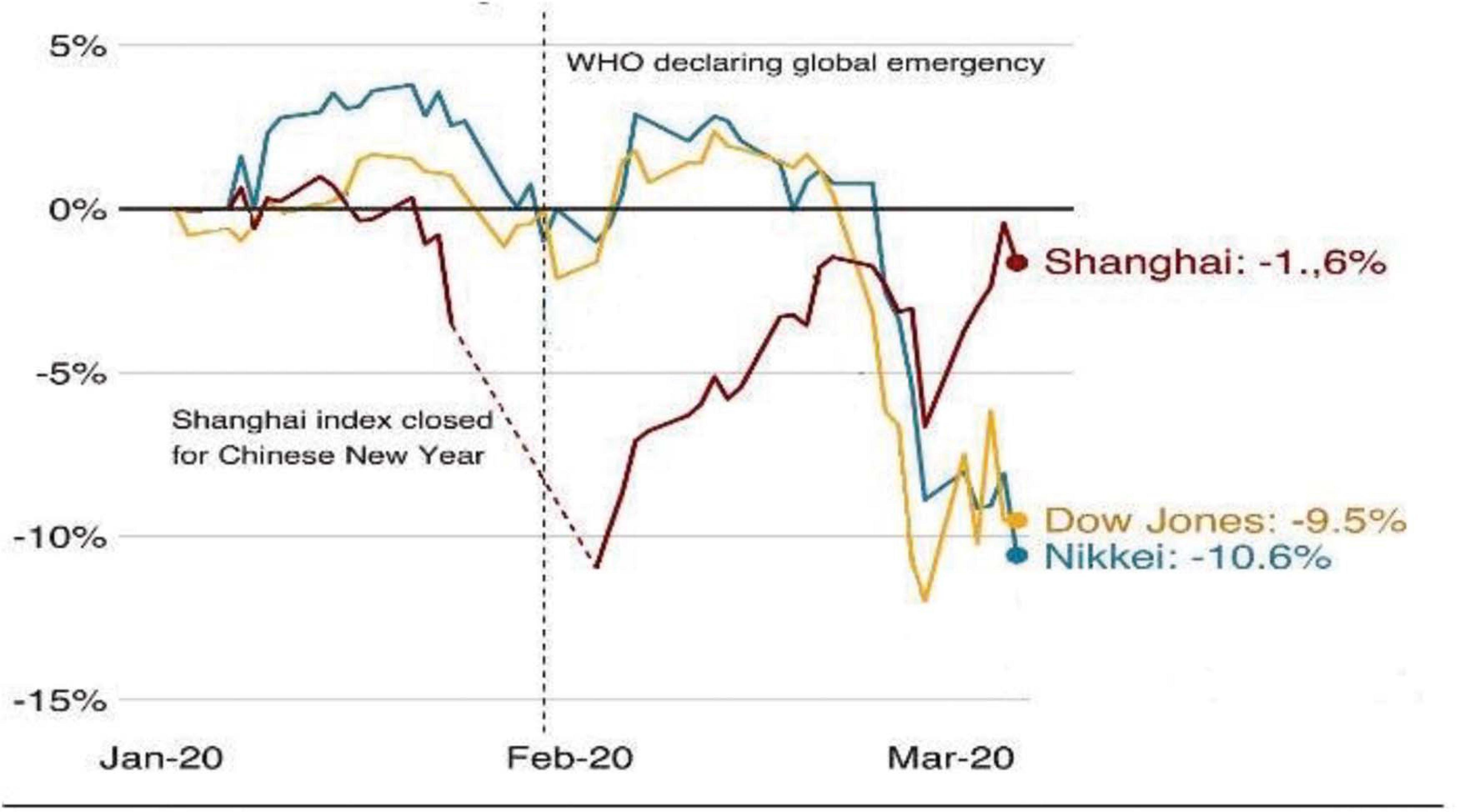

- Geopolitical Events: Mulki aur bay mulki mamlat jo markets ko asar andaz hoti hain.

Market Ka Rawiya:

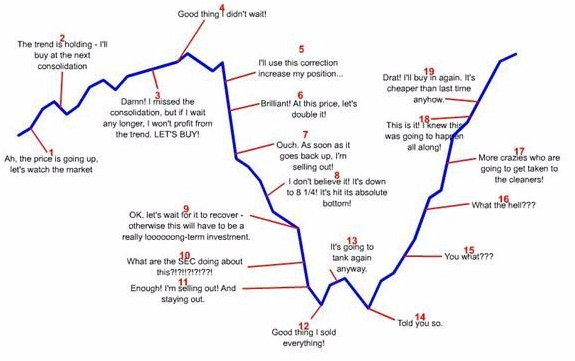

Maliyaat ki khabar ka asar market ke rawiya par hota hai. Market participants, jese ke investors aur traders, is khabar ko tajwezat banane mein aur apne trading strategies ko tanzim karne mein istemal karte hain. Kuch ahem rawaiye is tarah hote hain:

- Price Movements: Maliyaat ki khabar se mutasir hokar stocks, currencies, aur commodities ki keemat mein tabdiliyan hoti hain.

- Market Sentiment: Maliyaat ki khabar market sentiment ko bhi asar andaz karti hai. Agar khabar taqatwar hai, toh investors zyada confident ho sakte hain aur market tezi se barh sakti hai.

- Risk Appetite: Kuch khabaray aise hoti hain jo market participants ki risk-taking ability par asar dal sakti hain. For example, geopolitical tension ya economic instability.

Kyun Important Hai:

- Decision Making: Investors aur traders apne faislay maliyaat ki khabar ke roshni mein lete hain. Behtar malumat aur samajhdari se liye gaye faislay as aasani se karne mein madad karte hain.

- Market Analysis: Maliyaat ki khabar ko samajh kar market analysts market trends aur future expectations tajwez karte hain.

- Risk Management: Khabar ko samajhna traders ko risk management mein bhi madadgar sabit ho sakta hai, taake woh apne positions ko behtar taur par handle kar sakein.

- Economic Growth Ki Pehchan: Maliyaat ki khabar economic growth aur overall financial health ko darust taur par pehchane mein madad karte hain.

Is tarah, maliyaat ki khabar aur market ka rawiya dono hi ek dosre ke saath juray hote hain aur ek behtareen trading environment tajwez karte hain. Yeh dono factors market mein harkat paida karte hain aur participants ko apne maqasid hasil karne mein madad karte hain.

تبصرہ

Расширенный режим Обычный режим