Cup and Handle

"Cup and Handle Candlestick Pattern" forex trading mein aik technical analysis concept hai jo traders ko potential trend reversal ya continuation ke signals dene mein madad karta hai. Is pattern ka naam uske shape se aya hai, jise aik "cup" aur uske baad aane wale chhote pattern ko "handle" kehte hain.

Formation:

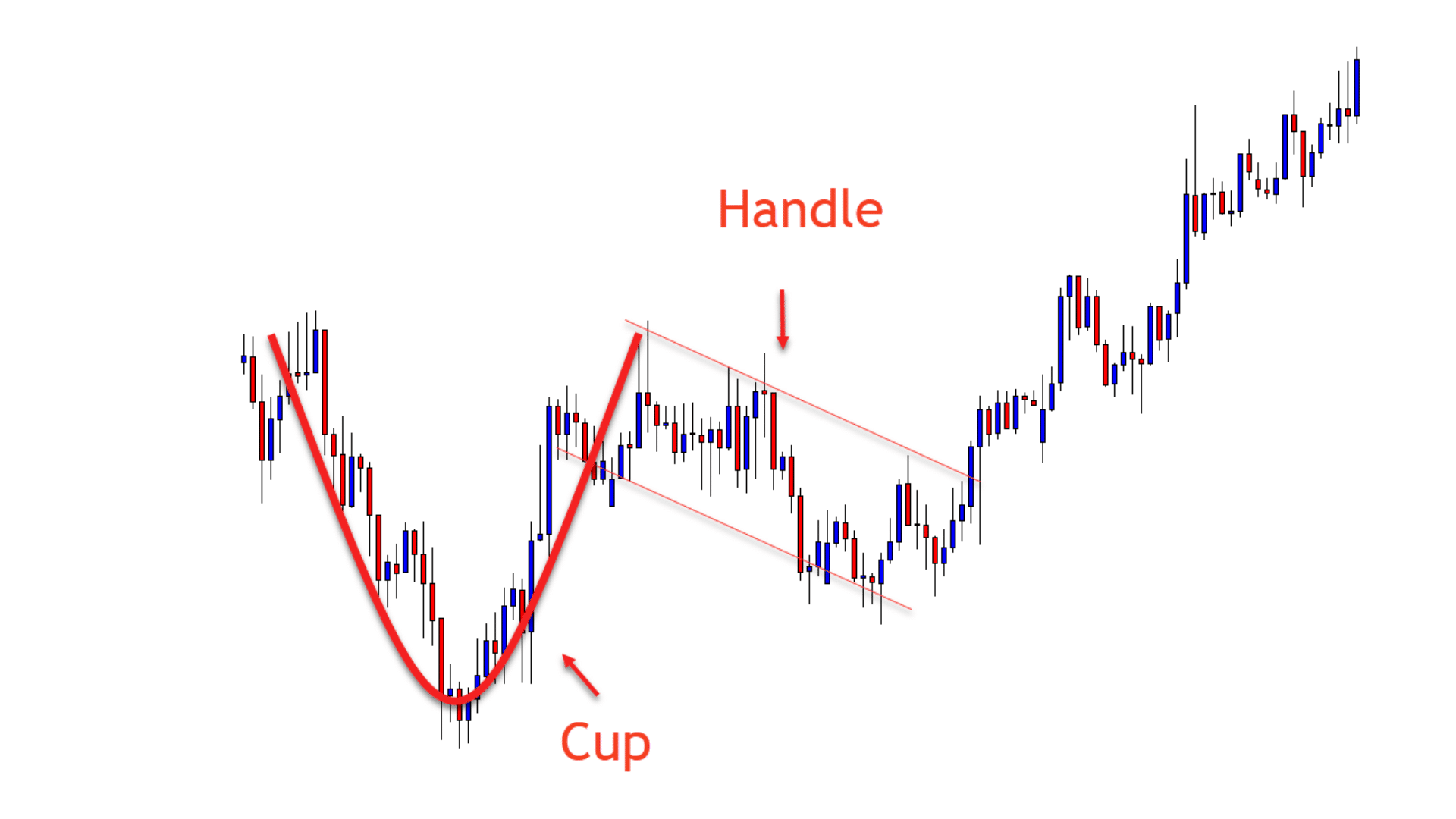

Cup and Handle pattern ka formation do phases mein hota hai. Pehli phase mein, price mein aik gradual downtrend hoti hai, jise hum "cup" kehte hain. Is downtrend ke baad price mein aik gradual uptrend shuru hota hai, jo ek chhota sa consolidation pattern banata hai, jise "handle" kehte hain.

Cup:

Cup, yaadgar taur par, price ki gradual girawat ko represent karta hai jise market mein thora sa pessimism hota hai. Is phase mein, traders sell karte hain aur price down hoti hai. Cup ki shape rounded hoti hai, aur iski depth aur duration vary karti hai.

Handle:

Handle phase mein, price mein aik chhota sa pullback hota hai, lekin overall trend ab positive hota hai. Handle price mein consolidation ko represent karta hai, jahan traders ko lagta hai ke downtrend khatam ho gaya hai aur ab fir se uptrend shuru ho sakta hai.

Trading Signals:

Cup and Handle pattern ko dekhte hue traders ko bullish reversal ya continuation ke signals milte hain. Agar price handle ke baad bhi uptrend mein rehta hai, to yeh confirmatory signal hai ke bullish momentum strong hai. Agar handle ke baad breakout hota hai, to traders ko buying opportunities ka signal milta hai.

Risk Management:

Hamesha yaad rakhein ke kisi bhi pattern ya indicator ki 100% guarantee nahi hoti. Cup and Handle pattern ka istemal karne se pehle, confirmatory factors ka bhi dhyan rakhein. Doosre technical indicators aur market context ko samajhna bhi crucial hai. Is pattern ko sahi tarah se interpret karne ke liye, stop-loss orders ka bhi istemal karna zaroori hai taki traders apne trades ko effectively manage kar sakein.

In conclusion, Cup and Handle Candlestick Pattern ek important tool hai jo traders ko market trends ke potential changes ke liye alert karta hai. Lekin, sahi risk management aur confirmatory signals ke sath istemal karna important hai.

"Cup and Handle Candlestick Pattern" forex trading mein aik technical analysis concept hai jo traders ko potential trend reversal ya continuation ke signals dene mein madad karta hai. Is pattern ka naam uske shape se aya hai, jise aik "cup" aur uske baad aane wale chhote pattern ko "handle" kehte hain.

Formation:

Cup and Handle pattern ka formation do phases mein hota hai. Pehli phase mein, price mein aik gradual downtrend hoti hai, jise hum "cup" kehte hain. Is downtrend ke baad price mein aik gradual uptrend shuru hota hai, jo ek chhota sa consolidation pattern banata hai, jise "handle" kehte hain.

Cup:

Cup, yaadgar taur par, price ki gradual girawat ko represent karta hai jise market mein thora sa pessimism hota hai. Is phase mein, traders sell karte hain aur price down hoti hai. Cup ki shape rounded hoti hai, aur iski depth aur duration vary karti hai.

Handle:

Handle phase mein, price mein aik chhota sa pullback hota hai, lekin overall trend ab positive hota hai. Handle price mein consolidation ko represent karta hai, jahan traders ko lagta hai ke downtrend khatam ho gaya hai aur ab fir se uptrend shuru ho sakta hai.

Trading Signals:

Cup and Handle pattern ko dekhte hue traders ko bullish reversal ya continuation ke signals milte hain. Agar price handle ke baad bhi uptrend mein rehta hai, to yeh confirmatory signal hai ke bullish momentum strong hai. Agar handle ke baad breakout hota hai, to traders ko buying opportunities ka signal milta hai.

Risk Management:

Hamesha yaad rakhein ke kisi bhi pattern ya indicator ki 100% guarantee nahi hoti. Cup and Handle pattern ka istemal karne se pehle, confirmatory factors ka bhi dhyan rakhein. Doosre technical indicators aur market context ko samajhna bhi crucial hai. Is pattern ko sahi tarah se interpret karne ke liye, stop-loss orders ka bhi istemal karna zaroori hai taki traders apne trades ko effectively manage kar sakein.

In conclusion, Cup and Handle Candlestick Pattern ek important tool hai jo traders ko market trends ke potential changes ke liye alert karta hai. Lekin, sahi risk management aur confirmatory signals ke sath istemal karna important hai.

:max_bytes(150000):strip_icc()/CupandHandleDefinition1-c721e47fd1f7451997d0d5d941f6e174.png)

تبصرہ

Расширенный режим Обычный режим