Fibonacci Gartley Pattern ka Istemal

Pehli nazar mein, Gartley Fibonacci pattern ki line drawing Gartley bullish reversal mein "M" ke letter ke mutabiq hoti hai ya bearish reversal pattern mein "W" ke letter ke mutabiq hoti hai. Yaad rahe ke pehle wing ke tops aur bottoms hamesha dusre wing se "sharper" hote hain (higher highs aur lower lows).

https://ibb.co/Ydnfsz5

(Note: 5 pictures ki limit puri ho gai tho es liye ma ny link paste kiya)

Ye ishara karta hai ke buyers aur sellers ke darmiyan push-pull pressure kamzor ho raha hai (converging) aur ye zyadatar reversal ko ishara karta hai jahan ek party ko market mein dominate karne mein kamiyabi milti hai. Gartley Bullish Fibonacci pattern mein, sellers ke pressure ke baad buyers market ko dominate karenge, aur ulte Gartley bearish pattern mein Bears ke pressure ke baad Bulls market ko dominate karenge.

Gartley pattern signal ke appearance mein precision par bharosa karta hai, kyun ke har leg (line ki taraf) ka apna ek area hota hai. Iska asar hai ke is pattern ko sabhi time frames mein istemal kiya ja sakta hai, lekin agar market mein zyada noise hai to Gartley Fibonacci pattern ko dhundhna mushkil ho sakta hai.

Or Lines aur Signal Draw Karne ka Tariqa

Gartley Fibonacci Pattern ki Signal ki Quality ke liye Amal

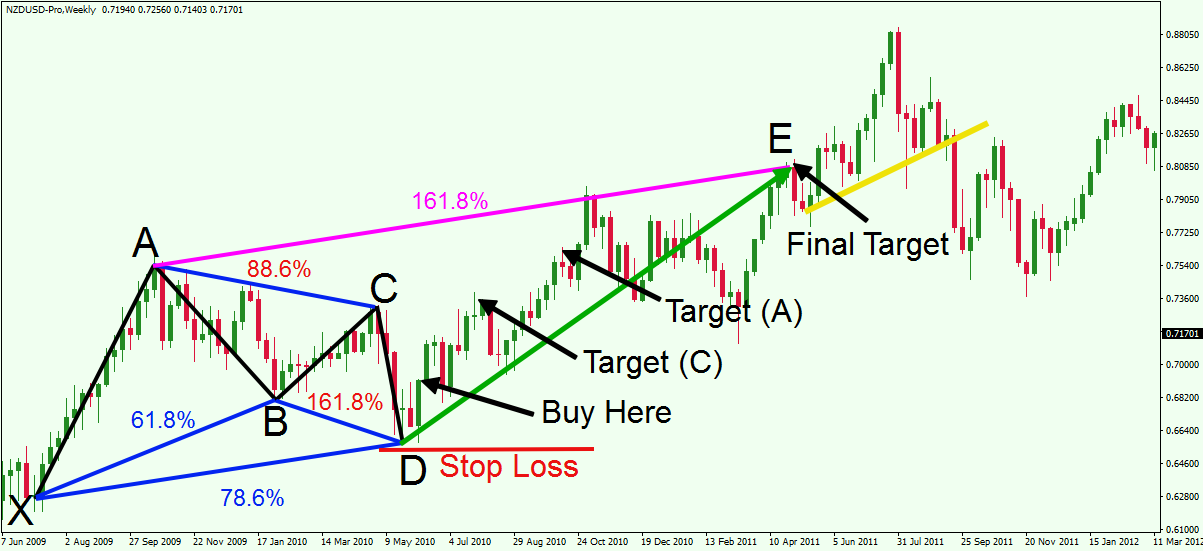

Yahan ek bullish Gartley Fibonacci pattern ki ek simple drawing ka example hai:

Har leg (line draw) ka apna apna criterion hota hai, general provisions ke saath, jo ke Fibonacci line ki retracement se related hote hain:

Iske ilawa, yahan do alag time frames par Gartley-Fibonacci pattern ke do examples hain:

Gartley Bullish Fibonacci Pattern H4

Gartley Bullish Fibonacci Pattern H1

Pehle Fibonacci pattern ka signal dusre signal se behtar hai (TF H1) kyun ke har leg upar diye gaye rules ke mutabiq hai. Jabki dusre pattern mein, drawdown ke risk ka khatra kaafi high hota hai kyun ke CD leg abhi lowest price ko touch nahi kiya hai (kyunki CD leg ko XA leg ke 0.75 retracement par "force" kiya gaya hai).

Trading Strategy: Gartley Fibonacci Pattern ke Signals ke Sath Entry aur Exit

Fibonacci pattern ka signal kaafi accurate hota hai agar saari legs requirements ko meet karte hain. Isliye, aise patterns ke signals se bachein jinke legs ko force kiya gaya ho ya jo requirements ko meet na karein.

Maqsad ke taur par, hum Gartley Fibonacci pattern ka istemal ek aise signal ke sath karenge jo quality mein acha hai:

Yeh hain Gartley-Fibonacci pattern ka istemal karne wale trading strategies ke liye tips aur tricks. Agar aapko aur jyada janana hai to aap diverse Fibonacci patterns ke article par ja sakte hain.

Pehli nazar mein, Gartley Fibonacci pattern ki line drawing Gartley bullish reversal mein "M" ke letter ke mutabiq hoti hai ya bearish reversal pattern mein "W" ke letter ke mutabiq hoti hai. Yaad rahe ke pehle wing ke tops aur bottoms hamesha dusre wing se "sharper" hote hain (higher highs aur lower lows).

https://ibb.co/Ydnfsz5

(Note: 5 pictures ki limit puri ho gai tho es liye ma ny link paste kiya)

Ye ishara karta hai ke buyers aur sellers ke darmiyan push-pull pressure kamzor ho raha hai (converging) aur ye zyadatar reversal ko ishara karta hai jahan ek party ko market mein dominate karne mein kamiyabi milti hai. Gartley Bullish Fibonacci pattern mein, sellers ke pressure ke baad buyers market ko dominate karenge, aur ulte Gartley bearish pattern mein Bears ke pressure ke baad Bulls market ko dominate karenge.

Gartley pattern signal ke appearance mein precision par bharosa karta hai, kyun ke har leg (line ki taraf) ka apna ek area hota hai. Iska asar hai ke is pattern ko sabhi time frames mein istemal kiya ja sakta hai, lekin agar market mein zyada noise hai to Gartley Fibonacci pattern ko dhundhna mushkil ho sakta hai.

Or Lines aur Signal Draw Karne ka Tariqa

Gartley Fibonacci Pattern ki Signal ki Quality ke liye Amal

Yahan ek bullish Gartley Fibonacci pattern ki ek simple drawing ka example hai:

Har leg (line draw) ka apna apna criterion hota hai, general provisions ke saath, jo ke Fibonacci line ki retracement se related hote hain:

- XA legs ko draw kiya jata hai period ki lowest price se nearest highest price tak. XA hamesha pehli aur sabse lambi leg hoti hai.

- Leg AB previous leg ki high price se next low price tak draw kiya jata hai. AB (ideally) 61.8 se Leg XA ka retracement hota hai.

- Leg BC AB se 38.2 se 88.6 ke beech ka retracement hota hai. Leg BC ki high price (bullish Gartley par) Leg AB ki high price ko exceed nahi kar sakti. Ulta Gartley par, price low hoti hai.

- CD leg XA leg ka 78.6 retracement hota hai. CD leg ki price XA leg ki price se kam nahi ho sakti. Gartley Fibonacci pattern ki signal ki accuracy behtar hoti hai agar AB aur CD legs AB=CD Fibonacci pattern ki signal ke liye criteria ko meet karte hain.

Iske ilawa, yahan do alag time frames par Gartley-Fibonacci pattern ke do examples hain:

Gartley Bullish Fibonacci Pattern H4

Gartley Bullish Fibonacci Pattern H1

Pehle Fibonacci pattern ka signal dusre signal se behtar hai (TF H1) kyun ke har leg upar diye gaye rules ke mutabiq hai. Jabki dusre pattern mein, drawdown ke risk ka khatra kaafi high hota hai kyun ke CD leg abhi lowest price ko touch nahi kiya hai (kyunki CD leg ko XA leg ke 0.75 retracement par "force" kiya gaya hai).

Trading Strategy: Gartley Fibonacci Pattern ke Signals ke Sath Entry aur Exit

Fibonacci pattern ka signal kaafi accurate hota hai agar saari legs requirements ko meet karte hain. Isliye, aise patterns ke signals se bachein jinke legs ko force kiya gaya ho ya jo requirements ko meet na karein.

Maqsad ke taur par, hum Gartley Fibonacci pattern ka istemal ek aise signal ke sath karenge jo quality mein acha hai:

- Entry position aam taur par point D ke position se kuch pips door hoti hai, jo ke akhri leg hoti hai. Ye behtar hai ke aap ek pending order ka istemal karein taake order tab execute ho jab price movement limit/stop order line ko choo jaye. Agar aap instant order ka istemal karte hain (taki aap moment na chhodain) to aap buy/sell order confirm kar sakte hain jab price point D se kuch pips door hoti hai.

- Pehle pattern mein (table 01) Stop Loss position X leg ki starting point se sirf kuch pips door hoti hai kyun ke assumption ye hai ke XA leg us period mein highest volatility ko represent karta hai. Dusre shabdon mein, agar price ke paas point se door move karne ka waqt hai to ye Stop Loss se bahar move kar sakti hai.

- Iske ilawa, Take Profit ke liye aap point A se D tak ka Fibonacci line draw kar sakte hain. Multi TP ka istemal Fibonacci points 0.38 se 0.78 par lot division system ke sath kar sakte hain. Agar aap sirf TP chahte hain to aap safe TP position (0.3 se 0.5 Fibonacci retracement points ke beech) ki taraf dekhein.

Yeh hain Gartley-Fibonacci pattern ka istemal karne wale trading strategies ke liye tips aur tricks. Agar aapko aur jyada janana hai to aap diverse Fibonacci patterns ke article par ja sakte hain.

تبصرہ

Расширенный режим Обычный режим