What is Zone

.Forex mein "Aur Zone" ya "Overbought and Oversold Zone" ka concept market analysis mein istemal hota hai. Yeh concept traders ko market ke momentum aur possible reversals ke bare mein samajhne mein madad karta hai. Jab kisi currency pair ka price bahut tezi se badh jaata hai, toh use "Overbought" kehte hain, aur jab bahut tezi se gir jaata hai, toh use "Oversold" kehte hain.

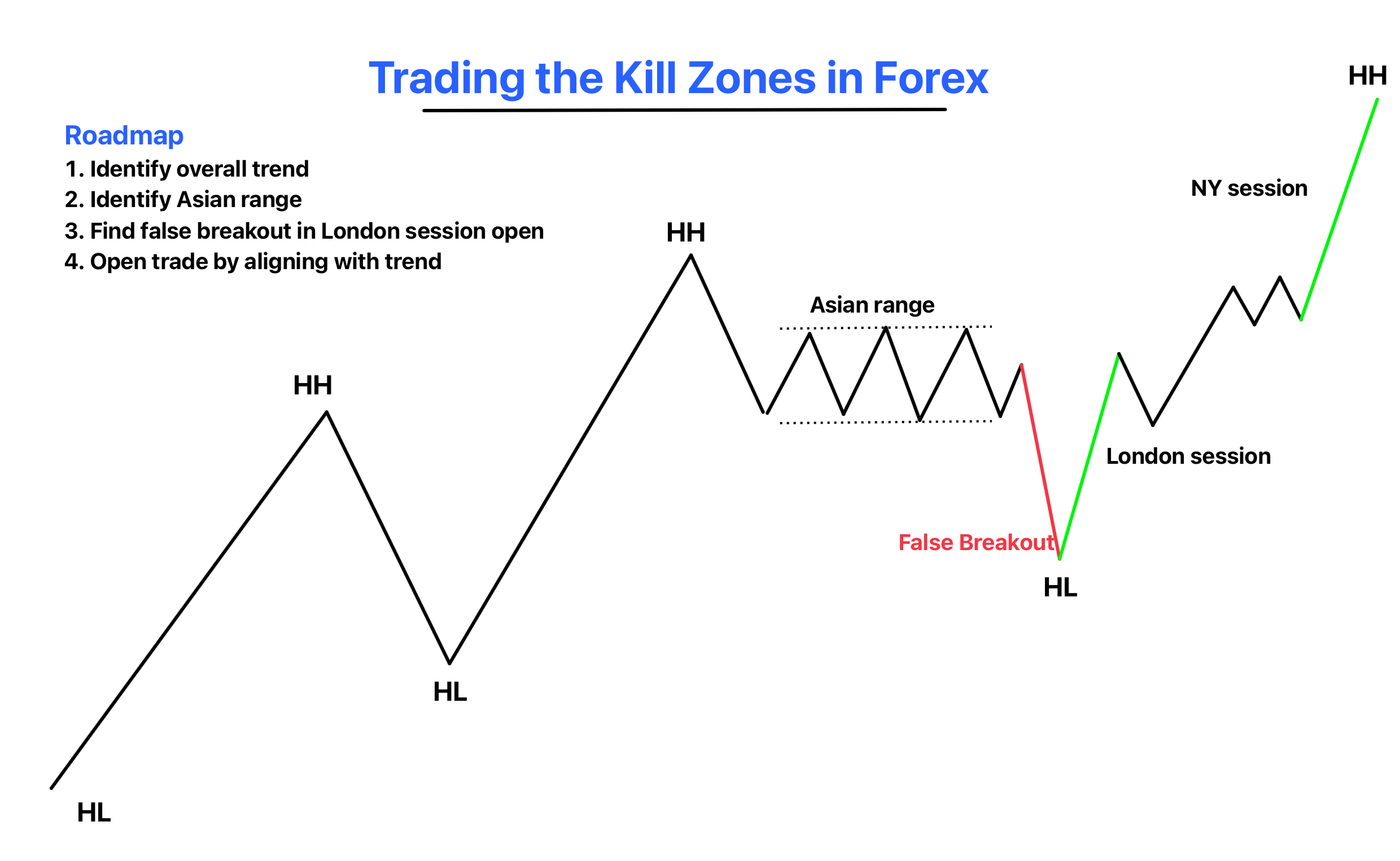

How To Trade The zone in Forex

"Aur Zone" ka asal maqsad yeh hai ke traders ko market mein hone wale possible trend reversals ka pata chale. Yeh zaroori hai kyunki market mein trend change hone par traders apni strategies ko adjust kar sakte hain.

Overbought zone mein, traders ko yeh indication milti hai ke market mein excessive buying ho rahi hai aur price overvalued ho sakta hai. Is situation mein, traders cautious ho kar apne positions ko monitor karte hain, aur potential reversal ke signals ko dekhte hain.

How To Identify The zone in Forex

Oversold zone mein, opposite scenario hota hai. Yeh indicate karta hai ke market mein excessive selling ho rahi hai aur price undervalued ho sakti hai. Traders is situation mein bhi vigilant rehte hain aur reversal signs ko observe karte hain.

"Aur Zone" ko analyze karne ke liye kai tools aur indicators istemal hote hain, jinme se ek common tool Relative Strength Index (RSI) hai. RSI, price ki recent changes ko dekhte hue overbought ya oversold conditions ko identify karta hai.

Understanding The Zone in Forex

Forex traders ko chahiye ke woh "Aur Zone" ko samajhe aur iska istemal theek tareeke se karein. Overbought ya oversold hone par market mein reversal hona zaroori nahi hota, isliye yeh sirf ek indicator hai, dusre factors ke saath milake dekha jana chahiye.

Is concept ko samajhna aur istemal karna traders ke liye zaroori hai takay woh market trends ko sahi tareeke se analyze kar sakein aur apni trading strategies ko improve kar sakein.

.Forex mein "Aur Zone" ya "Overbought and Oversold Zone" ka concept market analysis mein istemal hota hai. Yeh concept traders ko market ke momentum aur possible reversals ke bare mein samajhne mein madad karta hai. Jab kisi currency pair ka price bahut tezi se badh jaata hai, toh use "Overbought" kehte hain, aur jab bahut tezi se gir jaata hai, toh use "Oversold" kehte hain.

How To Trade The zone in Forex

"Aur Zone" ka asal maqsad yeh hai ke traders ko market mein hone wale possible trend reversals ka pata chale. Yeh zaroori hai kyunki market mein trend change hone par traders apni strategies ko adjust kar sakte hain.

Overbought zone mein, traders ko yeh indication milti hai ke market mein excessive buying ho rahi hai aur price overvalued ho sakta hai. Is situation mein, traders cautious ho kar apne positions ko monitor karte hain, aur potential reversal ke signals ko dekhte hain.

How To Identify The zone in Forex

Oversold zone mein, opposite scenario hota hai. Yeh indicate karta hai ke market mein excessive selling ho rahi hai aur price undervalued ho sakti hai. Traders is situation mein bhi vigilant rehte hain aur reversal signs ko observe karte hain.

"Aur Zone" ko analyze karne ke liye kai tools aur indicators istemal hote hain, jinme se ek common tool Relative Strength Index (RSI) hai. RSI, price ki recent changes ko dekhte hue overbought ya oversold conditions ko identify karta hai.

Understanding The Zone in Forex

Forex traders ko chahiye ke woh "Aur Zone" ko samajhe aur iska istemal theek tareeke se karein. Overbought ya oversold hone par market mein reversal hona zaroori nahi hota, isliye yeh sirf ek indicator hai, dusre factors ke saath milake dekha jana chahiye.

Is concept ko samajhna aur istemal karna traders ke liye zaroori hai takay woh market trends ko sahi tareeke se analyze kar sakein aur apni trading strategies ko improve kar sakein.

تبصرہ

Расширенный режим Обычный режим