Assalam.o.alaikum dear friend apki bat bilkul thek hay agar ham hikkake candlestick ko agar ham mamoli smjhy gay tu hamy bhaut hi nuqsan hoga q kay ye candle bhaut hi hard hoty hay is ko week smjhna sa hamy nuqsan ho sakta hay hay hamy treading market me ik achi hasiyat rhak kar hamy market ko smjhna cahaiye agar ham mhenat or ik acha work karna chaty hay to hamy is pattren ki zarorat hoti hay q kay is say hi ham ik achi treading kar sakty hay agar ham patren ko nhi smjhty tu hamy lose ho sakta hay Agar Ham market mein agar iski range Dekh Kar trading Karte Hain To Ham ismein bahut acchi trading kar Sakenge Agar Ham range ke mutabik ismein trading Karke Agar pattern aur knowledge aur experience ke Taur per Ham ismein work Karte Hain To Ham ummid Karte Hain Ki ismein acchi trading kar Sakenge Kyunki market ki range Dekh Kar trading Karni chahie Agar Ham range Dekh Kar trading Nahin Karenge To Ham ismein Achcha work nahin kar Sakenge Kyunki training Mein range ki bahut hi jarurat hoti hai Kyunki range ke mutabik Ham ismein trading kar sakte hain

Trading ek aise mahol mein karna hai jismein market ka hawa bhi badalta rehta hai. Yahaan, ek trader kaamyaabi hasil karne ke liye sahi tareeqon ka istemal karna zaroori hai. Lekin aksar, traders apni strategy ko nazar andaaz kar dete hain jo ke ek badi ghalti ho sakti hai. Is article mein, hum dekhein ge ke trading mein tijarat tareeqa kabhi bhi ignore nahi karna chahiye aur iska kya asar hota hai.

Trading Mein Tijarat Tareeqa Ka Ahmiyat:

Trading mein tijarat tareeqa ek mukhtasir rasta hai jo ke trader ko market mein navi-gation mein madad karta hai. Ye tareeqa usay guide karta hai ke kab aur kaise kharid-o-farokht karein, aur jab market mein tezi ya mandi aaye, toh iska sahi istemal karna trader ke liye behad zaroori hai.

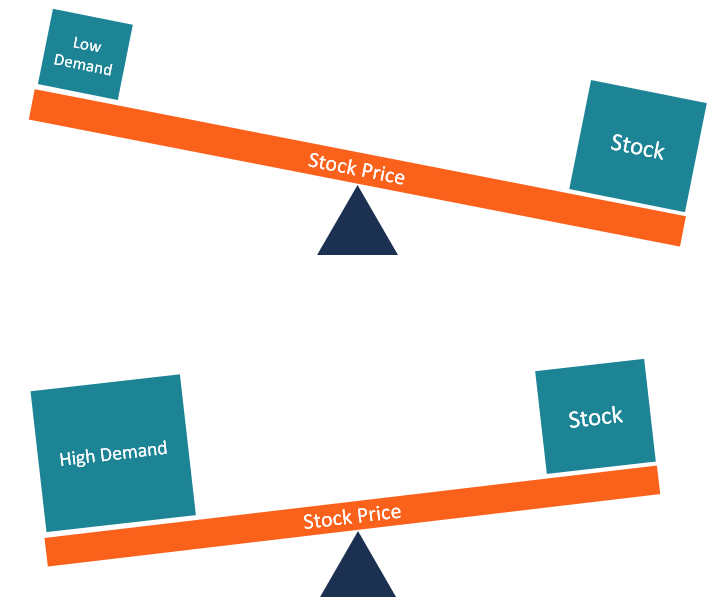

HIGHT TREADING

height reading karne se se Humko bahut hi nuksan ho sakta hai Kyunki Hamen trading Nahin Karni chahie hight trading ka maksad yah hota hai ki Hamen bahut hi jyada risk Lena Hota Hai setting karne se Hamen bahut nuksan ho sakta hai Kyunki hight trading bahut jyada man Nahin Hota Kyunki jo bhi freedom hoti hai na Hamen Soch samajhkar trading Karni Hoti Hai jisse Hamen bahut Achcha Tarika aur bahut Achcha experience ke sath Ham bhi trading kar sakte hain Kyunki Agar Ham thoda Lash aur thoda profit Hasil Karte Hain To Hamen bahut Achcha fayda hota hai agar Ham Karte Hain To usmein Hamen Jahar se baat nuksan hi hoga Kyunki Hamen high trading Se Bachana chahie

week treading

G dear Hamen market trading mein weak trading Karni chahie Kyunki Ham Magar weak trading Karte Hain To Ham bahut hi Apna account acche tarike se istemal kar sakte hain Agar istemal Karne Ka Tarika Hamen acche se aata hai to hamen usmein bhi trading Karni chahie Kyunki recording se hi Hamen fayda ho sakta hai hight trading ka koi maksad nahin Hota Kyunki hight trading Ek nuksan De ho sakti hai Hamen Achcha profit Hasil karne ke liye bhi chatting Karni chahie jisse hamen nuksan bhi na ho aur Hamara account bhi sev Rahe account sev Rahega To Ham bhi trading aur hight trading donon ko Mahmood Banakar Ham ismein kam kar sakte hain

Week and hight Advice

Humko is market Mein donon trading com use karna chahie week bhi aur high Bhi Agar high Aur Bhi donon Milkar Hamen Ek trading ke liye Achcha knowledge Deti Hai To Hamen chahie ki ham Kuchh Bhi trading bhi Karen aur hight se ek bhi Karen Kyunki vah to hydrated profit ke hisab se vah Mul banaya jata Hai Kyon Agar hamare pass profit aur account balance Jyada Hai To Ham trading kar sakte hain Agar hamare pass account balance bahut to kam hai to hamen bhi trading Karni chahie Kyunki trading se Hamen Achcha fayda Hoga aur high se bahut nuksan hoga market Mein inter hone se pahle Hamen high Aur Bhi market analyse aur petrol ko Laaj Mein check karna chahie

Trading ek aise mahol mein karna hai jismein market ka hawa bhi badalta rehta hai. Yahaan, ek trader kaamyaabi hasil karne ke liye sahi tareeqon ka istemal karna zaroori hai. Lekin aksar, traders apni strategy ko nazar andaaz kar dete hain jo ke ek badi ghalti ho sakti hai. Is article mein, hum dekhein ge ke trading mein tijarat tareeqa kabhi bhi ignore nahi karna chahiye aur iska kya asar hota hai.

Trading Mein Tijarat Tareeqa Ka Ahmiyat:

Trading mein tijarat tareeqa ek mukhtasir rasta hai jo ke trader ko market mein navi-gation mein madad karta hai. Ye tareeqa usay guide karta hai ke kab aur kaise kharid-o-farokht karein, aur jab market mein tezi ya mandi aaye, toh iska sahi istemal karna trader ke liye behad zaroori hai.

HIGHT TREADING

height reading karne se se Humko bahut hi nuksan ho sakta hai Kyunki Hamen trading Nahin Karni chahie hight trading ka maksad yah hota hai ki Hamen bahut hi jyada risk Lena Hota Hai setting karne se Hamen bahut nuksan ho sakta hai Kyunki hight trading bahut jyada man Nahin Hota Kyunki jo bhi freedom hoti hai na Hamen Soch samajhkar trading Karni Hoti Hai jisse Hamen bahut Achcha Tarika aur bahut Achcha experience ke sath Ham bhi trading kar sakte hain Kyunki Agar Ham thoda Lash aur thoda profit Hasil Karte Hain To Hamen bahut Achcha fayda hota hai agar Ham Karte Hain To usmein Hamen Jahar se baat nuksan hi hoga Kyunki Hamen high trading Se Bachana chahie

week treading

G dear Hamen market trading mein weak trading Karni chahie Kyunki Ham Magar weak trading Karte Hain To Ham bahut hi Apna account acche tarike se istemal kar sakte hain Agar istemal Karne Ka Tarika Hamen acche se aata hai to hamen usmein bhi trading Karni chahie Kyunki recording se hi Hamen fayda ho sakta hai hight trading ka koi maksad nahin Hota Kyunki hight trading Ek nuksan De ho sakti hai Hamen Achcha profit Hasil karne ke liye bhi chatting Karni chahie jisse hamen nuksan bhi na ho aur Hamara account bhi sev Rahe account sev Rahega To Ham bhi trading aur hight trading donon ko Mahmood Banakar Ham ismein kam kar sakte hain

Week and hight Advice

Humko is market Mein donon trading com use karna chahie week bhi aur high Bhi Agar high Aur Bhi donon Milkar Hamen Ek trading ke liye Achcha knowledge Deti Hai To Hamen chahie ki ham Kuchh Bhi trading bhi Karen aur hight se ek bhi Karen Kyunki vah to hydrated profit ke hisab se vah Mul banaya jata Hai Kyon Agar hamare pass profit aur account balance Jyada Hai To Ham trading kar sakte hain Agar hamare pass account balance bahut to kam hai to hamen bhi trading Karni chahie Kyunki trading se Hamen Achcha fayda Hoga aur high se bahut nuksan hoga market Mein inter hone se pahle Hamen high Aur Bhi market analyse aur petrol ko Laaj Mein check karna chahie

تبصرہ

Расширенный режим Обычный режим