Explanation.

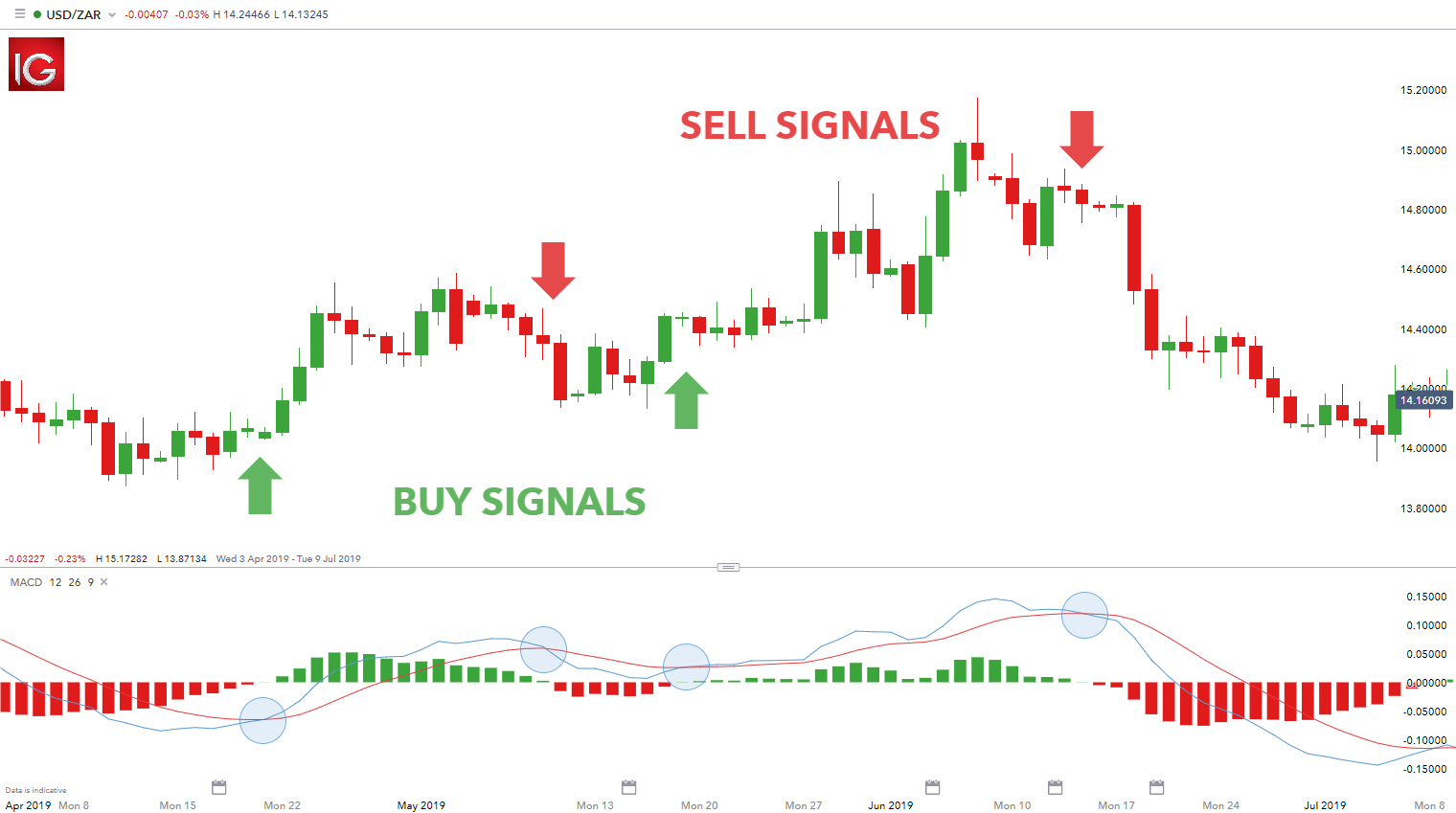

MACD (Moving Average Convergence Divergence) ek technical indicator hai jo price trends ko analyze karne me help karta hai. Ye indicator momentum, trend, volatility aur market strength ko measure karta hai.

MACD indicator ka use trend identification aur reversal trading strategies ke liye kiya jata hai. Iska use short term aur long term trading me bhi kiya jata hai.

MACD Indicator Benefits.

1. Trend Identification: MACD indicator trend identification me help karta hai. Jab MACD line signal line ko cross karta hai to ye trend reversal signal provide karta hai.

2. Momentum Indicator:

MACD indicator momentum indicator ke roop me bhi kaam karta hai. Jab MACD line zero line ko cross karta hai to ye momentum ke signal provide karta hai.

3. Volatility Indicator:

MACD indicator volatility indicator ke roop me bhi kaam karta hai. Jab MACD line aur signal line ke beech ka gap increase hota hai to ye volatility increase ka signal provide karta hai.

4. Divergence Indicator:

MACD indicator divergence indicator ke roop me bhi kaam karta hai. Jab price trend aur MACD trend opposite direction me move karta hai to ye divergence ka signal provide karta hai.

5. Easy to Understand:

MACD indicator easy to understand hai. Iska use beginners se lekar experienced traders tak kar sakte hain.Use krnay say pehly tools ka use krna chahiye or risk free trading krni chahiye.

More Important.

MACD indicator forex trading me bahut useful hai. Iska use trend identification, momentum indicator, volatility indicator aur divergence indicator ke liye kiya jata hai. Ye indicator easy to understand hai aur beginners se lekar experienced traders tak kaam kar sakta hai.

MACD (Moving Average Convergence Divergence) ek technical indicator hai jo price trends ko analyze karne me help karta hai. Ye indicator momentum, trend, volatility aur market strength ko measure karta hai.

MACD indicator ka use trend identification aur reversal trading strategies ke liye kiya jata hai. Iska use short term aur long term trading me bhi kiya jata hai.

MACD Indicator Benefits.

1. Trend Identification: MACD indicator trend identification me help karta hai. Jab MACD line signal line ko cross karta hai to ye trend reversal signal provide karta hai.

2. Momentum Indicator:

MACD indicator momentum indicator ke roop me bhi kaam karta hai. Jab MACD line zero line ko cross karta hai to ye momentum ke signal provide karta hai.

3. Volatility Indicator:

MACD indicator volatility indicator ke roop me bhi kaam karta hai. Jab MACD line aur signal line ke beech ka gap increase hota hai to ye volatility increase ka signal provide karta hai.

4. Divergence Indicator:

MACD indicator divergence indicator ke roop me bhi kaam karta hai. Jab price trend aur MACD trend opposite direction me move karta hai to ye divergence ka signal provide karta hai.

5. Easy to Understand:

MACD indicator easy to understand hai. Iska use beginners se lekar experienced traders tak kar sakte hain.Use krnay say pehly tools ka use krna chahiye or risk free trading krni chahiye.

More Important.

MACD indicator forex trading me bahut useful hai. Iska use trend identification, momentum indicator, volatility indicator aur divergence indicator ke liye kiya jata hai. Ye indicator easy to understand hai aur beginners se lekar experienced traders tak kaam kar sakta hai.

تبصرہ

Расширенный режим Обычный режим