Hello friend

Rick management with hikkake patterns

Risk management forex trading mein ek ahem hissa hai, aur jab yeh Hikkake patterns ke saath integrate kiya jata hai, to tajiro ki trading strategies aur decision-making process ko behtar banane mein madad karta hai. Hikkake pattern ek candlestick pattern hai jo market mein muntakhib reversals ko pehchanne mein madadgar hota hai. Yahan dekhein kaise risk management ko Hikkake patterns ke saath mila kar istemal kiya ja sakta hai:

Understanding The hikkake patterns

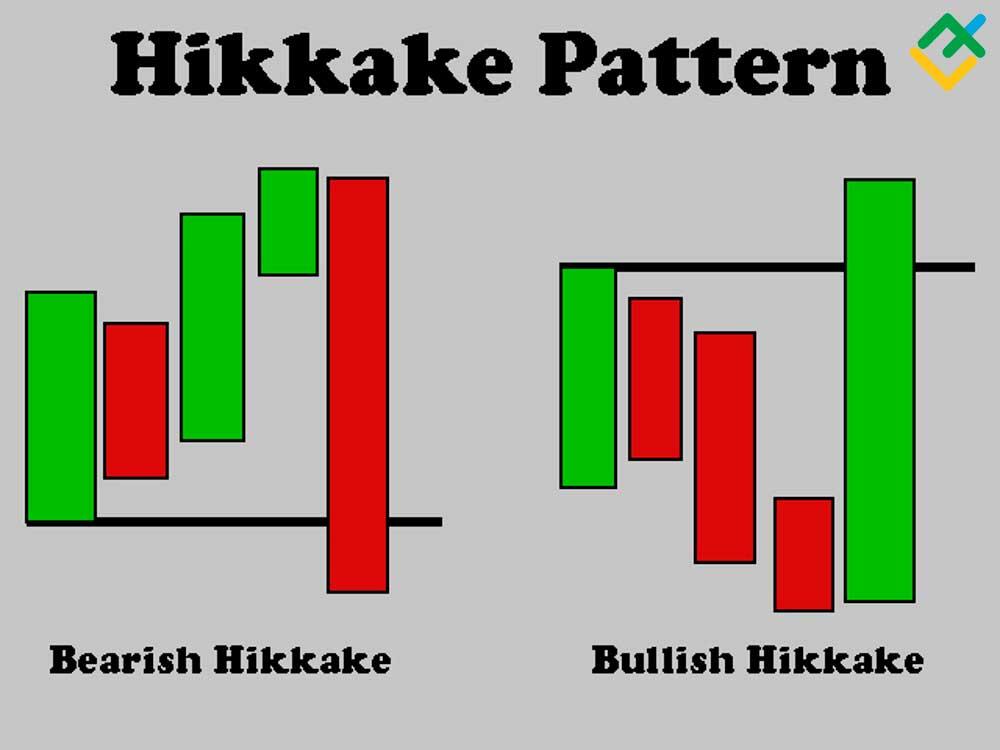

Hikkake pattern teen candles se bana hota hai aur isay trend ke baad hone wale possible reversals ko pehchane mein madad deta hai. Is pattern mein ek inside bar hoti hai (jiska high aur low pehle candle ke high aur low se kam hota hai), jise doosre do candles follow karte hain, jinme se ek higher high aur doosra lower low hota hai. Tajire is pattern ko istemal karte hain taake woh market ki muntakhib reversals ko pehchan sakein.

Setting stop loss order

Hikkake patterns ke saath risk management implement karne ka ek tareeqa hai ke tajire theek se stop loss orders set karein. Jab Hikkake pattern identify ho jaye aur woh potential reversal signal de raha ho, to tajire apne stop loss orders third candle ke low ke neeche lagasakte hain. Is se ye ensure hota hai ke agar market anticipated reversal ke khilaf move karta hai, to nuksan mehdood rahega.

Determining position size

Risk management ka hissa hai ke tajire apne risk tolerance aur stop loss level ke mutabiq sahi position size tay karein. Hikkake pattern ke saath, tajire apne position size ko calculate karte hain jis tarah unki pehle se tay ki gayi risk-reward ratio ke sath mawafiq ho. Ye isay guarantee karta hai ke nuksan ko control mein rakha jaye aur overall risk management strategy ke sath mawafiq rahe.

Confirmation with other indicator

Jabki Hikkake pattern valuable insights faraham kar sakta hai, risk management ko mazboot karne ke liye doosre technical indicators se tasdeeq lena bhi aham hai. Tajire aksar trendlines, support aur resistance levels, ya momentum indicators jese tools ka istemal karte hain Hikkake pattern ke signals ko tasdeeq karne ke liye. Confirmatory indicators trade setup ki mazbooti ko barhate hain.

trail stop loss order

Jab market Hikkake pattern ke mutabiq move karta hai, to tajire apne stop loss orders ko trail karna consider kar sakte hain. Isme stop loss level ko adjust karna shamil hai taake trade progress hoti rahe aur faida lock karte rahe. Trail stop loss orders faida ko secure karne aur market mein hone wale reversals ya retracements se bachane mein madad karte hain.

Continuous monitoring and adaptation

Risk management ek maamoolan process hai, aur tajire ko apne positions ko continuous monitor karna chahiye, khaas kar jab Hikkake pattern identify ho. Market conditions tabdeel ho sakti hain aur unexpected events trade ko asar daal sakte hain. Tajire ko apni risk management strategy ko zarurat ke mutabiq adjust karne ke liye tayyar rehna chahiye, chahe woh stop loss levels ko adjust karna ho, partial profits lena ho, ya trade ko zaroorat ke mutabiq bandhna ho.Risk management ko Hikkake patterns ke saath milakar istemal karna forex tajiron ke liye faydemand ho sakta hai. Is tarah ke integration se tajire potential trend reversals ko pehchan sakte hain aur apne capital ko bachane ke liye tayyar rehte hain. Agar sahi tarah se stop loss orders set kiye jaayein, optimal position sizes tay kiye jaayein, doosre indicators se tasdeeq hasil ki jaye, aur trades ko hamesha monitor kiya jaye, to tajire apni risk management practices ko behtar bana sakte hain aur informe tijarat ke faisle kar sakte hain.

Rick management with hikkake patterns

Risk management forex trading mein ek ahem hissa hai, aur jab yeh Hikkake patterns ke saath integrate kiya jata hai, to tajiro ki trading strategies aur decision-making process ko behtar banane mein madad karta hai. Hikkake pattern ek candlestick pattern hai jo market mein muntakhib reversals ko pehchanne mein madadgar hota hai. Yahan dekhein kaise risk management ko Hikkake patterns ke saath mila kar istemal kiya ja sakta hai:

Understanding The hikkake patterns

Hikkake pattern teen candles se bana hota hai aur isay trend ke baad hone wale possible reversals ko pehchane mein madad deta hai. Is pattern mein ek inside bar hoti hai (jiska high aur low pehle candle ke high aur low se kam hota hai), jise doosre do candles follow karte hain, jinme se ek higher high aur doosra lower low hota hai. Tajire is pattern ko istemal karte hain taake woh market ki muntakhib reversals ko pehchan sakein.

Setting stop loss order

Hikkake patterns ke saath risk management implement karne ka ek tareeqa hai ke tajire theek se stop loss orders set karein. Jab Hikkake pattern identify ho jaye aur woh potential reversal signal de raha ho, to tajire apne stop loss orders third candle ke low ke neeche lagasakte hain. Is se ye ensure hota hai ke agar market anticipated reversal ke khilaf move karta hai, to nuksan mehdood rahega.

Determining position size

Risk management ka hissa hai ke tajire apne risk tolerance aur stop loss level ke mutabiq sahi position size tay karein. Hikkake pattern ke saath, tajire apne position size ko calculate karte hain jis tarah unki pehle se tay ki gayi risk-reward ratio ke sath mawafiq ho. Ye isay guarantee karta hai ke nuksan ko control mein rakha jaye aur overall risk management strategy ke sath mawafiq rahe.

Confirmation with other indicator

Jabki Hikkake pattern valuable insights faraham kar sakta hai, risk management ko mazboot karne ke liye doosre technical indicators se tasdeeq lena bhi aham hai. Tajire aksar trendlines, support aur resistance levels, ya momentum indicators jese tools ka istemal karte hain Hikkake pattern ke signals ko tasdeeq karne ke liye. Confirmatory indicators trade setup ki mazbooti ko barhate hain.

trail stop loss order

Jab market Hikkake pattern ke mutabiq move karta hai, to tajire apne stop loss orders ko trail karna consider kar sakte hain. Isme stop loss level ko adjust karna shamil hai taake trade progress hoti rahe aur faida lock karte rahe. Trail stop loss orders faida ko secure karne aur market mein hone wale reversals ya retracements se bachane mein madad karte hain.

Continuous monitoring and adaptation

Risk management ek maamoolan process hai, aur tajire ko apne positions ko continuous monitor karna chahiye, khaas kar jab Hikkake pattern identify ho. Market conditions tabdeel ho sakti hain aur unexpected events trade ko asar daal sakte hain. Tajire ko apni risk management strategy ko zarurat ke mutabiq adjust karne ke liye tayyar rehna chahiye, chahe woh stop loss levels ko adjust karna ho, partial profits lena ho, ya trade ko zaroorat ke mutabiq bandhna ho.Risk management ko Hikkake patterns ke saath milakar istemal karna forex tajiron ke liye faydemand ho sakta hai. Is tarah ke integration se tajire potential trend reversals ko pehchan sakte hain aur apne capital ko bachane ke liye tayyar rehte hain. Agar sahi tarah se stop loss orders set kiye jaayein, optimal position sizes tay kiye jaayein, doosre indicators se tasdeeq hasil ki jaye, aur trades ko hamesha monitor kiya jaye, to tajire apni risk management practices ko behtar bana sakte hain aur informe tijarat ke faisle kar sakte hain.

تبصرہ

Расширенный режим Обычный режим