Bid price aur Ask price kiya hota hy?

Bid Price:

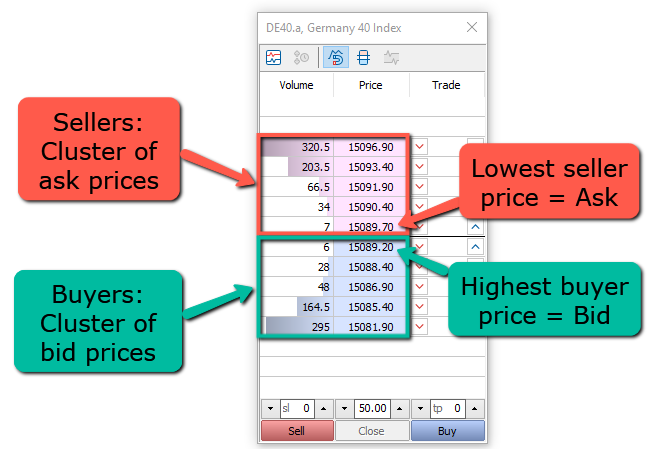

Assalam o alaikum!Dear my trading partners Bid price aik aisi price hoti hai jo ki hamesha lowest point per hoti hai yeh price bohot ziada low level per nazar aati hai Jaisa ke market mein EUR aur USD 1.3350 hoti hai Jab ke USD mein Iske kimat 99.16 mein hoti hai market mein tamaam members ko currency pairs ki selection karne se pahle market Mein v Bid price ko acche tarike se confirm kar lena chahie aur market mein currency pairs ki strongness aur weakness ko dekhte Huwe hi unko Apne treat ke liye select karna chahiye.Meta trader four per left side per Jo price apko show ho rahi hoti hai usko aap bed price ka naam Dete Hain yah Hamesha minimum price hoti hai jab aap market mein koi bhi commodity yeh currency pair sale karte hain to uski against aapko yeh price offer ki ja rahi hoti hai jab aap koi bhi trade open karte Hain To usmein aap ko Hamesha is price per apki values show ho rahi hoti hai isko bid price ka naam diya jata hai.

Ask Price:

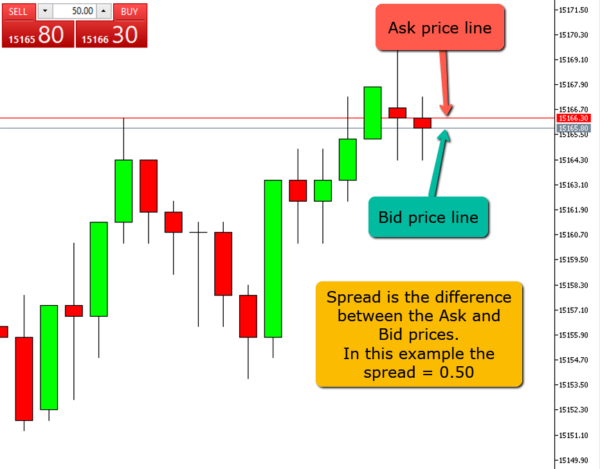

Mere aziz sathiyon Ask price bohot hi bary level ki price hoti hy Ask price Hamesha bid price se bohot ziada Bare level per nazar aati hai market mein a surprise ko clear karna bhi bohot zyada important hota hai market mein USD aur EUR ki price hamesha 0.7489 hoti hai market mein ask price hamesha ziada hoti hai market mein traders ko bid aur ask price ko confirm karne ke sath raat ko bhi confirm karna chahiye market Mein bid aur uska price ke between Jo difference hota hai usko separate Kaha jata hai answer key value ke jarie aise hi traders market mein best currency pair ko ap trading ke liye select kar paate hain aur use per apne trading start kar ke market mein apni trading co successfully bana sakte hain.Agar ap market mein kamyab hona chahte hain to is mein apko ask price aur bid price ka difference Pata hona chahiye ask price Hamesha metatrader 4 mein maximum price ko kaha jata hai agar aap market mein koi bhi commodity aur currency pair ko purchase karte hain to uske against hamesha apko yeh price offer ki ja rahi hoti hai jo metatrader 4 ki right side per show ho rahi hoti hai agar aap market mein kisi bhi commodity co purchase Karte hein to definitely apko highest prices provide ki ja rahi hoti hain.

تبصرہ

Расширенный режим Обычный режим